Excel expenses. How to keep a family budget in Excel

And you had to painfully remember, “Well, where did these one hundred (five hundred, thousand) rubles go?!”

Perhaps after that you decided to write down all the expenses, and maybe even started doing it. And soon you gave it up. Don't blame yourself for this. Maybe you just didn't have the right tool?

I have a simple and visual Excel spreadsheet that not only takes into account income and expenses, but also plans a budget that is not very complex, for example: personal income, family budget, small business budget, taking into account expected expenses and income. See if it suits you too.

Created to solve only urgent problems

Does not contain unnecessary and complicating

I made this table gradually, for my personal needs. It just became necessary to keep records of family income and expenses. Then it became clear that due to ordinary human forgetfulness, not all amounts are paid in a timely manner and it is necessary to periodically arrange everything by date. Then there was a need to plan future receipts and expenses.

The new version adds the ability to keep track of multiple accounts and group income and expenses by articles.

I did not ask myself: what would happen if I had to keep records in three currencies, how to convert them, at what rate, and how to keep a history of exchange rates. And other questions from the series “what will happen if suddenly?” I didn't ask either.

Therefore, a simple and convenient table turned out. I have been using it since 2008. Now I keep track of all my income and expenses, including receipts and payments on the current account of my individual entrepreneur in the bank.

Simple, compact, clear

This Excel spreadsheet allows you to keep track of income and expenses simply, compactly and clearly. Plus allows you to plan and analyze income and expenses.

- Just- Enter numbers in columns. Income with a plus, consumption with a minus. All other calculations are done by the spreadsheet.

- compact- All income and expenses for the month in one place, on one sheet.

- clearly- Graphs of incoming and outgoing balances and turnovers, income, expenses and total turnovers by item.

- Gives a sense of confidence- we enter the planned income and expenses and see how the situation with money will develop. If it’s tense, you can have time to prepare: transfer expenses for another time, save money, borrow or swindle debtors.

- Facilitates analysis- we mark each amount of income and expense with the necessary item. The table counts the total turnover by item.

Why is this Excel spreadsheet better?

other family budget management programs?

The main advantage is simplicity and clarity

When developing any program, they try (I myself am a programmer and I know) to include in it the maximum possibilities for all cases of its use. New versions of the program add new settings, new buttons, new complex ways to use it. Then they say to the user: we tried here, be kind, try too, learn how to use all this.

This is done for very simple reasons: to increase “perceived value” and outperform competitors. The convenience of working with the program is often sacrificed. As a result, the average person uses only one-tenth of the program's capabilities.

I made my table from completely different considerations, simplicity and convenience were in the first place.

How to get a

Description

The table is designed to record income and expenses for several accounts (up to five). It is assumed that transactions of one month are taken into account on one sheet. Each actually performed operation (income or expense) can be attributed to one of the articles. In addition to the actual operations performed, you can enter the amounts of the planned operations in order to determine the moments of shortage of funds.

When entering operations, select the names of articles from the drop-down list. The list of articles can be edited: add, delete, change titles. The table calculates the balances and turnovers for each account, each item and the total. In addition, you can calculate the turnover for the specified article for the specified period.

Initially, the table consists of three sheets. Two explanatory sheets and one worksheet. It contains data that can serve as an example. New worksheets are added with the button New month/sheet. There is a separate sheet for each month.

The table is protected from accidental changes (in other words, from damage to formulas), data entry cells (not protected) are highlighted with a bluish background. How to remove protection if necessary is written on the first sheet of the table.

Results

The table starts with totals.

Top of table

- Introduced incoming balances

- Are calculated total income and expenses.

- Outgoing balances based on transactions. Next are the outgoing balances.

- Outgoing balances taking into account planned operations. Next are the planned balances.

Here are introduced actual closing balances(hereinafter referred to as actual balances). If you forget to record some transactions, the actual and estimated outgoing balances will differ.

This part of the table contains perhaps the most important information. Therefore, it is fixed and always in front of the eyes when scrolling. You can unpin the area if you want.

Accounting for income and expenses is carried out on several accounts, and, in addition, payments between these accounts are also possible. Such internal payments are called "mirror". These mirror payments significantly increase the total amount of receipts and expenditures. Therefore, there is a problem of calculating the real total amount of income and the total amount of expenses for all accounts without taking into account mirror payments. The table solves this problem.

