How to create a spreadsheet in excel. Key templates for budgeting in Excel

The peculiarity of accounting for your expenses is that this is a process that is extended in time, and the results of this process will not be immediately noticeable. But short-term expectations make most people give up their home bookkeeping after a couple of weeks. A person does not see his benefit from daily accounting of his expenses. At first, when the enthusiasm is still alive, a person performs all the necessary actions, and when the enthusiasm dries up, the "work" is carried out by inertia. It must be remembered that there are benefits from family accounting ... you just haven't felt it yet. If you don't give up, in a couple of months you will see tangible results that will allow you to save on expenses and make your financial goals more realistic.

Poll: Have you done home bookkeeping before?

What are the benefits of home bookkeeping?

1. Knowing your monthly expenses, you can cut unnecessary spending and save a significant amount over time. This amount may be enough to buy some useful thing (telephone, bicycle, suit).

Many do not even realize what exactly eats up a significant part of their budget. After a month of waiting and the first report, some people clutch their heads when they see the true picture of their spending. For example, harmless gatherings with friends or eating out can be a significant drain on your wallet. Some women may think a lot if they find out how much money is spent monthly on cosmetics. Separately, we can note the work of the "money vacuum cleaner" - the supermarket. It encourages useless purchases. We tend to believe that we are spending less than we actually do. But the facts (reports) will bring you back to reality and, perhaps, force you to change something for the better.

2. Having information about all your sources of income, you can increase your income at times.

For example, you have multiple sources of income. Having a full report for several months, you can track the dynamics of changes in each source and find the most promising one. By abandoning the "frail" sources, you will get time to develop promising ones.

How to make a home budget?

The family budget can be compared with the budget of the company, so the expected expenses and incomes must be broken down into separate groups. But first, you should analyze the expenses for the last month.

If you are doing home bookkeeping, then you can take the expense report for the past month as a basis. Analyzing the information, you can conclude that not all purchases were necessary. Often people spend significant sums after the paycheck on entertainment and useless trinkets. That is why you should keep a detailed record of all purchases. For anyone, you can make a whole list of products that you can safely do without. Very rarely, a person can plan a family budget without analyzing past expenses.

How to spend money correctly? People have different incomes and, therefore, expenses can also differ significantly - everyone has different priorities, life circumstances and opportunities.

After analyzing your purchases, you need to place each one in one of four groups: essentials, necessary expenses, desired purchases, and unnecessary. Now, to plan an emergency version of the home budget, it is enough to exclude the last two groups from expenses - the desired and the unnecessary. If the salary allows, then you can draw up another budget, which will take into account the third group - the desired purchases. It is better to exclude the fourth group of expenses (unnecessary) from the plan altogether, and instead of unnecessary expenses, it is better to start saving.

Examples of expenses from the first group (first necessity):

- Rent

- Food

- Medications

- Credit

- Transport and/or car

- Internet

- Hygiene products

- Gym

- A laptop

- New shoes

- New phone

- Vacation package

- Cafes and restaurants

- Lottery

- Harmful food

- Bad habits (alcohol, cigarettes)

Food is a significant part of family expenses. Many families spend between 25% and 60% of their income on groceries. That is why you need to take a closer look at this category of expenses. It is advisable to keep a detailed list of expenses, for example, take into account separately the costs of sausages, dairy and confectionery, vegetables, canned food, etc. Over time, you will be able to identify the most expensive category of food, and try to save money on it.

Read also:

In this review, we present the results of testing five home bookkeeping programs. All these programs run on Windows OS. Each application was installed on a computer and tested in several ways.

How to save money on groceries? First, you should study all the promotions that take place in your supermarket. You should also determine which of the "cheap" products you really need. Secondly, you can buy in advance. For example, canned food, cereals and pasta have a long shelf life, and if you purchase these products in large quantities at a discount, then the average price for such a product will be lower. Thirdly, try not to buy unnecessary products - cakes and fast food. They will not bring you any benefit, but you can spend a lot of money on these "pleasures". Remember that even a modest lunch in a cafe will cost much more than "homemade" food. It is better to take lunch from home to work than to dine in a canteen or restaurant.

Excel spreadsheet for home budget

Beginning home accountants can use a regular Excel spreadsheet to track expenses and income - it's easy and free. A spreadsheet will not give you a complete financial picture, but you will gain invaluable experience, which will then be useful for accounting for finances in programs or web services.

A simple Excel spreadsheet for home accounting can be downloaded. A complete selection of Excel spreadsheets is available at this link. The selection contains a variety of tables that will help you not only take into account current expenses and income, but also plan your family budget for several months in advance.

