Reflection of costs in management accounting. Management accounting as a reflection of the financial condition of the enterprise Basic principles of accounting completeness

Management Accounting- this is an ordered system for collecting, registering, summarizing and presenting information about the economic activities of the organization and its internal structural divisions, necessary for making management decisions.

Information requirements for management accounting

There are a number of specific requirements for information for internal management. She must be:

operational, formed on the principle of "the sooner the better." The minimum accounting period of one month is unacceptable for most management tasks. If there is a choice between accuracy and speed of obtaining data for management, the manager will usually prefer the latter;

target, i.e. aimed at solving specific management problems;

targeted, having a focus on a specific consumer - the manager and the tasks he solves. Targeting should take into account the level of the official hierarchy of officials in the organization's management apparatus;

sufficient. Management accounting information should not be redundant, but quite sufficient for making appropriate decisions. Its sufficiency is largely ensured by the analyticity of the data or the possibility of their use in economic analysis. This allows, with a certain limitation of the initial indicators for management, to widely use their derivatives, the results of analytical calculations, groupings, comparisons, etc.;

economical to obtain and use;

flexible, adapted to the possibilities of changes in the business. The market economy is distinguished by the dynamism of development, the uncertainty of many economic situations, and their multivariance. Accordingly, the management accounting system should not be stable, unchanged for many years. On the contrary, it should be subjected to constant renewal, improvement and development in form, scope and content.

What does management accounting provide?

Well-designed management accounting:

contributes to the success of enterprises;

ensures high rates of their strategic development;

allows management to quickly receive the necessary accounting and analytical information;

provides the organization with competitive advantages through cost management, business operations and general management organization;

structures different types and directions of activity of the enterprise;

provides an assessment of the contribution to the final result of various structural units.

Strategic and current management accounting

According to the intended purpose, management accounting systems can be divided into strategic accounting for the top management of enterprises, companies, firms and current accounting for internal management.

Goals of management accounting

The main goal of management accounting is the preparation of planned, actual and forecast information about the activities of the organization and its external environment for making the necessary management decisions.

Users of management accounting information

The main users of management accounting information are senior managers, heads of structural divisions and specialists.

Senior managers are usually provided with:

management information in the form of reports on the results of the production, financial and investment activities of the organization and its structural divisions for a specific period of time and for the past;

analysis of the impact of identified internal and external factors on the performance of the organization and its main structural divisions;

planned and forecast indicators for future periods.

Heads of structural divisions are provided with:

management reports on the activities of units at a specific point in time;

planned and forecast information about the divisions, as well as the necessary information about the counterparties of the organization.

Specialists receive the necessary information about the activities of the organization and its structural divisions, as well as forecasts of the impact of identified internal and external factors on the results of the economic activity of the enterprise.

Objects of management accounting

The objects of management accounting include:

1. The costs of the enterprise and its structural divisions.

2. Results of economic activity.

3. Internal pricing.

4. Forecasting future financial transactions.

5. Internal reporting.

Tasks of management accounting

The main task of management accounting is the preparation of internal reports, the information of which is intended for the owners of the enterprise (organization) and the management apparatus.

These reports should contain information about the general financial position of the enterprise, the state of affairs in production activities.

The information that is necessary for making managerial decisions, controlling and regulating managerial activities can include, for example:

selling prices;

production costs;

demand, competitiveness, profitability of goods produced by their enterprise.

The main tasks of management accounting are:

analysis of the state of material, labor and financial resources and compilation of information on these resources;

analysis of costs and revenues and deviations from established norms and estimates;

calculation of various indicators of the actual cost of products (works, services) and deviations from standard and planned indicators;

calculation of the financial results of the activities of individual structural divisions by responsibility centers, products sold, work performed and services rendered;

control and analysis of the financial and economic activities of the organization, its structural divisions and other responsibility centers;

planning the financial and economic activities of the organization as a whole, its structural divisions and other centers of responsibility;

providing information on the impact of expected future events based on an analysis of past events;

presentation of management reporting for making the necessary management decisions in the future.

management accounting requirements

The information generated by the management accounting system must meet the following requirements:

authenticity. Reliability is understood as the ability for a competent user to draw correct conclusions based on accounting and reporting data;

completeness. The completeness of management accounting means the sufficiency of information for the management of the enterprise and its divisions, the ability to ensure this sufficiency. The most complete are management accounting systems, including the use of accounts and double entry, providing control not only over the costs and results of current activities, but also over inventories, investments, and the effectiveness of functional business management;

relevance. Relevant from the standpoint of making a managerial decision are data and information that takes into account the conditions in which the decision is made, its target criteria, which have a set of possible alternatives and characterize the consequences of the implementation of each of them;

integrity. This means that management accounting must be systemic even when it is maintained without the use of primary documentation, accounts and double entry. Consistency in this case means the unity of the principles for reflecting accounting information, the relationship of accounting registers and internal reporting, ensuring, if necessary, the comparability of its data with accounting and reporting indicators;

clarity. The clarity of management accounting information is ensured by reflecting in the accounting registers the results of the analysis of the obtained indicators, presenting data in the form of analytical tables, graphs, time series, etc.;

timeliness. The timeliness of management accounting means its ability to provide managers with the necessary information by the time of decision-making;

regularity. It is also important that internal reporting be regular; repeatable in time.

Thus, the data of well-organized management accounting make it possible to identify areas of greatest risk, bottlenecks in the organization's activities, inefficient or unprofitable types of products and services, places and methods for their implementation.

They are used to determine the most favorable assortment of products and works for given conditions, prices and tariffs for their sale, discount limits under different conditions of sale and payment, to assess the effectiveness of additional costs and the rationality of capital investments.

Only according to management accounting data, it is possible to choose the best option for solving problems such as: “make it yourself or buy it”, “how much is profitable to buy and sell”, “what equipment should be ordered”, “in what cases is equipment repair better than buying new machines” and etc.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Management accounting: details for an accountant

- Management accounting for the cost of paid services

Practitioners and methodological solutions of management accounting institutions. Management accounting (reflection in accounting ... the most important in the organization of management accounting, since it also fixes the rules ... of inventories), in the management accounting system it is necessary to fix the persons responsible ... policies, revealing the features of management accounting in terms of providing paid ... to note that the task of organizing management accounting has been successfully solved by many educational institutions ...

- How to speed up reporting in retail by automating transformational adjustments

According to IFRS, for example, management accounting can be based. The retail sector is no exception... under IFRS under Russian law); Management accounting and the budgeting system are based on ... such detail is needed, for example, for management accounting. Availability of specialists Transformation of the group of companies...

1C: Enterprise, version 8.0. Salary, personnel management Boyko Elvira Viktorovna

16.10. Ways to reflect salaries in management accounting

Methods for reflecting salaries in management accounting allow you to:

Reflect for a given cost item with “automatic substitution” of some data that are known in payroll accounting: an employee of an enterprise and a division of an enterprise.