Below the balances and total income / expenses, the total income and expenses for all accounts are displayed, excluding mirror payments and without planned ones. Those. how much is actually received and how much is actually spent. An example will be given below.

As you can see in the screenshot (screen image), the total income for all accounts is 47,500, but if you remove the mirror payments current account expense / arrival on the map and spending from the card / income in cash, then in fact the total income is 21,500.

Income received, expenses incurred

the date. The current date is inserted by pressing Ctrl+; (symbol ";" on the same key where the letter "g"). The dates of Saturdays and Sundays are highlighted in bold, this is done by the table.

Operation, Consumption entries are entered with a minus sign. The table itself marks the consumption in red. Explanations can be written on the right in the column Comment or in a cell comment (Shift+F2).

The item of income / expenses is selected from the drop-down list. The list is automatically generated from the list of articles you enter at the bottom of the sheet. This part will be shown next.

In the initial state, this part of the table contains 100 lines for entering the amounts of income and expenses. The table contains detailed instructions on how to correctly insert lines, if necessary, without damaging the form.

Planned income and expenses

The transaction date is entered in the column the date. Current date - Ctrl+;.

Transaction amounts are entered in the column Operation, Consumption entries are entered with a minus sign. To the right, in the next cell, the remainder is calculated taking into account the entered operation.

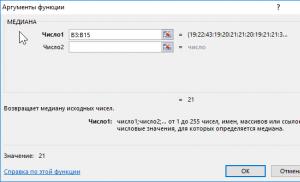

Turnovers for the period for the specified item

The article is selected from the drop-down list.

Articles and Turnovers in total by articles

In column Article the list of items of income and expenses, which we see in the drop-down list when entering the income and expenses made. To the right of the title of the article, the total turnover of this article for each account and the total. How to add a new article to the list is described in detail in the table.

When you change the list of articles, the drop-down list automatically changes.

The list of articles can be sorted in five ways by clicking the corresponding button. In the example shown, the list is sorted by column Total in ascending order.

RPM charts

How to get a

Beginning of work

You get a table filled with sample data. Look at these numbers and experiment with them.

Then you need:

- Create sheet for new month with button New month/sheet.

- Clear sheet - press buttons Clear received/made and Clear Planned. You will be asked for confirmation before cleaning.

- Enter incoming balances on all accounts.

- Enter actual balances. At the beginning of the month, the incoming balance must be equal to the actual balance. discrepancy should be 0.

Within a month

- Introduce new ones regularly actual balances.

- Enter made expenses and income received.

- Enter planned income and expenses.

- As it is done endure planned expenses/incomes to made.

See the table for more detailed instructions.

Tables work on excel for Windows Mac

How to get a table

If you want to take control of your money - you can get an Excel spreadsheet "by paying 295 rub. in one of the ways below.

For this money, you get a feeling of confidence, because a planning person is always more confident than a passive person, you get an excellent tool for analyzing expenses and getting rid of painful thoughts “where did these fifteen hundred go?”.

My name is Vladimir Prokhorov(IP Prokhorov V.V., OGRNIP 311645410900040), I have been doing economic calculations for over 20 years. From 1992 to 2008, he worked as a programmer and head of the IT department in banks and commercial organizations. I have extensive experience in developing software for banking systems and accounting. Since 2008, I have been developing Excel spreadsheets for economic calculations.

I can be contacted by mail [email protected]

([email protected]), by phone +7 927 055 9473

, In contact with vk.com/vvprokhorov

I know what many thought: it would be nice to know the opinion of the buyers of this table.

Reviews, questions, wishes and other correspondence about the tables in the guest book of the site »»

I guarantee:

- Delivery within a few hours after receipt of payment. See below for payment processing times for various payment methods.

- All tables filled with data, which serve as an example and help to understand the logic of work.

- tables provided with detailed explanations for completion and work.

- I answer any questions for working with tables. Of course, it is assumed that you are familiar with the subject area and have basic Excel skills.

When a new version is released:

- Price updates depends on how much the functionality of the new version of the table increases.