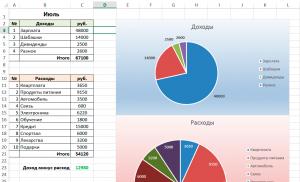

Let's analyze the simplest table home-buh.xls . So far there is one leaf "July". You can add new sheets by month: "August", "September", etc. In each new sheet, you can copy the contents of the "July" sheet (it will be a template). In our example, everything is extremely simple - there are two sections "Income" and "Expenses". Entering data into these sections, you form the "total" field and reports. You can add new fields (categories) to the specified sections - the report and the "total" field will be automatically updated.

Read also:

This review was created to help you choose a program for managing your family budget. We tested the most popular windows-programs designed for financial control. The main focus of the review is the accounting of expenses and incomes on a family scale.

Even such a primitive report can point you to holes in the family budget. If any category of expenditure eats up a significant part of the budget, then it needs to be reviewed. This is done simply - you need to break this category into separate subcategories and keep track of expenses in more detail. For example, such an expense item as "Food" is quite extensive. This includes sausages, fruits, and pastries.

- Ready meals

- Sausages

- Confectionery

- Candies

- Ice cream

- Vegetables

- Fruit

- Bakery products

After such a division, you need to follow each subcategory. For example, you will eventually find that the cost of sausages is unreasonably high. In this case, you should try to reduce this expense item. To do this, you should generally abandon the sausage or replace it with a cheaper analogue - chicken meat.

On the Internet, you can find many programs and services that allow you to keep home accounting. Mobile applications are also gaining popularity, with the help of which you can establish a full account of personal finances. In this review, we will look at several popular solutions in this area.

Housekeeper - accounting for personal finances

is a simple program with a friendly interface. Due to its simplicity, Housekeeper is available to a wide range of users - from beginners to pros. The main menu is located in the left part of the window: Expenses, Incomes, Debts... If you enter any section, you can see that the data is stored in tables. Each table can be sorted by a separate field. To do this, click on the title of the corresponding field. For example, you want to sort expenses by amount - then click the "Amount" column, and if you need to see the history of expenses, then click the "Date" heading.

In addition to accounting for expenditure and income transactions, the following functions are available in the program: accounting for debts (I owe, I owe), loans (with a history of repayment), a system of user accounts (with a choice of base currency), as well as a system of directories (categories of expenses and income). The program also has a table with monthly reminders of important events (rent, loan payments). Reports can be viewed in a separate section. Here the user will be able to select the type of report, the user, as well as the time interval. The current version of the Housekeeper has 17 reports - this number is quite enough to analyze your family budget.

Output. A good program with advanced functionality and a clear interface. An ideal option for beginner "home accountants" - everything is simple and clear here. Works under Windows, has a small size, you can carry it with you on a USB flash drive.

Drebedengi

Drebedengi is an online service for home bookkeeping. The advantage of such a service is obvious - access to the system is possible from any device and from any place where there is Internet. The mobile version of the site looks good even on cheap smartphones with a small screen resolution.

Particular attention is paid to planning the family budget. The system has a special section for this, where users can plan their expenses and incomes. This feature will allow you to look into your financial future - you can find out how much money will accumulate in a month or a year. It is very convenient to plan savings for future large purchases. A plan can be drawn up not only for each family member, but for all at once. If the system determines a deviation from the planned, it will automatically report this and show the amount of deviation.

The service allows you to combine different accounts into a single segment. This is very convenient if you are doing family accounting (each member has his own account). In this case, the users will be combined by the joint budget and statistics. The developers of the Drebedengi system offer to use applications for iPhone and Android devices in order to manage expenses offline, with further data synchronization with the main service. Applications for Windows (including Windows Phone) have also been created.

Output. The Drebedengi web service is intended for fans of cloud technologies. The main advantage of the system is access from any device and anywhere (where there is Internet). The functionality is not bad - it is quite enough for home bookkeeping.

Personal Finances

Personal Finances is a powerful and convenient family bookkeeping tool. Thanks to a clear and colorful interface, the user will quickly find a common language with this program. The main principle of the application: less action - more results. Using the budget planning feature, you will be able to stay within your current financial possibilities.

The program can work not only on a computer under Windows, but also on smartphones and tablets (Android, iOS). Any member of the family can keep a table of expenses separately. Reports will allow you to determine who earns and spends the most. The privacy protection feature will prevent unauthorized editing, as well as help hide some expenses or income from other users.

For quick input of information, auto-substitution of words by the first letters is provided. It is also possible to undo previous user actions, such as undoing the deletion of a record from the database.

The main functions of the program: work with several users, quick accounting of personal finances, multicurrency, task scheduler, loans and debts, budget planning.