Reflect for those cost items for which the base accruals were reflected: the so-called. reflection method "proportional to the base".

Ways of reflecting salaries in management accounting are implemented in the form of a reference book, which contains two predefined ways of reflecting in accounting:

Reflection of accruals by default;

Do not reflect in management accounting.

The method of reflection in management accounting (i.e. a link to the element of the directory of reflection methods) can be set:

For a specific employee - established by the document Accounting for employees' earnings or can be further specified by personnel documents, for example, when transferring an employee to another job by personnel transfer;

To a specific accrual - it is indicated directly in the description of the accrual.

In management accounting, the reflection method will be selected in the above sequence. If no method was found for accrual in the above three paragraphs, then the default reflection method is selected.

From the book Accounting author8.2. The choice of the best option for solving economic situations, the procedure for their reflection in accounting and reporting The theory of accounting allows an organization to choose at its discretion the best possible alternative accounting methods that

From the book Accounting author Melnikov IlyaLEASING OPERATIONS AND THEIR RECORDING IN ACCOUNTING The object of leasing is any movable and immovable property that, according to the current classification, is classified as fixed assets. The subjects of leasing are: - the lessor - a legal entity engaged in leasing activities

From the book Enterprise Cost Management author Koteneva E N5.3. Cost in financial and management accounting The cost of production plays an important role in the production activities of an enterprise, industry, and the entire national economy. Production cost shows efficiency

From the book Accounting in agriculture author Bychkova Svetlana Mikhailovna13.5. The concept of financial results and the procedure for their reflection in accounting The financial result is an estimated indicator and expresses the economic efficiency of the agricultural enterprise. This indicator is determined by the indicator of profit or

From the book Accounting Policies of Organizations for 2012: for the purposes of accounting, financial, managerial and tax accounting author Kondrakov Nikolai PetrovichChapter 8 Accounting policy of the organization in management accounting 8.1. The main regulatory documents used in management accounting 1. Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.2. Regulation on accounting and financial reporting in

From the book Management Accounting. cheat sheets author Zaritsky Alexander Evgenievich8.1. The main regulatory documents used in management accounting 1. Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.2. Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated

From the book Common Mistakes in Accounting and Reporting author Utkina Svetlana Anatolievna26. Principles and objectives of the organization of the budgeting system in the management accounting of the enterprise The budgeting system is an integral part of the enterprise planning system. Traditionally, the budget was understood as a financial plan, which has the form of a balance sheet.

From the book Fixed Assets. Accounting and tax accounting author Sergeeva Tatyana Yurievna44. The concept and classification of costs in the management accounting of an enterprise A clear delineation of costs depending on their economic purpose is a defining moment in the organization of management accounting in an enterprise. At all levels of management

From the book 1C: Enterprise, version 8.0. Payroll, personnel management author Boyko Elvira Viktorovna54. The use of direct costing in management accounting The term "direct costing" (direct-costing) means "accounting for direct costs". This term does not fully reflect the essence of this cost accounting method, since the main element of this method is the organization

From the book Accounting and tax accounting of profit author Nechitailo Alexey Igorevich55. Use of the standard costing system in management accounting Standard costing is a system of cost accounting and costing using standard costs. "Standard" - the number of costs necessary for the production of a unit of output;

From the author's bookExample 25. The procedure for reflecting land plots in accounting

From the author's bookExample 12. An organization has violated the procedure for recording in accounting and tax accounting the surplus of goods identified during the inventory. Reflection in tax accounting as part of the cost of purchased goods sold, the accounting value of the surplus sold is

From the author's bookexample 16

From the author's book4.1. Methods of calculating depreciation in accounting The amount of depreciation is determined monthly, separately for each object of depreciable property. Depreciation begins on the 1st day of the month following the month in which this object was introduced

From the author's book16.9. Ways of reflecting salaries in regulated accounting Ways of reflecting are implemented in the form of a reference book, which contains two predefined methods:? reflection of accruals by default;? do not reflect in accounting. The method determines the procedure for reflecting salaries

From the author's book1.4. Concepts of formation and reflection of profit in accounting Formation of information on financial results is based on a set of conventions, many of which have nothing to do with the reality around us. In accounting these

It is no secret that many enterprises enter into a lot of fictitious contracts, which lead to a formal underestimation of income and profit, overestimation of costs and prime cost. Accounting for entries under these contracts complicates and confuses the picture of real business processes not only for regulatory authorities, but also for the company itself. As a result, on the basis of such reporting, it is impossible to analyze and make informed decisions, therefore, in parallel, “black”, or real, accounting is created, which tries to adequately reflect the actual state of affairs. Quite often, "black" accounting is transformed into management accounting, developing original software to support it.

More recently, the concept of “management accounting” existed in Russia only in the literature, and every entrepreneur managed his business as best he could, knew how and wanted. In small firms, this was expressed in direct observation and influence on the part of the head, who himself delved into all the details, independently made almost all decisions, knew all the employees by sight, in a word, was always aware of everything.

As businesses grew and failed, entrepreneurs learned from their mistakes, and the term "management accounting" began to come into vogue. However, how it differs from accounting, many have not figured out to this day.

Management accounting (from English management accounting) arose at the junction of two cultures - financial accounting and management. Management has always needed information, but financial accounting, as the business environment evolved and became more complex, gave managers less and less of the information they needed. Therefore, management accounting arose not just in the development of accounting, but as a new independent discipline. Management accounting uses not only actual data on completed transactions, but also analytical, estimated data, as well as data on possible future events (plans and budgets), provides the manager with not only quantitative, but also qualitative (informal) information.

Another important difference between management accounting and accounting is the absence of any single standard: management accounting is individual for each enterprise. Each enterprise has its own goals, strategies, priorities, interests, values, culture, traditions, which differ from the same set of attributes in other enterprises. Each enterprise has its own structure of business processes, organizational structure, features in business management, the system of distribution and transfer of responsibility, and problems. Therefore, there is no force that can force the majority of enterprises to comply with any standard in business management. Nevertheless, in management and, as a result, in management accounting, certain principles, approaches and methods have been formed, the effectiveness of which is almost beyond doubt.

Our expertise

O.A. Baskakova, accountant-auditor

When the need to introduce management accounting is obvious, but the head of the company wants to save on salary costs and refuses to attract highly paid specialists, the accountant has to look for a way out of this situation alone.

First of all, it is necessary to understand that management accounting is a complex system for identifying, measuring, accumulating, analyzing, preparing, interpreting and presenting information necessary for interested internal users to plan, evaluate and control business activities, in other words, on-line information -line for internal users of the organization (directors, managers, accountants, shareholders) with analytics elements.

The tasks of management accounting are:

Formation of complete and reliable information about the activities of the organization and its property status;

Control of the availability and movement of property and liabilities, reasonable use of material, financial and labor resources in accordance with approved standards and budgets;

Maximizing the profit of the company and maintaining it at a satisfactory level;

Providing management with timely and complete information for making management decisions;

Prevention of negative results of economic activity.