- Release announcements received only by subscribers of the mailing list. Subscription form at the bottom of the page.

Table " Accounting and planning of income and expenses»

Option for Windows: 295 rub.

Option for Mac and Windows: 354 rub.

Tables work on excel for Windows(Excel 2007, 2010, 2013, 2016) and Mac(Excel 2011, 2016). They don't work on OpenOffice.

Phone for payment and delivery questions +7 927 055 9473

mail [email protected]

([email protected])

Payment Methods:

- Robokassa

- Cards Visa, MasterCard, Maestro, World

- Internet client Alfa-Bank, Russian Standard, Promsvyazbank, etc.

- Terminals

- Communication salons Euroset, Svyaznoy

- Electronic money Yandex.Money, QIWI, WebMoney, Wallet One (W1), Eleksnet

- Bank

to the current account Prokhorov Vladimir Viktorovich (IP), TIN 645400330452,

Settlement account 40802810711010053426, Branch “Business” of PJSC “Sovcombank”, Moscow,

C/C 30101810045250000058, BIC 044525058.Please note that the indication of the form of ownership (IP) is mandatory.

After placing an order, you can print an invoice for legal entities. persons

or a receipt in the form of PD-4 for physical. persons.You can also get an invoice by writing on [email protected] ([email protected]).

For payments outside of Russia, specify the currency transaction code (VO10100) in the payment purpose

For example, the purpose of the payment:

(VO10100) Invoice No. ... For Spreadsheets " Accounting and planning of income and expenses". Without VAT.

Where VO are capital Latin letters, 10100 are numbers. The curly braces are required. Spaces inside curly braces are not allowed.Delivery:

A link to download the tables will be sent to the e-Mail specified in the order after the receipt of money. If there is no letter for a long time, check the folder SPAM.

For the way 1 (Robokassa) a letter with a link is sent automatically, immediately after the receipt of money. The usual time for receipt of money is minutes.

For the way 2 (Bank) An email with a link is sent after the payment is received on the current account. Time of receipt of money 1-2 business days. For legal entities and IP I send pdf-copies of the invoice in the form Trade 12. The original invoice will be sent upon request, please indicate the postal address in the request.

If you need any other documents, please agree on this issue BEFORE PAYMENT.

Further correspondence regarding received tables

Further correspondence regarding the received tables (questions on working with tables, updates, etc.) takes place via the address to which the tables were sent. When corresponding by e-mail, please keep the history of correspondence, i.e. include all previous letters and their responses in the letter. At the same time, place your message at the top (before the story).

P.S.

If you want to receive working version one table and demo versions of all others of my tables, sign up for a 9 email series with a brief description of the tablesYou are getting:

- working version table "Accounting for income and expenses." Download link in first email.

- Demos other tables: Business valuation, Payment calendar, Cost price, Investments, IFRS financial analysis, RAS financial analysis, Break-even point, Assortment analysis, Personal planning. Download link in first email.

- 40% discount (4706 rubles) on a set of six of my tables. How to get a discount - in the second letter.

- Discount about 20% into separate tables. How to get a discount - in a letter describing a specific table.

- 20% discount to new tables. The discount is valid for three days from the date of sending a letter about the new table.

- Messages about new tables.

- Messages about new versions of tables.

- Messages about discount promotions. Usually the discount is valid for three days from the date of sending the letter about the discount.

- Messages about corrected options when errors are found.

In addition, please take into account that notifications about promotions, discounts and releases of new versions only subscribers receive. No special announcements are made on the site.

I do not recommend subscribing to corporate mailboxes, because There is a chance that the mail server will consider the mailing as spam. Those. not you, but the system administrator will decide which letters you can receive.

I dedicated my blog to the topic of saving and planning. But it turned out that in this process, many are confused not so much by general as by specific technical points. Therefore, today I will write about how to budget and save money in Excel.

The easiest way to manage a family budget is to live alone. After all, all financial receipts and expenses are controlled by you and only you! In a large friendly family, counting common and personal money is already much more difficult.

The main thing is that the idea of \u200b\u200b"accounting and saving" is supported by all family members (including children and elderly relatives). We all get together at dinner, voice a joint plan, discuss the details and ... build the future step by step!