Output. A good option for advanced "home accountants". If you are not afraid of the abundance of functions, and you want to study your finances in great detail, then Personal Finances is your tool. A good interface and an abundance of reports will satisfy the needs of the most demanding users.

This program is quite well-known in the Runet. We list the main advantages of "Home Accounting": simplicity (no additional knowledge is required), benefits (awareness of one's position will help achieve financial goals), benefits (analysis of income and expenses will help to gain financial stability), security (data protection with a password and database backup).

The program is able to keep track of finances for the whole family. Each family member can create an account and enter income and expenses separately from the rest. Accounting for loans and debts will help stabilize your financial situation. As the base currency, you can choose any world currency (dollar, euro, rubles, hryvnia, etc.). Expenses and income can be synchronized with different devices - tablets, smartphones, PCs (there is a version for iOS and Android).

The reporting system has a finished and thoughtful look. You can get a report on the status of accounts or expenses in a couple of seconds. Home accounting will give you the opportunity to analyze income and expenses, and you can also draw up a correct financial plan based on reports.

The function of data import and export will significantly reduce the time of entering data into the program. Import bank statements and data from other databases into the program. If you want to transfer data from the program to someone, then information export is provided for these purposes.

Output. Keepsoft home bookkeeping is an affordable tool with good functionality. The presence of a mobile version makes the program multiplatform. If you are not afraid of complex interfaces, then you will surely make friends with this program.

MoneyTracker

MoneyTracker is another popular family bookkeeping software. It has all the necessary set of tools for controlling personal finances - accounting for expenses / income, debts, loans, a powerful reporting system, a calendar and much more.

![]()

![]()

The program has an interesting detail - the information window. This is an area of the screen, the content of which can be customized. Here you can display individual blocks, for example, reminders, exchange rates, the current state of the budget. Due to the information window, the visibility of the program increases significantly. Such a "trick" will appeal to fans of widgets. The Calendar module can be used to schedule important events. Here it is easy to set up a reminder for any event.

It should be mentioned that the MoneyTracker program can work on a local network. That is, the database will be one, and there will be several users (programs). Such a function will be in demand in families where several computers are used at once, for example, the son has a stationary PC, the head of the family has a laptop, and the wife has a tablet. All these devices can be linked to one database, and each family member will comfortably enter expenses and incomes into a single database of the MoneyTracker program.

Drebedengi

Saving the family budget is a hot topic for almost all of us, insofar as it is much more reasonable to save money than to get into debt and take out bank loans. After all, personal accounting is not as easy as it seems at first glance, and saving personal funds helps to optimize expenses and income. The most effective way to optimize your expenses is to keep a journal of expenses and income, for this you can use one tool - an Excel spreadsheet. True, not everyone knows how to properly manage a family budget in Excel, let's try to understand this topic.

Where to begin

First of all, if you are interested in the question of how to keep track of expenses and income at home, then you should take into account one important fact, only one of the whole family should deal with finances and distribute funds for the needs of all family members. Accordingly, the first step to start budget planning is to discuss the personal needs of each family member. If this issue cannot be resolved, then, accordingly, there can be no talk of any accounting and savings. Money loves an account, or to be more precise, in this case, accounting.

By the way, if you have a large and friendly family, then it will be much more difficult to control income and expenses, because not all family members will be ready to support such an idea. But in fact, it is almost impossible to put things in order in financial matters without home accounting, so the primary task is to motivate all family members and make sure that you keep a journal.

How to install an Excel spreadsheet

Even if you are not a confident Internet user, installing an Excel spreadsheet on your computer will be quite simple. The instruction will look like this:

- in the menu of your computer, find the Microsoft Office folder, open the Microsoft Excel program in it;

- after the table opens, click the "File" button;

- select the "Create" line in the menu;

- in the window that opens, select the link "Budgets" from the left column;

- among the proposed options, you need to find the “Family Budget for a Month”;

- click the "Download" button.

Actually, that's all, the table for your accounting is ready. As you can see, it already has several lines that you can easily adjust, that is, remove items of expenditure that you do not need and add new ones. To carry out this action, it is enough to move the mouse cursor over the line, click on it, then, by pressing the Backspace button, delete the expense item that you do not need, and type the necessary values on the keyboard.

However, we will analyze how to use the table, and how to properly keep track of the family budget, a little later. I would also like to say that if such a scheme seems too complicated for you, then you can easily download the finished table. There are enough resources on the Internet that allow you to download an Excel spreadsheet with a ready-made family budget template for free, in order to find the option that suits you, enter the query “download family budget Excel spreadsheet” in the search box, then you are faced with the task of choosing the most understandable and convenient option for yourself.

Please note that in order to download a table in Excel, you need Internet access, among other things, you will have a lot of options from which you can choose the most intuitive for yourself.