BASIC PRINCIPLES OF COMPLETE ACCOUNTING

In the reflection of financial and economic operations in management accounting, the basic principles are:

Completeness - timely reflection of information on business transactions in full;

Timeliness;

credibility;

Prudence - a greater readiness to recognize expenses, losses and liabilities than possible income and assets, while at the same time avoiding hidden reserves;

The priority of content over form is the reflection in accounting of the facts of economic activity, based not so much on their legal form, but on the economic content of the facts and conditions of economic activity.

ATTENTION

The reporting period for management accounting is a calendar month.

To reflect business transactions in the management accounting of the company, the accrual method is to be applied - recognition of the results of transactions and other events, as well as their accounting and reflection in the reporting, in the reporting period when they occurred, regardless of the time of actual receipt or payment of funds or their equivalents.

Management reporting prepared on an accrual basis informs internal users:

About past operations related to the payment and receipt of funds;

On the obligations of the company, entailing the payment of funds in the future;

About resources that may be available in the future.

Document flow rules and accounting information processing technology must be disclosed in the Accounting Policy Regulations.

All business transactions carried out at the enterprise must be documented with supporting documents, on the basis of which information on completed business transactions is subject to reflection in accounting registers, therefore it is completely pointless to reflect in management accounting information on business transactions that are not confirmed by supporting documents.

Documents of financial (accounting) accounting may be accepted for accounting if the information contained in them fully characterizes the completed business transaction. In other cases, management accounting documents should be accepted for accounting.

The primary management accounting document must contain the following mandatory details:

Name and date of compilation;

Name of company;

Name of the business transaction counterparty;

Measuring instruments of business transactions, in physical and monetary terms;

Personal signatures of the head and accountant-analyst.

THE DOCUMENTS

A type of primary management accounting document is an electronic document received (or sent) by one company to another via electronic means of communication. A prerequisite for attaching an electronic document is the ability to identify the sender by an encoded digital signature.

Management accounting documents are subject to compilation at the time of the transaction, and if this is not possible, immediately after the completion of the transaction.

ACCOUNTING REGISTERS

Accounting registers are designed to systematize and accumulate previously identified information. The main systematizing is a synthetic register based on the Working Chart of Accounts, where accounting is carried out using the double entry method.

To obtain information detailed by various signs of accounting objects, analytical accounting registers are used that are interconnected with the accounts of a synthetic register.

Working chart of accounts:

Developed by the organization itself;

It is fixed in the Regulations on Accounting Policy for Management Accounting;

Contains a complete list of accounts (including sub-accounts) with a description of analytical registers (or other objects) assigned to each account.

Information in accounting registers is subject to reflection in chronological order with a mandatory reference to primary accounting documents.

For reflection in management accounting and reporting, property, liabilities and business transactions are valued in monetary terms in the main currency of management accounting - Russian rubles (hereinafter - the main currency) or in any other currency that suits the company (dollars, euros, etc.).

When carrying out transactions with property and obligations denominated in a currency other than the main one (hereinafter referred to as the other currency), entries in accounting registers are made both in the main and other currencies. In this case, the amount of the transaction in the main currency is determined by converting the other currency at the appropriate rate set by the Central Bank of the Russian Federation on the date of the transaction.

In order to ensure the reliability of management accounting data, it is recommended to conduct an inventory of property and liabilities at least once a year.

The procedure, types and timing of inventories are subject to indication in the Regulations on Accounting Policy.

ACCOUNTING PLAN

First, the accountant needs to develop a plan according to which accounting will be carried out. It is most appropriate to start with the Accounting Policy, as in other, more familiar types of accounting.

Here is an example of an accounting policy for management accounting:

POSITION

on Accounting Policies for Management Accounting Purposes

1. Accounting operations for property and liabilities that are not regulated by regulatory documents on the Company's management accounting are subject to reflection in accordance with the current legislation on financial (accounting) accounting of the Russian Federation.

2. Management accounting is based on the observance of the basic principles of management accounting - completeness, timeliness, reliability, prudence, priority of content over form.

3. A calendar month is recognized as a reporting period for management accounting.

4. To reflect business transactions in management accounting, the Company should apply the accrual method - recognition of the results of transactions and other events, as well as their accounting and reporting in the reporting period in which they occurred, regardless of the time of actual receipt or payment of funds or their equivalents.

5. Documents of financial (accounting) accounting may be accepted for accounting if the information contained in them fully characterizes the completed business transaction. In other cases, management accounting documents should be accepted for accounting.

6. To accept an asset as a fixed asset, its evaluation and accounting, one should be guided by PBU 6/01 “Accounting for Fixed Assets”.

7. Accrual of depreciation of fixed assets to produce a linear method.

8. The useful life of each asset is set in calendar months in accordance with the Classification of fixed assets included in depreciation groups, approved. Decree of the Government of the Russian Federation of 01.01.02 No. 1 (hereinafter referred to as the Classification). At the same time, the useful life is recognized as the minimum period established by the Classification for the group of fixed assets to which each object belongs.

9. Fixed assets worth no more than 10,000 rubles. subject to 100% depreciation at the time of their commissioning.

10. Intangible assets include objects that meet the conditions of PBU 14/2000 “Accounting for intangible assets”. Assessment and accounting of intangible assets are carried out in accordance with the specified RAS.

11. For management accounting, the cost of goods (services) purchased or produced for sale shall be formed solely on the basis of variable costs.

12. Fixed costs (direct and indirect) are recognized as expenses of the reporting period and are subject to write-off to the financial result at the time of their occurrence (accrual).

13. Direct costs are those that can be accurately and uniquely attributed to cost centers.

14. Indirect costs are those that arise in several places and are subject to distribution between them in some acceptable way.

15. The company has the right to create reserves:

For uncollectible receivables;

Employee bonuses;

For costly repairs.

REMEMBER

Accounting policy for management accounting purposes can be drawn up taking into account the characteristics of the organization, depending on the chosen taxation system (the example shows the Accounting policy for the general taxation system). If the organization has switched to a simplified taxation system or a single tax on imputed income, then it is more expedient to build management accounting “on payment”.

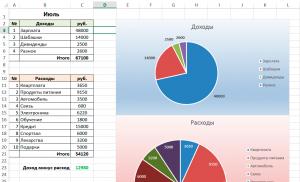

The next stage in the organization of management accounting, as a rule, is the definition of goals, for which it is necessary to clarify with the company's management what exactly they are interested in: income, expenses, profit, loss, or all indicators in combination. Most often, in practice, managers are interested in everything: how much they earned, how much they spent, what is the economic result. To reflect the activities of the enterprise, an Income and Expenditure Budget (BDR) is drawn up.

When forming a budget, it is necessary not only to see the actual costs, but to compare them with planned figures, on the basis of which it is possible to analyze budget items, identifying positive and negative factors affecting the financial and economic activities of the organization.

Expenses and incomes can be grouped into general items, you can also break them into groups, break groups into articles, etc.