Children, by the way, are the easiest to motivate. It is enough to give a boring daily accounting a game form.

We consider expenses

At a general family council, we come up with names for the main items of expenditure. The first thing that comes to mind: “Food”, “Communal”, “Communication” (telephone, Internet), “Entertainment”, “Clothes”, “Transport” (public / taxi / expenses for a private car), “School / children garden/institute”, “Pets”, “Health”, “Beauty”, “Loans”, etc. In each family, the list of such articles will be individual.

It’s also not worth splitting expenses too much - a dozen categories are enough. In a computer program "Home bookkeeping" I noticed that food expenses are divided into "Bread", "Dairy products", "Meat and sausages", "Vegetables and fruits" and others. I don't see much point in this. Especially if the accounting will be done manually. After all, food is food in Africa.

Looking ahead, I will share one more trick. Keeping track of personal (out of pocket) expenses is very difficult - both technically and morally. Therefore, you can enter the section "Petya / Vasya / Masha's personal money". In this column, we fix the amount that is issued to Petya / Vasya / Masha for pocket expenses (once a week or once a month).

And they can spend it at their discretion: buy bars and chips or save up for roller skates. Most importantly, the amount handed out is already displayed in Excel.

By the way, everyone needs pocket money: schoolchildren, students, a housewife, and the head of the family. This one is like with personal space and time - some piece should belong only to you.

Yes, and do not forget to highlight such an expense item as "Force Majeure". This includes everything that goes beyond the daily budget: repairing a car or an apartment, a vacation at sea, medicines in case of a serious illness, and a trip to a grandmother's anniversary.

Well, then we give each family member a tiny notebook. And during the day, Petya / Vasya / Masha fixes expenses in it by category. In the evening we all got together and transferred the expenses to a common table on the computer. In terms of time, “reconciling debit with credit” takes a maximum of ten minutes.

What will cost accounting provide?

- You accumulate specific statistics by months, which can be adjusted and used as a guide for the future

- You can clearly see where and what the money is spent on.

- The results of the first months allow you to effectively optimize costs

By the way, if you know your own " weak spots”, on which it would be worth saving, I advise you to highlight them for clarity in a separate category. My friend, for example, kept records under the article "Cigarettes". According to his records, it turned out that for the year the bad habit cost him about $ 600. He eventually quit smoking.

We consider income

For obvious reasons, income items will be much less than expenses. For example: "Petya's salary", "Masha's salary", "Irina's pension", "Roma's scholarship".

If there are secondary sources of income, it is better to consider them separately. For example: “Interest on deposits”, “Garage rent”, “Part-time jobs”.

And just in case, we make one more income item: “Other” (winning the lottery or money in a birthday envelope).

What will income accounting give?

- Additional control: the total amounts of income and expenses for the month must converge to within a couple of hundred rubles

- You will clearly see the growth and fall of income by year and month

- Dry figures will be illuminated like a spotlight "holes" in the budget, which should be "patched" in advance

A classic example: New Year's holidays, holidays, birthdays. During these months, as a rule, all savings are spent "under zero", and the family gets into debts and loans.

How to transfer home accounting to Excel?

The easiest way is to place all items of income and expenses in the first column, and the dates - horizontally (or vice versa).

You can make separate Excel sheets for each month in one document, but in different tabs (“January 2015”, “February 2015”, etc.). For clarity, you can transfer the monthly totals to Excel, and keep daily records in a regular paper weekly.

The main thing is that it does not take too much of your time. Oh, and by the way, at the end of each month it is worth holding "family meetings" - with debriefing and drawing up a plan for the future. By the way, here you can download the template for Excel.

Finally, I’ll say that I used to keep a budget in Excel, but it turned out to be not convenient.

Now I use, which allow me to do it better and spend much less time entering data. In addition, they can build charts and analytics based on historical data, which makes it easier to control their funds. In general, I recommend!

And in what form do you keep your family budget? Subscribe to updates and share the best posts with your friends!

The problem of lack of money is relevant for most modern families. Many literally dream of paying off their debts and starting a new financial life. In a crisis, the burden of low wages, loans and debts affects almost all families without exception. That is why people strive to control their spending. The point of saving costs is not that people are greedy, but to find financial stability and look at your budget soberly and impartially.