How to complete the expense and income section

So, after your table is ready, you face a new task - to fill in all the fields correctly, that is, in each family of an article, expenses can vary significantly, so first think about what you usually spend your money on . By the way, there are ready-made options in the table, these include items such as food, utility bills, transportation costs, education, loans, personal needs, entertainment, and more. That is, for each individual family, you need to create your own list of basic expenses.

Advice for Excel Users! You should not write too many lines with expenses so as not to get confused in the future, some categories can be combined into one, for example, you pay separately for services such as gas, electricity, water, home telephone, Internet, etc., together they create one category - public Utilities.

By the way, it is always worth remembering that each family member has expenses that he bears exclusively for his own needs, or in another way - this can be called pocket expenses. Be sure to display this in your account. In fact, every family member should have free funds, including children, if they have reached at least school age. At the same time, the pocket expenses of each family member should correspond as much as possible not only to his personal needs, but also to the total income of the whole family.

Table example

Keeping the income section, of course, is much easier, because the main task is simply to indicate in the table the income that the family has. By the way, family income includes absolutely all the money that, one way or another, falls into the family budget, for example, wages, benefits, alimony, pensions, additional earnings, and much more.

It is on this principle that a family budget can be kept. The family income and expenses table in Excel will only help you find the answer to one simple question that everyone probably asks themselves - where does the money go. Indeed, it is almost impossible to find an adequate answer to such a question if you do not take into account all your income and expenses. However, even an elementary table in Excel will not help you fully answer this question. Let's take a closer look at how to understand what you spend money on.

By the way, for every month you need a new account, or rather, a report. To do this, it is not necessary to create several documents; it is enough to start keeping records from a new page in Excel every new month. That is, create several pages and fill out a new one for each month, after a certain time you will be able to conduct statistics on your income and expenses.

How to properly allocate funds

So, if you decide to keep track of your family's income and expenses, then you must surely understand what you are spending money on and what you are wasting it on, that is, in every family there will certainly be expenses that could have been avoided. Moreover, even the cost of such an item as food is not always justified, because the issue of choosing products and compiling a diet for the whole family needs to be worked on.

Advice! If you cannot adequately answer the question of where you are spending your money, conduct a simple experiment: for two weeks or a month, collect checks from stores so that at one moment you can carefully study them and cross them out, count those purchases that you could do without. the amount of thoughtless expenses, for sure, the result will surprise you.

So, insofar as the main item of expenditure for each family is food, the main task of each housewife is to correctly allocate funds to her. First of all, there are many secrets on how to save on food and at the same time not worsen the quality of your life. If you can extract unnecessary groceries and other purchases from your expenses, then you can easily save on food while doing absolutely no harm to your health.

If you find the right approach, then you can save on absolutely everything. In addition, if you carefully record all your expenses, then after a certain time you will see for yourself that you are spending much more money than you could spend if you approached the issue of expenses more deliberately. By the way, you should not make a too complex table with numerous rows, so as not to waste time filling it out.

By the way, it is impossible not to say that the costs are divided in turn into two categories: planned and actual. That is, for each month you can independently draw up a plan for your expenses, that is, allocate the amount of funds for certain needs, for example, for utility bills, food, entertainment, loans and other items of expenditure. As you complete the table at the end of the month, you will be able to see how effective your plan was and whether it needs to be improved, especially if the actual costs are significantly higher than planned.

Among other things, you can learn how to spend your money in such a way that at the end of the month you will still be in the black. That is, after paying for all your needs, you may have an amount of free funds that can be directed to a savings bank account or spent on something necessary for the family.

Interesting! In practice, there are people who, after taking into account the family budget, gave up such a bad habit as smoking, after they calculated how much money they spend on buying cigarettes per year.

Why you need to keep track of the family budget

First of all, the task of each family is to optimize their income and expenses, that is, to reduce the debit to the credit. Surely everyone is familiar with such a situation that two different families, having the same income, distribute money differently, respectively, some live in abundance, while others constantly need additional funds. By the way, even with a small income, you can completely get rid of debts and not get into loans, because, as practice shows, maintaining a family budget allows you to save significant money.

The table of income and expenses allows you to visually understand where the money goes and for what needs, basically, you spend it. If you carefully analyze the statistics of your expenses, you will definitely find those expenses that can be completely avoided. In the next reporting period, you will be able to more effectively allocate your budget to certain expenses, minus all the costs that you consider useless.

After a certain time of maintaining your family budget, you will be able to approach the planning of the family budget in the most reasonable way and learn how to spend personal funds in such a way that they are enough for all needs, plus there is some balance left that can be spent on savings or on a large purchase.