As a result of budgeting income and expenses, management will have a real opportunity to assess the financial condition of the enterprise

Production costs in management accounting are reflected in at least three directions, each of which is an independent separate system of interrelated accounting records (Fig. 8).

Management cost accounting also needs to be kept on the accounts of accounting, as they are reflected in financial accounting, by cost elements. In financial accounting, there is no need to reflect expenses by items, it is enough that they are grouped in terms of production costs, periodic management and commercial expenses. Such a grouping is sufficient for the preparation of accounting public statements of profit and loss. In management cost accounting, hundreds of analytical accounts are allocated in various areas of grouping, which complicates the reflection of information required

There is no well-thought-out system (several systems) for maintaining detailed cost accounting on accounts.

Management accounts, which reflect analytical information on current production costs, data for their control by responsibility centers and, most importantly, for calculating costs in market conditions, constitute a trade secret that is strictly protected from competitors and any other interested parties. In the practice of foreign companies, management accounts are kept separately from other accounts (financial accounts), since it is on these latter that information is collected for the preparation of public financial statements, subject to audit and disclosure to all users. Management accounts are separated from financial accounts in such a way that each group is summarized as a separate financial system that is not interconnected by any common accounting entries. In large companies, along with the chief accountants of financial accounting, the position of an accountant-manager is established, i.e. chief accountant for management accounting.

In Russian practice, initially they kept general and cost accounting according to a single chart of accounts, limited to additional analytical accounting in the interests of internal management. This practice of organizing accounting is still preserved in many Russian organizations. And the charts of accounts of accounting did not provide for the possibility of separate financial and management accounting on the accounts. Recently, it has become possible to maintain separate accounting, as provided for by the Chart of Accounts for accounting for the financial and economic activities of the organization, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94 (see Section III “Production Costs”).

In the Instructions for the Application of the Chart of Accounts, in the explanations to section III "Production Costs", it is said that the formation of information on expenses for ordinary activities, which constitute production costs, is carried out either on accounts 20-29, or on accounts 30-39. In the first case, the primary scheme for accounting and costing in a single chart of accounts for all operations of a given organization is conserved. In the second case, accounts 20-29 can be used to group costs by cost items, places of origin and other features, as well as to calculate the cost of products, works, services; accounts 30-39 are used for accounting by elements of expenses. The accounting procedure for the elements of expenses will be described later when considering the organization and methods of financial accounting.

The relationship of cost accounting by items and elements is carried out using specially opened reflective accounts, which makes it possible to separate the grouping of costs by items from the grouping of costs by elements and thereby separate management cost accounting from financial accounting on the accounts. The instruction specifically states: "The composition and methodology for using accounts 20-29 with this accounting option is established by the organization based on the characteristics of the activity, structure, management organization based on the relevant recommendations of the Ministry of Finance of the Russian Federation."

The division of accounts in accounting for production costs into two equal parts 20-29 and 30-39 with different purposes of the information summarized on them allows specialists to consider the possibilities and options for dividing the accounts of this section into management accounts and financial accounts. The authors of some publications suggest using accounts from financial accounting with the same numbers in the management accounting department, marking them with a distinctive “asterisk”. Back in 1991, we proposed a two-circle accounting system (managerial and financial) using the same accounts with distinctive signs. But the proposal did not find practical application.

The technical accounting system is a sign system. The use of the same characters for financial and management accounting confuses the coding and correspondence of accounts. Therefore, to revive again a long-forgotten proposal is futile. You should think about other approaches, based on the instructions in the instructions for the Chart of Accounts on the possibility of using reflective accounts to transfer information from financial accounting to management accounting. We believe that this is a more promising approach to solving a complex issue.

Section III "Production Costs" of the Chart of Accounts contains only seven accounts with a certain content. The remaining 13 accounts are not marked, their content is not indicated, as can be seen in Fig. 9. The composition of unmarked accounts, according to the instructions for using the Chart of Accounts, is established by the organization based on the characteristics of its activities, structure, management organization.

Accounts 20-29 relate to management accounting. They are built in strict accordance with the cost accounting methodology for cost items, which is clearly presented in the comparative table. 6.

Accounts for accounting for production costs should be supplemented with a reflective account 27 "Reflection of production costs" for the mirror transmission of information generated in financial accounting on account 37 "Reflection of expenses by elements" (see section 7).

Account 27 "Reflection of production costs" is used to record the costs accounted for by elements during the reporting period. The amount of expenses by elements, recorded in financial accounting on the debit of account 37 “Reflection of expenses by elements”, in turn, is simultaneously recorded on the credit of account 27 “Reflection of production costs” in correspondence with accounts 20-29, on which costs are formed for articles, calculation objects, places of occurrence (responsibility centers), - fig. 10.

Accounts for management cost accounting Accounts for cost accounting Cost items Account 20 “Main production” 1. Raw materials and materials

Returnable waste (according to the credit of account 20)

Purchased products, semi-finished products and services of an industrial nature from outside

Fuel and energy for technological purposes

Wages of production workers

Social contributions

General production expenses Account 26 “General expenses” 9. 7. Expenses for the preparation and development of production

General running costs

Other production expenses Account 28 "Marriage in production" 11. Losses from marriage

Between accounts 27 and 37, in the process of recording primary data on expenses for ordinary activities, full equality is maintained. Turnovers and the balance on the debit of account 37 “Reflection of expenses by elements” are always equal to the turnover and balance on the credit of account 27 “Reflection of production costs”. This equality is ensured without direct correspondence of accounts 27 and 37 as a result of the fact that entries on both accounts are made on the basis of a single array of primary documents, accounting statements and calculations that process the organization's expenses for ordinary activities for the reporting period.

Account 20 "Main production" reflects the direct costs of production, performance of work, provision of services, which are the main, profile in the activities of this organization. It also reflects information on the cost of products and works of auxiliary industries consumed in the main production, writes off indirect costs for maintenance and management, as well as final losses from marriage. Ultimately, this account reflects information on production costs attributed to the cost of products, works, services.

The debit of account 20 "Main production" reflects the direct costs associated with the production of products (works, us-

and articles

meadow) in correspondence with account 27 “Reflection of production costs”. In correspondence with account 23 "Auxiliary production", the debit of account 20 "Main production" is debited with the costs of auxiliary production related to the output produced, work performed, services rendered in the main production.

Indirect overhead costs related to the divisions of the main production, and losses from marriage are monthly debited to the debit of account 20 "Main production" in correspondence with accounts 25 "General production costs" and 28 "Marriage in production". As a result, on account 20 "Main production" information is generated on the reduced production cost.

In management accounting on account 20 “Main production”, information is reflected accumulatively, on an accrual basis from the beginning of the reporting year. Consequently, the debit balance of account 20 "Main production" for each reporting date during the year reflects the amount of costs incurred since the beginning of this reporting year. The sum of this balance also reflects the cost of work in progress. If necessary, it is possible to calculate the cost of manufactured products, delivered works and services only by calculation, based on the calculation of the cost of work in progress at the end date of the reporting period using the following formula:

WIP balance for

beginning of the year

Production cost

Costs of production + from the beginning of the year

WIP balance for

reporting date.