The benefit of controlling the financial flow is obvious - it is cost reduction. The more you save, the more confidence in the future. The money saved can be used to form a financial cushion that will allow you to feel comfortable for a while, for example, if you are left without a job.

The main enemy in the way of financial control is laziness. People first light up with the idea of controlling the family budget, and then quickly cool down and lose interest in their finances. To avoid this effect, you need to acquire a new habit - to constantly control your expenses. The most difficult period is the first month. Then the control becomes a habit, and you continue to act automatically. In addition, you will immediately see the fruits of your “labor” - your expenses will be surprisingly reduced. You will personally see that some expenses were superfluous and you can refuse them without harm to the family.

Poll: Excel spreadsheets are enough to control the family budget?

Accounting for family expenses and income in an Excel spreadsheet

If you are new to family budgeting, then before using powerful and paid home bookkeeping tools, try keeping a family budget in a simple Excel spreadsheet. The benefits of such a solution are obvious - you do not spend money on programs, and try your hand at controlling finances. On the other hand, if you bought the program, then this will stimulate you - since you spent the money, then you need to keep records.

It is better to start compiling a family budget in a simple table in which everything is clear to you. Over time, you can complicate and supplement it.

Read also:

Here we see three sections: income, expenses and report. In the "expenses" section, we have entered the above categories. Near each category is a cell containing the total expense for the month (the sum of all days on the right). In the "days of the month" area, daily expenses are entered. In fact, this is a complete monthly report on the expenses of your family budget. This table gives the following information: expenses for each day, for each week, for a month, as well as the total expenses for each category.

As for the formulas that are used in this table, they are very simple. For example, the total expense for the category "car" is calculated by the formula =SUM(F14:AJ14). That is, this is the amount for all days on line number 14. The amount of expenses per day is calculated as follows: =SUM(F14:F25)- all numbers in column F from the 14th to the 25th line are summed up.

The section "income" is arranged in a similar way. This table has categories of budget revenues and the amount that corresponds to it. In the "total" cell, the sum of all categories ( =SUM(E5:E8)) in column E from the 5th to the 8th line. The "report" section is even simpler. Here, information from cells E9 and F28 is duplicated. The balance (income minus expenses) is the difference between these cells.

Now let's complicate our expense table. Let's introduce new columns "expenditure plan" and "deviation" (download the table of expenses and incomes). This is necessary for more accurate planning of the family budget. For example, you know that the cost of a car is usually 5,000 rubles / month, and the rent is 3,000 rubles / month. If we know the costs in advance, then we can make a budget for a month or even a year.

Knowing your monthly expenses and income, you can plan large purchases. For example, family income is 70,000 rubles / month, and expenses are 50,000 rubles / month. This means that every month you can save 20,000 rubles. And in a year you will be the owner of a large amount - 240,000 rubles.

Thus, the columns "expenditure plan" and "variance" are needed for long-term budget planning. If the value in the "deviation" column is negative (highlighted in red), then you deviated from the plan. Deviation is calculated by the formula =F14-E14(i.e. the difference between the plan and the actual costs per category).

What if you deviate from the plan in any month? If the deviation is insignificant, then next month you should try to save on this category. For example, in our table in the category "clothes and cosmetics" there is a deviation of -3950 rubles. This means that next month it is advisable to spend 2050 rubles (6000 minus 3950) on this group of goods. Then, on average, for two months you will not have a deviation from the plan: (2050 + 9950) / 2 = 12000 / 2 = 6000.

Using our data from the expense table, we will build a cost report in the form of a chart.

Similarly, we build a report on the income of the family budget.

The benefits of these reports are clear. Firstly, we get a visual representation of the budget, and secondly, we can track the percentage share of each category. In our case, the most expensive items are “clothes and cosmetics” (19%), “food” (15%) and “credit” (15%).

Excel has ready-made templates that allow you to create the necessary tables in two clicks. If you go to the "File" menu and select the "Create" item, the program will prompt you to create a finished project based on the existing templates. Our theme includes the following templates: "Typical Family Budget", "Family Budget (Monthly)", "Simple Expenses Budget", "Personal Budget", "Half Monthly Home Budget", "Student Monthly Budget", "Personal Expenses Calculator" .