To summarize, the table of family income and expenses is necessary first of all in order to learn how to manage your finances correctly and wisely. The main task is to correctly record all the income and expenses of the family in order to adjust the purchase plan in the future so that all expenses are reasonable and deliberate.

The family is a state in miniature: it has a head, an adviser, subsidized population”, income and expense items. Planning, distribution and sequestration ( familiar words?) of the family budget is an important task. How to save and save without going on a starvation ration? - Create a table of accounting for funds received by the family, and revise the structure of payments.

- Money- one of the greatest tools created by man. They can buy freedom, experience, entertainment and everything that makes life more comfortable. But they can be squandered, spent who knows where, and senselessly squandered.

Legendary American actor of the early twentieth century Will Rogers said:

"Too many people spend money on things they don't need to impress people they don't like."

Have your income been less than your expenses in the last few months? Yes? Then you are not alone, but in a big company. The problem is that this is not a very good company. Debts, loans, penalties and late payments are growing like a snowball ... it's time to jump out of a sinking boat!

Why you need to keep a family budget

“Money is just a tool. They will take you where you want, but they will not replace you as a driver,” Russian-born writer who emigrated to the States, Ayn Rand, learned firsthand the need to plan and budget her own finances.

Unconvincing? Here three good reasons Start planning your family budget

- The calculation of the family budget will help you figure out long-term goals and work in a given direction. If you drift aimlessly, throwing money at every attractive item, how can you save money and take a long-awaited vacation, buy a car or make a down payment on a mortgage?

- Table of family budget expenses sheds light on spontaneous spending and forces to reconsider shopping habits. Do you really need 50 pairs of black high heels? Family budget planning forces you to prioritize and refocus on achieving your goals.

- Illness, divorce or job loss can lead to a serious financial crisis. Emergencies happen at the most inopportune times. That is why everyone needs a reserve fund. The structure of the family budget necessarily includes the column " saving"- a financial pillow that will help you stay afloat for three to six months.

How to allocate the family budget

A few rules of thumb for planning a family budget, which we will give here, can serve as a rough guide for making decisions. Everyone's situation is different and constantly changing, but the basic principles are a good starting point.

50/20/30 rule

Elizabeth and Amelia Warren, authors of the book All Your Worth: The Ultimate Lifetime Money Plan" (in translation " All Your Wealth: The Ultimate Money Plan for Life”) describe a simple yet effective way to budget.

Instead of breaking down household spending into 20 different categories, they recommend dividing the budget structure into three main components:

- 50% of income must cover basic expenses such as housing, taxes and groceries;

- 30% - optional expenses: entertainment, going to a cafe, cinema, etc.;

- 20% goes to pay off loans and debts, and is also set aside as a reserve.

80/20 rule

Step 2: Determine the income and expenses of the family budget

It's time to look at the structure of the family budget. Start by compiling a list of all sources of income: wages, alimony, pensions, part-time jobs, and other options for getting money into the family.

Expenses include everything you spend money on.

Divide spending into fixed and variable payments. Fill in the fields for variable and fixed costs in the table for maintaining a family budget, based on your own experience. Detailed instructions for working with the excel file in the next chapter.

In the distribution of the budget, it is necessary to take into account the size of the family, housing conditions and the desires of all members of the “cell of society”. A short list of categories is already included in the sample table. Consider the categories of expenses that will be needed to further refine the structure.

Income structure

As a rule, the income column includes:

- the salary of the head of the family (marked "husband");

- earnings of the chief adviser ("wife");

- interest on deposits;

- pension;

- social benefits;

- part-time jobs (private lessons, for example).

Cost column

Expenses are divided into fixed, that is, unchanged: fixed tax payments; home, car and health insurance; fixed amounts for internet and TV. This also includes those 10 - 20% that need to be set aside for unforeseen cases and a "rainy day".

Expenses are divided into fixed, that is, unchanged: fixed tax payments; home, car and health insurance; fixed amounts for internet and TV. This also includes those 10 - 20% that need to be set aside for unforeseen cases and a "rainy day".

Variable cost graph:

- products;

- medical service;

- spending on a car

- clothes;

- payment for gas, electricity, water;

- personal expenses of the spouses (recorded and planned separately);

- seasonal spending on gifts;

- contributions to school and kindergarten;

- entertainment;

- expenses for children.

Depending on your desire, you can supplement, concretize the list or reduce it by enlarging and combining expense items.

Step 3: Track your spending throughout the month

It is unlikely that it will be possible to draw up a table of the family budget this very hour, it is necessary to find out where and in what proportions the money goes. This will take one to two months. In the finished excel spreadsheet, which you can download for free, start making expenses, gradually adjusting the categories " for yourself».