In this case, we receive the cost of manufactured products for the entire period from the beginning of the reporting year. To determine the total production cost, the amount of overhead costs is added to the amount of the cost recorded on account 20 “Main production”.

Analytical accounting on account 20 "Main production" is carried out by cost items, types of products, works, services (by costing objects), if necessary, also by cost centers - responsibility centers.

At the end of the reporting year, the final data on the costs of the main production are displayed in a separate file and stored in the archive for analytical comparisons. At the same time, the final internal reporting on the costs and cost of products, works, services for the reporting year is compiled. Account 20 “Main production” is closed by an accounting entry on the credit of the named account to the debit of account 27 “Reflection of production costs”. In the next reporting year, entries on account 20 "Main production" begin with a zero balance. There is no opening balance on the account.

The cost of work in progress is determined in various ways, depending on the technological and organizational conditions of production, mass or individual production and the accounting policy adopted in the organization. In accordance with the regulations, the value of the work in progress

production is determined by the actual production cost (reduced or full), standard or planned production cost, direct production costs, costs of raw materials, materials and semi-finished products.

Costs for work performed that are not handed over to customers remain in work in progress. There is no work in progress in the provision of services. The cost of work in progress in individual and small-scale production, where costs are taken into account in the context of open production orders: construction, heavy engineering, services, R&D, etc., is determined by the sum of the costs of fulfilling open orders for each reporting date.

In mass and large-scale production, work in progress includes products or works that have not passed all the stages, redistributions, operations provided for by the technological process, or are understaffed, have not passed the necessary checks from technical or chemical control. In this case, according to the inventory of work in progress or according to the operational and technical accounting of production, the natural remains of incompletely finished products (works) are allocated according to their degree of readiness at each stage, operation, at each redistribution. According to the percentage of readiness of natural residues, their cost is determined per the accepted unit of assessment (production cost, direct costs or costs of raw materials, materials, semi-finished products). Hundreds and thousands of technological operations are performed in individual heterogeneous industries. When entering the first operation, the cost of work in progress includes the full costs of raw materials, materials, semi-finished products, and the wages of production workers are determined by the degree of completion of technological operations. Operations performed are subject to standard payroll costs.

In case of separate accounting and calculation of the cost of semi-finished products of own production, the work in progress includes the amount of costs for the balance of semi-finished products recorded on account 21 “Semi-finished products of own production”. When evaluating the balance of work in progress, losses from marriage and unproductive expenses are completely excluded.

The value of work in progress is shown as the balance of the respective accounts in financial accounting only. In management accounting, the value of work in progress is used in various cost and cost calculations without being reflected as a balance on account 20 “Main production”, although a different methodology for such accounting is possible.

Account 21 "Semi-finished products of own production" is used to reflect and summarize information about the costs of semi-finished products of own production, their movement and balances in organizations that keep accounting of semi-finished products separately from accounting for the main production. Such an account makes sense in limited conversion industries: metallurgy, foundry and some chemical industries, the development of rubber products, and some types of mineral fertilizers. In most sectors of the national economy, separate records of semi-finished products of own production are not kept. Their costs are taken into account in the general order on account 20 "Main production".

According to the debit of account 21 “Semi-finished products of own production”, in correspondence with account 20 “Main production”, the costs for the production of semi-finished products received at warehouses and storage facilities are reflected. On the credit of account 21, again in correspondence with account 20 “Main production”, the costs of semi-finished products transferred for further processing to other redistributions or sold to third-party organizations and individuals are written off.

The specifics of management accounting of semi-finished products of own production is such that production costs for the balance of semi-finished products are reflected as a debit balance of account 21 “Semi-finished products of own production”. This balance at the end of the reporting year is not closed, but goes into management accounting for the next reporting year. The ending balance on the debit of account 21 "Semi-finished products of own production" is balanced by the ending balance on the credit of account 27 "Reflection of production costs". To be reflected in the accounting balance sheet, the value of the balances of semi-finished products of own production, together with the value of other balances of work in progress, is recorded as a balance in the debit of the financial accounting account.

Analytical accounting of semi-finished products is carried out in the context of their storage locations, for each storage facility separately, by types, grades, sizes and other distinctive features. Costs for semi-finished products on account 21 “Semi-finished products of own production” can be grouped by calculation items, but can also be taken into account as a single amount, depending on the need for relevant information.

Account 23 "Auxiliary production" reflects information on the costs of products and services that are auxiliary to the main production of the organization. These include the production and transformation of electricity, heat, steam, compressed air, repair and transport services, the production of tools and devices, and other similar works and services.

Direct costs of auxiliary productions are recorded in the debit of account 23 "Auxiliary production" in correspondence with account 27 "Reflection of production costs". Expenses for the management and maintenance of auxiliary production units are recorded in the debit of account 23 "Auxiliary production" in correspondence with account 25 "General production expenses". According to the credit of account 28 "Marriage in production", in the debit of account 23 "Auxiliary production", losses from marriage that arose in subdivisions of auxiliary production are written off.

Products, works and services of auxiliary productions handed over to subdivisions of the main production and sold to third-party organizations and persons are written off to the account of the main production. Outsourcing operations transform the products and services of ancillary industries into salable products. The costs of these operations are quite reasonably related to the cost of products, works and services of the main production. Costs for products, works and services of auxiliary production, consumed in the main production or sold to the side, are written off to the debit of account 20 "Main production" in correspondence with account 23 "Auxiliary production".

According to the conditions of economic activity and the technological features of the operations carried out, the products, works and services of auxiliary industries can be related to the costs of managing and organizing production in the main divisions, to managing the entire organization as a whole, to service industries and non-production farms. In this case, the costs of auxiliary production are recorded on the credit of account 23 "Auxiliary production" in the debit of accounts 25 "General production expenses", 26 "General expenses", 29 "Service production and farms".

The methodology for reflecting the costs of auxiliary production is such that, under certain conditions, a balance is necessarily formed on the debit of account 23 “Auxiliary production”, which characterizes the unclosed costs of auxiliary production units, i.e., in fact, work in progress. This balance cannot be excluded, and it is determined in management accounting at the end of each month. This balance at the end of the reporting period is not closed. It is carried over to management accounting for the next financial year. The ending balance on the debit of account 23 "Auxiliary production" is balanced with the ending balance on the credit of account 27 "Reflection of production costs".

Analytical accounting of the costs of auxiliary production is carried out in the context of the relevant auxiliary units by cost items, types of products, works and services.

Account 25 "Overall production expenses" is used to reflect information on the costs of servicing and managing divisions of the main and auxiliary industries, and in large organizations - also on the costs of servicing and managing service industries and farms.

Analytical accounting of overhead costs is carried out by subdivisions (shops, sections, departments, teams, etc.) in the context of articles of the approved estimate for each subdivision and a summary estimate of overhead costs.