A selection of free Excel budgeting templates

Ready-made Excel spreadsheets can be downloaded for free from these links:

The first two tables are discussed in this article. The third table is described in detail in the article about home accounting. The fourth collection is an archive containing standard templates from an Excel spreadsheet.

Try downloading and working with each table. After reviewing all the templates, you are sure to find a table that is right for your family budget.

Excel Spreadsheets vs. Home Bookkeeping: Which Should You Choose?

Each method of doing home accounting has its own advantages and disadvantages. If you have never done home accounting and have poor computer skills, then it is better to start accounting for finances using a regular notebook. Enter all expenses and incomes into it in any form, and at the end of the month you take a calculator and reduce the debit with the credit.

If the level of your knowledge allows you to use an Excel spreadsheet or a similar program, then feel free to download templates for home budget tables and start accounting electronically.

When the functionality of the tables no longer suits you, you can use specialized programs. Start with the simplest personal accounting software, and only then, when you get real experience, you can purchase a full-fledged program for a PC or smartphone. For more information about financial accounting programs, see the following articles:

The advantages of using Excel spreadsheets are obvious. This is a simple, clear and free solution. It is also possible to gain additional skills in working with a spreadsheet processor. The disadvantages include low performance, poor visibility, as well as limited functionality.

Specialized family budget management programs have only one drawback - almost all normal software is paid. Only one question is relevant here - which program is the highest quality and cheapest? The advantages of the programs are: high speed, visual presentation of data, many reports, technical support from the developer, free updates.

If you want to try your hand at family budget planning, but are not ready to pay money, then download it for free and get down to business. If you already have experience in home bookkeeping and want to use more advanced tools, then we recommend installing a simple and inexpensive program called Housekeeper. Consider the basics of personal accounting with the help of "Housekeeper".