Below you will find detailed explanations for this document, since this excel includes several interrelated tables at once.

- The purpose of this step is to get a clear idea of your financial situation, visualize the structure of expenses and, in the next step, adjust the budget.

Step 4: Separate Needs from Wants

When people start recording spending, they find that a lot of money " flies away» on completely unnecessary things. Impulse, unplanned expenses seriously hit the pocket if the level of income is not so high that a couple - another thousand pass unnoticed.

Refuse to buy until you are sure that the item is absolutely necessary for you. Wait a few weeks. If it turns out that you really can't live without the item you want, then it really is a necessary expense.

A little advice: Put aside credit and debit cards. Use cash to learn how to save. It is psychologically easier to part with virtual amounts than to count papers.

How to plan a family budget in a table

Now you know what is really happening with your money.

Look at the categories of expenses that you want to cut and make your own plan using a free excel spreadsheet.

Look at the categories of expenses that you want to cut and make your own plan using a free excel spreadsheet.

Many people don't like the word " budget”, because they believe that these are restrictions, deprivations and lack of entertainment. Relax, an individual spending plan will allow you to live within your means, avoid stress and sleep better, and not think about how to get out of debt.

“An annual income of £20 and an annual expenditure of £19.06 lead to happiness. An income of 20 pounds and an expense of 20.6 lead to suffering, ”the ingenious note of Charles Dickens reveals the basic law of planning.

Enter the finished family budget in the table

You have set goals, determined income and expenses, decided how much you will save each month for emergencies andfigured out the difference between needs and wants. Take another look at the budget sheet in the table and fill in the empty columns.

The budget is not static, fixed figures once and for all. You can always correct it if necessary. For example, you planned to spend 15 thousand monthly on groceries, but after a couple of months you noticed that you spend only 14 thousand. Make additions to the table - redirect the saved amount to the “savings” column.

How to budget with irregular income

Not everyone has a permanent job with regular salary payments. This does not mean that you cannot create a budget; but that means you have to plan in more detail.

- One strategy is to calculate the average income over the past few years and focus on this figure.

- Second way- determine for yourself a stable salary from your own income - what you will live on, and save the surplus to an insurance account. In lean months, the account balance will decrease exactly by the missing amount. But your "salary" will remain unchanged.

- Third planning option- maintain two budget tables in parallel: for " good" And " bad» months. It is somewhat more difficult, but nothing is impossible. The danger that lies in wait for you along the way: people spend and take out loans, expecting income from the best months. If the "black streak" drags on a little, the credit funnel will eat up both current and future income.

Below you will find solutions on how to distribute the family budget according to the table.

After we have decided on the main goals, let's try to distribute the family budget for a month, indicate current income and expenses in the table, in order to correctly manage the funds, so that we can save for the main goals without missing out on current and everyday needs.

Open the second sheet Budget"and fill in the fields of monthly income, annual income, and the program will calculate the results itself, for example:

In columns " variable costs" And " fixed costs» enter the estimated figures. Add new items where it says " other", in place of unnecessary names, enter your own:

Now go to the tab of the month from which you decided to start saving and planning family expenses. On the left you will find columns in which you need to fix the date of purchase, select a category from the drop-down list and make a note.

- Additional notes are very convenient to refresh your memory if necessary and clarify what exactly the money was spent on.

The data that is entered in the table for example, just delete and write your own:

To account for expenses and income by months, we suggest looking at the table on the third sheet in our Excel " This year“, this table is automatically populated based on your expenses and income, summarizes and gives you an idea of your progress:

And on the right there will be a separate table that will automatically summarize all expenses for the year:

Nothing complicated. Even if you have never tried to master working with Excel spreadsheets, highlighting the desired cell and entering numbers is all that is required.

Poll: How old are you?

Every person who cares about the financial well-being of his family is engaged in the analysis of income and expenses. If you don't know how much money you have, then you don't have any. Keeping a budget allows you to always stay in the black, prevent unnecessary spending, realize goals and dreams.

There are many ready-made programs for accounting for income and expenses. But finding the best program that would fulfill all the needs of a particular family is difficult. Because the requests are different. We offer you to create a family budget in Excel and adapt it to your needs.

Personal income and expense budget in Excel

Several templates are built into the Microsoft Office software package to solve certain tasks. Open Excel - click the button "File" - "Create" - "Sample Templates" - "Personal Monthly Budget" - OK.

If for some reason you do not have this template or you could not find it, you can download a personal budget for a month in Excel.

A simple template will open where you can enter planned, actual indicators. Distribute income and expenses by items, calculate amounts automatically.

We can adapt a ready-made family budget template to our needs:

- add/remove articles;

- change conditional formatting options;

- line names;

- fill colors, etc.