According to the debit of account 25 "Overall production costs", data on the costs incurred for a period of time (usually a month) are recorded, in correspondence with account 27 "Reflection of production costs".

The monthly amount of actual expenses is reflected in the credit of account 25 "General production expenses" in the debit of the accounts:

20 "Main production" - for the amount of costs in the divisions of the main production;

23 "Auxiliary production" - for the amount of costs in the subdivisions of auxiliary production;

"Defective in production" - for the amount of costs related to rejected products;

“Serving industries and farms” - for the amount of costs in the subdivisions of these industries and farms.

This entry on the credit of account 25 “General production expenses” closes this account on a monthly basis, which does not and should not have a balance on the end date of each month. In order to save accumulative information from the beginning of the reporting year for each division and each article, credit records can be reflected in a specially designated separate sub-account. The credit balance on this sub-account will balance the debit balance of all other sub-accounts, and the balance is reflected cumulatively from the beginning of the reporting year. At the end of the reporting year, the balance of all subaccounts is mutually closed by internal postings on all subaccounts to account 25 "General production costs". Entries in the next reporting year begin with a zero balance on all sub-accounts of this account.

When distributing overhead costs by types of products, works and services, the costs accounted for in this particular unit are distributed only to those types of products (works, services) that were produced or performed, in whole or in part, in this particular unit.

Account 26 “General business expenses” reflects information on general management costs that are not directly related to production processes, as well as on costs included in the cost item “Other production costs”. According to the debit of account 26 “General business expenses”, in correspondence with account 27 “Reflection of production costs”, all amounts of costs related to this account are recorded.

Analytical cost accounting on account 26 “General business expenses” is carried out according to budget items, management units and responsibility centers. All costs in analytical accounting are reflected accumulatively, on an accrual basis from the beginning of the reporting year. At the end of the reporting year, the final data on the costs reflected in the account are displayed in a separate file, which is stored in the archive. A final internal report on these costs is also prepared. After the completion of all operations of the reporting year, account 26 “General expenses” is closed by an accounting entry on the credit of the named account to the debit of account 27 “Reflection of production costs”.

If it is necessary to calculate the full production cost of manufactured products, delivered works and services, general business expenses recorded on account 26 are calculated (without reflection in the management accounting system) to the reduced production cost that was formed on account 20 "Main production". For management accounting, it is more important to summarize cumulative information on budget items and responsibility centers than to summarize all information for costing on the main production account.

Account 28 "Marriage in production" serves to reflect information on the cost of the identified marriage, the costs of correcting it and identifying the final losses from the marriage in a given period. The usual cycle for identifying waste from marriage is one month.

A marriage revealed in production is formalized with primary documents, which indicate what is rejected, the reasons, perpetrators and place of detection of the marriage, the possibility of correcting the rejected item. In management analytical accounting, all the named characteristics of marriage are summarized in order to analyze the possibilities for eliminating the causes and preventing or reducing marriage in the future.

The costs of rejected items that are not subject to correction (final marriage) are recorded in the debit of account 28 "Marriage in production" in correspondence with accounts 20 "Main production" and 23 "Auxiliary production". Additional costs for the correction of marriage are also included in the debit of account 28 "Marriage in production" in correspondence with account 27 "Reflection of production costs". The costs associated with the correction of marriage are reflected at reduced production costs, therefore, in the debit of account 28 "Marriage in production", the corresponding part of overhead costs is recorded by posting on the credit of account 25 "General production costs".

Losses from marriage, recorded in the debit of account 28 "Marriage in production", are reduced by the cost of rejected items at the price of possible use, as well as by the amounts to be recovered from the perpetrators of the marriage - the organization's personnel or from suppliers of low-quality materials and semi-finished products that led to marriage. In management accounting, these compensations are recorded on the credit of account 28 "Marriage in production" in the debit of account 27 "Reflection of production costs".

In financial accounting, the amounts compensating for losses from marriage are recorded on the credit of account 37 “Reflection of expenses by elements” in the debit of the accounts:

10 "Materials" - for the value of rejected items at the price of possible use, for example, at the price of scrap metal credited to the warehouse;

73 “Settlements with personnel for other operations”, sub-account 73-2 “Settlements for compensation for material damage” - for the amount of compensation for losses from marriage to be recovered from employees of the organization;

76 "Settlements with various debtors and creditors", sub-account 76-2 "Settlements on claims" - for the amounts to be collected from suppliers of low-quality materials, semi-finished products, etc., as a result of which a defect was formed in production.

As a result of comparing the amounts recorded in the debit and credit of account 28 "Marriage in production", the amount of final losses from the marriage is determined. It is recorded in the debit of account 20 "Main production" by posting on the credit of account 28 "Marriage in production". At the same time, account 28 “Marriage in production” is closed and has no balance on the end date (end of the month).

Account 29 “Service industries and farms” reflects the costs of service industries and farms that are on the balance sheet of the organization and are not directly related to the main production activity of the organization. Among them are the costs of housing and communal services, public catering, sanatoriums, rest homes, children's and medical institutions, as well as scientific and cultural institutions, and other service departments.

The costs of service industries and farms are not included in the cost of products, works and services of the organization, as these are non-production costs. But they require control over compliance with planned estimates. The costs of service industries and farms are reflected in analytical accounting by types of industries and farms, places of occurrence - responsibility centers, budget items. The amounts of costs are recorded in the debit of account 29 "Serving industries and farms" in correspondence with account 27 "Reflection of production costs". Indirect costs for the management of service units are monthly debited to account 29 "Servicing industries and facilities" in correspondence with account 25 "General production costs".

In management accounting on account 29 “Serving industries and farms”, information on costs is reflected in some

on a cumulative basis from the beginning of the reporting year. The debit balance at the end of each reporting month reflects the amount of costs posted since the beginning of the reporting year, which makes it easier to control costs by responsibility centers and budget items. The sum of the balance of costs also reflects the value of the balance of work in progress. The cost of products manufactured, works delivered and services rendered is determined by calculation using the formula

Cost price since the beginning of the year

Costs since the beginning of the reporting year: balance of account 29

Change in WIP cost at the beginning and end of the period.

At the end of the reporting year, after compiling the final internal report on costs by responsibility centers and cost items, the balance of account 29 “Service industries and farms” is closed, entries in the next reporting year begin with a zero balance on this account. Accounting entry:

debit account 27 "Reflection of production costs";

credit of account 29 "Service industries and farms".

The balance of the balance on the accounts of management accounting (accounts 20-29) is ensured by the method of all entries on the accounts through their reflection on the credit (or, in appropriate cases, on the debit) of account 27 “Reflection of production costs”. The amount of debit balances on accounts 20 "Main production", 23 "Auxiliary production", 26 "General expenses", 29 "Service production and farms" is always equal to the balance on the credit of account 27 "Serving production and farms". As a result, a separate balance sheet system of management accounting is formed on accounts 20-29, in which turnovers and balances are mutually balanced for the entire set of these accounts. This allows you to keep management accounts separately from financial accounting accounts, without compiling an overall balance sheet for all accounts recommended by the current Chart of Accounts. They make up two balances of accounts: financial accounting and separately management accounting, which allows you to close confidential information about costs, detailed on management accounting accounts.