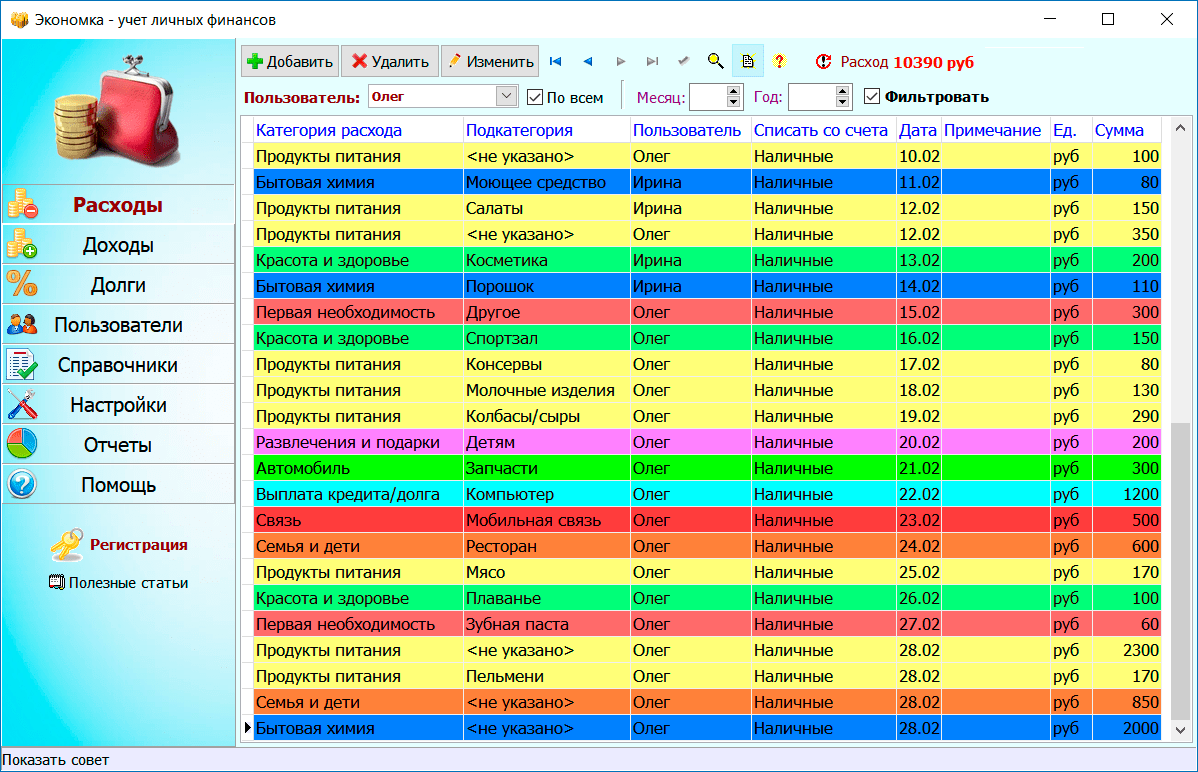

Household bookkeeping in the program "Economy"

A detailed description of the program can be found on this page. The functionality of the Housekeeper is simple: there are two main sections: income and expenses.

The section "Incomes" is arranged in a similar way. User accounts are configured in the "Users" section. You can add any number of accounts in different currencies. For example, one account can be in rubles, the second in dollars, the third in Euros, etc. The principle of the program is simple - when you add an expense transaction, the money is debited from the selected account, and when you add a profitable transaction, the money, on the contrary, is credited to the account.

To build a report, you need to select the type of report in the "Reports" section, specify the time interval (if necessary) and click the "Build" button.

As you can see, everything is simple! The program will independently build reports and point you to the most costly items of expenditure. Using reports and a table of expenses, you will be able to manage your family budget more efficiently.

Video on the topic of the family budget in Excel

On the Internet, there are many videos on family budgeting. The main thing is that you not only watch, read and listen, but also apply the acquired knowledge in practice. By controlling your budget, you reduce unnecessary expenses and increase savings.

Many companies use Microsoft Excel to keep track of department or company expenses. Currently, Excel can be used on all PCs that have the Windows operating system installed. For this reason, you can keep track of your own expenses if this program is installed on your home PC. There are a large number of expense tracker templates from Microsoft and other sites, recent versions of Excel include a built-in template as a preinstalled one. You can also create your own dynamic spreadsheet in Excel to keep track of expenses. In both cases, follow the instructions below.

Steps

Working with an Excel template

- In Excel 2003, choose "New" from the "File" menu. From the On My Computer taskbar, select New Book to see the templates in a new dialog box.

- In Excel 2007, choose New from the File menu. This will bring up the New Book dialog box. Select "Installed Templates" from the "Templates" menu on the left menu. Select "Personal Monthly Budget" from "Installed Templates" in the central menu and click "Create".

- In Excel 2010, choose New from the File menu. Select "Sample Templates" at the top of the "Available Templates" panel, then select "Personal Monthly Budget" from all the sample templates and click "Create".

-

Choose a template online. If the pre-installed templates are not suitable for keeping track of your expenses, you can select a template online. You can download it from any site or by connecting via Excel to Microsoft Office Online.

- For Excel 2003, you can select the appropriate template from the Microsoft Office Online Library at https://templates.office.com/en-us. (You can also find templates for later versions of Excel there.)

- In Excel 2007, select the Budgets tab under the Internet section found in the New Workbook dialog box. You must be online to connect to the Online Template Library for Office.

- In Excel 2010, select "Budgets" from the Office.com section in the Available Templates panel. You must have internet enabled to connect.

-

Enter the required information in the appropriate fields. The information depends on the particular dynamic table template you use.

You can use the suggested name for the dynamic table or change the name. It will be enough to indicate your name and the current year in the file name.

Select a preset template. Latest Versions The programs include a template for keeping track of personal expenses, as well as templates for keeping track of business expenses. You can access these templates and use them to track expenses.

Create your own dynamic cost accounting table

- Once you have your dynamic table and column headers ready, you can use the Freeze Pane feature to keep the headers displayed while you scroll down. The Freeze Pane feature is found on the View menu in Excel 2003 and earlier versions and on the View menu, Window tab in Excel 2007 and 2010.

-

Enter information about the first type of expense in the cell of the third row.

Enter the balance formula in cell G3. Due to the fact that you are entering the balance for the first time, it will be defined as the difference between expenses and income. How you write this depends on whether you want to display expenses or available funds.