Before us is a summary statement of income and expenses. It may be useful for some families. But we propose to detail the tables.

Family budget table in Excel

Suppose a family maintains a separate budget. It is important who brings how much to the house. It is necessary to take into account the monthly earnings of the husband and wife. And the money is coming in unevenly. One day - a salary, a week later - an advance payment. A couple of days later - interest on the deposit. Plus occasional work.

To detail receipts, on a separate sheet we create an Excel table of family income and expenses. We give her a name.

We denote the columns: “Date”, “Article”, “Amount”. Below - "Total". In this cell, we drive in the formula for calculating the amount.

We return to the summary sheet. Select the cell above which we want to insert a row. Right mouse button - "Insert" - "Line" - OK. We sign:

Now we need to make sure that the total amount from the detailed report is automatically transferred to the summary. Select an empty cell where the numbers should be displayed. Enter "equal".

Go to the sheet with a detailed report. And press the total amount of receipts for the month. "Input":

We have attached the detailed report to the master summary sheet. Now you can make changes to the detail sheet as many times as you need within a month. The sums in the summary will be recalculated automatically.

Detailing of budget expenditures

Money is spent almost every day: food, fuel, travel tickets are bought. To optimize the management of the family budget, it is recommended to pay expenses immediately. Spent - recorded.

For convenience, we will create detail sheets for all items of expenditure. Each one has an Excel spreadsheet of family budget expenses in detail. "Date" - "Expense item" - "Amount". It is enough to do it once. And then copy and paste.

To name a detail sheet, right-click on its designation. "Rename".

Do not forget to write down the sum formula in the "Total" line.

Now we will link the expense reports to the summary sheet. The connection principle is the same.

Try to select exactly the cell with the total amount!

Protecting data in a cell from changes

Often expenses and incomes are entered in a hurry. Because of this, you can make an error, enter an invalid value. This will result in incorrect summary data. And sometimes it is impossible to remember at the end of the month exactly where the inaccuracy was.

How to protect a cell from changes in Excel:

To protect the entire book, on the Review tab, click the corresponding button.

Working with Formulas in the Personal Finance Spreadsheet

When you extend a formula in a table with income and expenses (“multiply” over the entire column), there is a danger of shifting the link. You should fix the reference to the cell in the formula.

Press F4. A $ sign appears before the column name and the row name:

Pressing the F4 key again will result in this kind of link: C$17 (mixed absolute link). Only the line is fixed. The column can move. Press again - $C17 (the column is fixed). Entering $C$17 (absolute reference) will fix the values relative to row and column.

To remember the range, we perform the same actions: select - F4.

The family budget disciplines. Helps to develop financial behavior, avoid unnecessary cash spending. And Excel allows you to take into account the characteristics of a particular family.

Surely every family in our country dreams of making an idea come true.

However, few people know that for this you need to control your costs so that if necessary, try to reduce them. Moreover, there are even programs for this.

For this reason, let's talk about the distribution of the family budget in more detail.

How to make a spreadsheet and allocate a budget in it

For control income and expenses family uses the option with a table in Excel. This is very convenient, because by downloading this document you can easily see:

For control income and expenses family uses the option with a table in Excel. This is very convenient, because by downloading this document you can easily see:

- monthly income families;

- expected(which will be spent, for example, on utilities) expenses and actual(these may be those types of expenses that are not planned: for any event, urgent repairs, and so on);

- difference in income and expenses for the past month.

In simple words, using this table, you can adjust the difference and thus not go “in the red”.

In order not to create confusion with the calculation formulas, it is recommended to download a ready-made table (links below) and adjust it to fit your family budget.

It is necessary to take into account the fact that Excel provides the ability to create a table for family cash control, so it is enough to download a ready-made template.

To create a table, you need:

- Download excel.

- In the upper left corner, select "Create" from the menu.

- After that, you should go to the “Budgets” subsection.

- In this subcategory, the “Family Budget” tab is selected.

After selecting the last tab, a wide selection of ready-made templates appears on the screen. It is enough to choose the one suitable for your family and download it.

After all the operations have been done, as well as the possible filling in with your data, you should get something like this table (again, it all depends on which one the family chooses):

You can also choose this one:

By and large, all such tables for controlling the family budget work according to the same algorithm.

At the beginning of each month, planned costs are recorded, and at the end of the current month, actual costs are entered.

As can be seen from the tables, there must be a column with a difference. It indicates the family in the “plus” or in the “minus”. By and large, the structure as in the pictures is present in all ready-made templates, so there are no problems with this.

Programs

To date, there are many paid and free programs that allow you to control the income and expenses of the family.

To date, there are many paid and free programs that allow you to control the income and expenses of the family.