Consider an example.

1. Data records on management accounts. Contents of the entry Debit account Credit account Amount 1) Expenses by elements are regrouped and recorded in management accounts 25 20 23

28 29 27 27 27 27 27 27 2500 1400 1500 1600 200 900 8100 production 23 25 600 5) The cost of products and services of auxiliary industries transferred to the main production 20 23 1700 6) Write-off of general production costs of the main production and related to the correction of defects 20 28 25 25 850 50 900 7) Amounts recovered as compensation for losses from defects 27 28 130 8) The final amount of losses from marriage is written off to the costs of the main production 20 28 340

2. Reflection of the balance of accounts. Account Name of account Record No. Turnover Credit debit credit credit debit 20 Main production 1 2500 2 150 3 120 5 1700 6 850 8 340 Total 5390 270 5120 - 23 Auxiliary production 1 1400 3 100

Account Name of account No. Turnover Balance debit credit Debit credit 4 600 5 1700 Total 2000 1800 200 - 25 General production expenses 1 1500 4 600 5 900 Total 1500 1500 - - 26 General expenses 1 1600 1600 27 Recording of production costs 1 2,150 7,130 Total 280 8,100 - 7,820 28 Production scrap 1,200 3,220 6 50 7,130 8,340 Total 470,470 - - 29 Service industries and farms 1,900 900

3. Balance of management accounts Account Turnover Balance Debit Credit Debit Credit 20 5390 270 5120 - 23 2000 1800 200 - 25 1500 1500 - - 26 1600 - 1600 - 27 280 8100 - 7820 28 470 - 290 490 12 140 12 140 900 7820 7820

Note. The balance at the beginning of the period was not reflected in the accounts in order to simplify calculations.

An example of cost records on management accounts indicates the possibility of separating this group of accounts into an independent balance sheet system and receiving cumulative information on most key accounts on an accrual basis from the beginning of the year. On accounts that are being closed (accounts 23, 25, 28), you can also get cumulative information about costs if you reflect debit and credit turnovers (and balances) separately on different sub-accounts. Obtaining accumulative information about the costs on the accounts of management accounting is extremely important for organizing, controlling us in terms of responsibility centers and budget items.

06.12.2007

Upcoming conferences on the organization of management accounting

Sergey Dolginov and Mikhail Kuznetsov,

PricewaterhouseCoopers

In what cases does it make sense to completely or partially combine accounting processes? How to do it in practice? PricewaterhouseCoopers consultants Sergey Dolginov And Mikhail Kuznetsov answer these questions in their article and describe in detail the procedure for convergence of accounting systems, illustrating each stage with examples.

In today's Russian practice, there are several main reasons for the emergence of a management accounting system parallel to accounting:

- Distortion of the legal corporate structure in comparison with the organizational (financial) structure, as well as distortion of the principles of legal registration of business transactions in comparison with their actual content. Such distortions can be caused both by tax planning tasks and by “growing pains” of the holding structure;

- Strict regulation by Russian accounting standards (RAS) and the Tax Code (TC RF) of the procedure for accounting for certain types of business transactions, which sometimes is a serious burden for enterprises and significantly reduces the efficiency of some business processes;

- The desire of enterprises to maintain management accounting in accordance with generally recognized international standards (IFRS / GAAP);

- Problems associated with the efficiency of data entry in accounting, as well as the orientation of accountants to fiscal tasks.

At enterprises that conduct parallel accounting and management accounting, the “deep essence” of business operations is often reflected only in management reporting. This is due to the fact that high analyticity of accounting is required primarily by financiers-managers. In the absence of a "customer" of high-quality analytical information, it becomes larger and more primitive.

Recently, the influence of some of the factors that previously forced enterprises to maintain two parallel accounting systems has weakened. At the same time, incentives have appeared that encourage full and objective disclosure of the company's real financial position and performance in reporting: the desire to gain access to financial markets, improve the company's status in the market, and reduce tax risks.

Benefits of convergence between accounting and management accounting

By bringing accounting and management accounting together, an enterprise can acquire a number of benefits.

The most obvious of them is to increase the efficiency of the financial and accounting function and reduce the cost of maintaining it. A positive result is obtained by combining even a limited number of accounting processes. For example, the moment of reflection and evaluation of cash inflow and outflow transactions for all accounting systems are usually the same. Therefore, combining the process of posting bank and cash statements for accounting and management accounting purposes can provide real savings, especially if the number of documents to post is large.

In the case of a complete combination of accounting processes, there is generally no need to maintain two apparatuses for keeping records, maintaining parallel systems of internal regulatory regulation and ensuring internal control. And with the automation of accounting, you can achieve significant savings in the implementation and support of the information system.

Another advantage of combining is the formation of a single internal information space and an unambiguous understanding by all employees (both accounting employees and managers) of the essence of the processes taking place at the enterprise. There is no need to build a correspondence between the reflection of transactions in management and accounting, since all transactions are qualified and reflected uniformly.

With the formation of a unified accounting system, the efficiency of internal and external control also increases. If the result of management accounting is a truncated set of reports that reflects only the most important aspects of the activity, then most likely the enterprise does not have a mechanism for verifying credentials and ensuring their integrity. Maintaining management accounting according to the rules of accounting allows in such cases to improve the quality of reporting.

Open reporting prepared in accordance with the rules of RAS can be confirmed by an independent audit, which plays an important role in building relationships with owners and creditors, both current and prospective.

Problems of convergence of accounting and management accounting

The most significant obstacle in the project of convergence of accounting and management accounting is the resistance of the company's personnel. Therefore, the larger the changes and the more people they affect, the more time is required to adapt and learn. It is vital that senior management fully support strategic change and be prepared for the cost (both material and time) of its implementation.

Here are the main problems preventing the convergence of accounting and management accounting.

1) Contradictions for accounting purposes. Accounting is mainly for fiscal purposes, while management accounting is a decision-making tool for company management. A striking example is the increase in the analyticity of accounting. Since the level of detail for different areas of accounting in the two systems is different, it is necessary to put maximum analytics into a single accounting system so that the interests of all reporting users do not suffer. For accountants, an increase in analyticity means an increase in the amount of information that needs to be mastered and the complexity of work.

The timing of reporting is also important. As a rule, more responsive reporting is required for management purposes. Sometimes its timeliness is even more priority than reliability. In the case of financial statements, on the contrary, priority is given to reliability.

2) Differences in accounting methodology. One of the reasons for parallel accounting and management accounting is the strict regulation of accounting procedures by RAS standards and other regulations. As an example, we can cite the value limit for classifying objects as fixed assets, which is strictly regulated in tax accounting (accountants tend to adhere to it in accounting as well). In the case of applying an alternative limit on the cost of fixed assets in management accounting, different accounting systems form a different composition of assets and a different financial result. Bringing accounting systems closer together will require either complying with the strict rules of RAS and tax laws, or making significant changes to business processes.