- If you want the spreadsheet to show expenses first, the balance formula should be =E3-F3, where E3 shows expenses and F3 shows income. With this setting, the formula will show expenses as a positive number, making it easier to understand the amount of expenses.

- If you want the table to display the funds available to you in the first place, the balance formula should be =F3-E3. With this setting, the table will display a positive balance if your income is higher than expenses, and a negative balance if the situation is reversed.

-

Enter information about the second type of expense in the cell of the fourth row.

Enter the balance formula in cell G4. The second and subsequent values will continue to show the balance, so you need to add the difference between expenses and income to the balance value of the previous entry.

- If you are looking at expenses first, the balance formula would be =G3+(E4-F4), where G3 is the cell that shows the previous balance, E4 shows expenses, and F4 shows income.

- If you are maintaining a spreadsheet to display cash, the balance formula will be =G3+(F4-E4).

- The brackets around the cells showing the difference between expenses and income are optional. They are used only to make the formula clearer.

- If you want the balance to remain empty until an entry is entered, you can use an IF value in the formula so that if no date has been entered, the cell will not display the value. The formula for such an entry will be =IF(A4="","",G3+(E4-F4)) if the table is needed for maintaining expenses, and =IF(A4="","", G3+(F4-E4) ) if the table is needed to display cash (you can not use brackets around the cell that shows expenses and income, but you need to use outer brackets).

-

Copy the formula balance to other cells in column G (balance column). Right click in cell G3, select "Copy". Then select the cells below in the column. Right-click on the selected cells and select Paste to paste the formula into the selected cells (in Excel 2010, choose Paste or Paste Formula from the menu). The formula will automatically update the cells to display the expenses, income, and date (if used) from the current series and the balance from the series above the current series.

-

Save the dynamic table. Give it a meaningful title, such as "Expense Tracker.xls" or "Personal Budget.xls." As in the case of the template name, you can include your name and year in the file name (note that quotes are used only to show an example, you should not use them in the name. You do not need to specify the file extension either, Excel itself will do this) .

- Excel 2003 and older versions save spreadsheets in the old ".xls" format, while Excel 2007 and 2010 save spreadsheets in the newer XML-based ".xlsx" format, but you can read and save spreadsheets and in the old ".xls" also. If you have multiple PCs and want to store the spreadsheet on each of them, use the older format if one of your PCs has Excel 2003 or older, or the newer format if all computers have at least Excel 2007 installed.

Open Excel.

Enter column headings. Suggested names and order: "Date", "Expense Category", "Note", "Expense", "Income", and "Balance". Fill in these headings from cell A2 to G2. You may need to make the columns wider to fit the title or value.

I tried many programs for calculating expenses and doing home accounting. Not a single calculator has coped with unusual tasks. For example, I set up a typical expense calculator for a long time in order to introduce a new variable. Online calculators, as you yourself understand, do not always allow you to save data and rarely have everything you need to enter all items of household expenses.

As a result, I spat on this matter and quickly painted for myself a small Excel calculator for the family budget, which can be used to take into account both monthly expenses and calculate expenses for, for example, building a fence in the country or calculating the cost of repairs. The finished calculation clearly shows the spending on the graph and the file can be saved under your own name. Thus, one Excel spreadsheet can be used to calculate household finances and one-time expenses.

By the way, money turns the head of many. Received vacation pay and bonus beckon to the store for thoughtless spending. In order to find out how much I can spend, I use my method. I collect all the items of mandatory expenses, enter here the thing that I want to buy and see how much money I have left per day for a month until the next receipts.

So, if you were wondering how much money is left for the day after all mandatory payments are made, then you have come to the right place. In addition to the post, I post an expense calculator - a small spreadsheet file for Ms Excel or Scalc (OpenOffice), which is called "How much is left for the day after all mandatory payments have been made." This expense calculator shows the ratio of expense items and provides an answer to the question “How much is left for the day?”. This allows you to very reasonably calculate the costs and bring the costs to an acceptable rate.

How much is left for the day after all mandatory payments are made Ms Excel

And if you are concerned about saving a little, then I recommend looking where you can find household appliances, clothes, shoes, electronics at a very attractive price. I recommend bookmarking the catalog. This helps to save both money and time.