Paid

Today there are several paid programs, which allow you to control the family budget, namely:

- AceMoney;

- Family

AceMoney

First of all, you need to pay attention to the fact that The cost of this program is about 500 rubles(the free version is allowed, but the free version has only 1 account, which is very inconvenient).

If we talk about the minuses in this program, then it is one, but at the same time significant - there is no way to separate expenses and the profit itself, and only one function is available - financial transactions.

If we talk about the benefits of this utility, they are as follows:

- it is possible to account for various shares or other securities;

- there are separate columns for such expenses as payment for: television, food, utilities (for each service separately), etc.;

- it is possible to enter information about what deposits are available and at what interest rates. At the same time, the program calculates monthly interest on these deposits.

With this program, you can easily understand how to properly manage your budget.

Family 10

This utility from the first minutes of its use will make it clear that it is configured for a mutually beneficial relationship. In simple terms, it includes a convenient and intuitive interface that any member of the family can easily understand.

This utility from the first minutes of its use will make it clear that it is configured for a mutually beneficial relationship. In simple terms, it includes a convenient and intuitive interface that any member of the family can easily understand.

The functionality of the program allows you to accounting for almost everything that can be found in the house of a particular family.

It must be taken into account that there is no fee for the first month of use, but already from the second month it will be necessary to pay about 20 dollars.

Free

Free programs include:

- DomFin;

- money tracker.

DomFin

This utility includes a rather primitive interface that has specific functionality for excellent control over your family budget. Thanks to this interface, you can easily indicate current income and expenses, calculate the difference.

In "DomFin" there are only those terms that will be clear to every member of the family, who even does not understand anything at all in accounting. From the first days of use, the program is completely free.

Money Tracker

By and large, the program is fully thought out for the successful implementation of their funds. However, it's still worth getting used to.

By and large, the program is fully thought out for the successful implementation of their funds. However, it's still worth getting used to.

Many of our fellow citizens who use this program at home note that it contains many features that can affect the efficient and fast accounting of their income and expenses.

Moreover, if you do not study the program in its entirety, you might even think that many of the functions are useless.

However, it is necessary to note a small positive nuance in this program. This applies to the ability to indicate the modification of prices in supermarkets, as well as to predict your budget for several months in advance, or even if you wish, you can predict for the whole year.

The program provides several options for color notifications. If the green color lights up, the difference between expenses and income is acceptable, if it is yellow, it is worth thinking about reducing costs, if it is red, it is urgent to reduce financial costs.

An example of a finished table in excel

In order to better understand which table a particular family needs, it is recommended to look at samples of ready-made tables:

If desired, any of these tables can be used to control your family budget.

After analyzing the many reviews of our citizens on the Internet, we can highlight the main tips provided by these users for those who are just starting to control their family budget.

So, tips for managing a family budget are as follows:

So, tips for managing a family budget are as follows:

- First of all, you should learn to understand the meaning of how to plan a budget, Why do you need to control your funds?. An example of this may be the desire to reduce the amount of monthly expenses by 10-15% in order to save up for repairs in an apartment or to achieve another goal. When approaching this case because “everyone does it this way”, nothing will work out.

- When creating a table with your personal budget do not overload it with small details. In this table, only the main points need to be indicated. In particular, you can indicate the cost of: food, utilities, clothing, entertainment, and so on. You should not write that “I bought only sausage today - 400 rubles”. It is always worth paying attention to time to enter data into the table- with prolonged attention, she will quickly get bored and then any desire to control expenses will disappear. You need to work with the table according to the principle - “Brevity is the sister of talent”.

- Savings can be only with any large acquisitions. On the little things, as a rule, you should not try to save money - it's useless. There is no suitable folk wisdom for this advice, which says - “Drunk on vodka, you can’t save on buying matches” . This rule must always be remembered and then you can achieve certain success. What is meant by this? It's simple - you need to analyze those columns where the most is the percentage of waste, and try to lower this percentage a bit. We can say that saving 10%, there is a probability of making a profit of 40%.

- If there is a possibility, then it would be best to open a bank account, which should carry the function of a savings account.. All funds that have been saved after the current month will need to be transferred to this account.

- It must always be remembered that all the goals set, because of which, in fact, the family budget is controlled, must be feasible. At the first stages, you should pay attention to the fact that it will be very difficult, but only after the family can cope with this, it will be possible to see firsthand the results of controlling the family budget.

- If a situation arises when it becomes clear that it is impossible to do without a revision of the family budget, or rather spending it, everything must be done to reduce your financial costs. Many families are afraid of change in this and prefer to stay on this control. Rather, quit controlling your finances and live as before. However, to achieve your goals, you cannot do without revising your budget.