3) Preparing opening balances and transitional reporting. When switching to a unified accounting system, it is necessary to bring the credentials to a single incoming balance. Naturally, reporting and synthetic accounting data must be deciphered by analytical accounting data. This is a time-consuming task, since differences in accounting rules and materiality criteria lead to the fact that both the set of analytical objects and their assessment differ in the two accounting systems. In such cases, priority is usually given to accounting data, since financial statements are subject to external control. When switching to a unified accounting system, it is advisable to draw up a transitional balance sheet, in which it is necessary to reflect all changes in the balance sheet items of management accounting and their total impact on the amount of equity capital.

Stages of combining accounting and management accounting

It is advisable to carry out the combination of accounting and management accounting in stages. If changes affect a large number of employees with conflicting interests, it is very important to document project processes from beginning to end. Fixing the current accounting model and working out the future model is one of the key factors for the successful implementation of the project.

1) At the beginning of the project, it is necessary to identify discrepancies in accounting and management accounting and draw up a detailed list of them. Further, for each type of difference, discussions are held with key managers and decisions are made on how to eliminate (accept an accounting position, a management accounting position, develop an alternative compromise option, do not eliminate the difference). At the same time, the degree of convergence can be different - from complete integration to convergence on individual business processes. This aspect of the strategic decision is set at the earliest stages of the project and determines all other stages. Sometimes enterprises even make legal and organizational changes: changing the ownership structure, restructuring, etc.

Example 1. List of discrepancies in accounting and management accounting

|

Accounting section, accounting aspect |

Current accounting position |

Current position of management accounting |

Worked out solution |

|

Accounting currency |

Rubles (accounting legislation requirement) |

US dollars (wish of the company's management) |

Keep accounting and management records in rubles. Management reporting should be submitted both in rubles and in US dollars (a number of assets and capital items - at the historical rate, cash items - at the rate as of the reporting date, other items - at the weighted average monthly rate) |

|

Cost criterion for classifying an asset as fixed assets |

10 thousand rubles (tax law requirement) |

2 thousand US dollars (wish of the company's management) |

Establish a single criterion for referring to the OS - 10 thousand rubles. In the interests of management accounting, allocate fixed assets worth from 10 to 54 thousand rubles using special analytics. |

|

Analytics of income from ordinary activities |

Accounting for income by consolidated types of activities |

Detailed analytics in the context of all types of income |

Develop a single list of analytics for income from ordinary activities (see example 3), which meets the requirements of both accounting and management accounting |

2) Based on the results of the elaborated list of differences, they begin to form documents of internal regulatory regulation of the upper level - accounting policies, charts of accounts and analytics (types of income and expenses). If accounting and management accounting are fully combined as a result of the project, then it makes sense to develop a single accounting policy, a single chart of accounts and a list of analytics. If the union is incomplete, then two sets of documents must be generated. This toolkit will allow for stricter control over the convergence of accounts, as well as to increase the degree of convergence in the future.

Example 2. Single Chart of Accounts for Accounting and CS purposes

|

Check |

Sub-account of the 1st order |

Sub-account of the 2nd order |

Sub-account of the 3rd order |

Name |

|

|

RAS/UU |

Sales |

||||

|

RAS/UU |

Revenue |

||||

|

RAS/UU |

Revenue from type of activity A (rendering services) |

||||

|

Revenue from type of activity A (rendering services) received from holding companies |

|||||

|

Revenue from type of activity A (rendering services) received from third-party companies |

|||||

|

RAS/UU |

Revenue from type of activity B (wholesale trade) |

||||

|

Revenue from type of activity B (wholesale) received from holding companies |

|||||

|

Revenue from type of activity B (wholesale trade) received from third-party companies |

|||||

|

RAS/UU |

Cost of sales |

||||

|

RAS/UU |

Cost by type of activity A (rendering services) |

||||

|

Cost by type of activity A (rendering services), in terms of income received from holding companies |

|||||

|

Cost by type of activity A (rendering services), in terms of income received from third-party companies |

|||||

|

RAS/UU |

Cost by type of activity B (wholesale trade) |

||||

|

Cost by type of activity B (wholesale trade), in terms of income received from holding companies |

|||||

|

Cost by type of activity B (wholesale trade), in terms of income received from third-party companies |

|||||

|

RAS/UU | |||||

|

RAS/UU |

VAT by type of activity A (rendering services) |

||||

|

VAT by type of activity A (rendering services), in terms of income received from holding companies |

|||||

|

VAT by type of activity A (provision of services), in terms of income received from third-party companies |

|||||

|

RAS/UU |

VAT by type of activity B (wholesale trade) |

||||

|

VAT by type of activity B (wholesale), in terms of income received from holding companies |

|||||

|

VAT by type of activity B (wholesale), in terms of income received from third-party companies |

|||||

|

RAS/UU |

Profit/loss on sales |

||||

|

RAS/UU |

Profit/loss on sales by type of activity A (rendering services) |

||||

|

Profit / loss from sales by type of activity A (rendering services), in terms of income received from holding companies |

|||||

|

Profit/loss from sales by type of activity A (rendering services), in terms of income received from third-party companies |

|||||

|

RAS/UU |

Profit/loss on sales by type of activity B (wholesale trade) |

||||

|

Profit/loss from sales by type of activity B (wholesale trade), in terms of income received from holding companies |

|||||

|

Profit/loss on sales by type of activity B (wholesale trade), in terms of income received from third-party companies |

A comment: all presented accounts (sub-accounts of account 90) in this example are used for both accounting and management accounting. Sub-accounts of the 1st order are organized in accordance with the requirements of accounting regulations. Sub-accounts of the 2nd order (in the context of activities) are of interest to both accountants and financiers-managers. Sub-accounts of the 3rd order (allocation of intra-group income and intra-group financial result) are of interest primarily for management accounting.

Example 3. A single list of analytics for the purposes of accounting, accounting and accounting (types of income)

|

Accounting section (RSBU, UU, RAS / UU) |

Revenue item code |

Name of income item |

Classification for tax accounting |

|

RAS/UU |

Income from ordinary activities |

|

|

|

RAS/UU |

Income from operations for the provision of hotel services |

|

|

|

Accommodation - standard rooms |

Sales revenue |

||

|

Accommodation - VIP rooms |

Sales revenue |

||

|

Accommodation - family rooms |

Sales revenue |

||

|

Booking Services |

Sales revenue |

||

|

Fitness center services |

Sales revenue |

||

|

Beach area services |

Sales revenue |

||

|

Beauty salon services |

Sales revenue |

||

|

RAS/UU |

Income from the provision of catering services |

|

|

|

Restaurant Sales |

Sales revenue |

||

|

Coffee shop sales |

Sales revenue |

||

|

bar sales |

Sales revenue |

||

|

RAS/UU |