The ratio of liquid assets to short-term liabilities. Solvency and liquidity of the enterprise

One of the indicators of the company's activity is the level of liquidity. It assesses the creditworthiness of the organization, its ability to fully pay off its obligations on time. More details about what liquidity ratios exist, formulas for the new balance sheet for calculating each indicator are presented in the article below.

essence

Liquidity is the extent to which a firm's assets cover its liabilities. The latter are divided into groups depending on the period of transformation into. This indicator evaluates:

- the ability of the firm to respond quickly to financial problems;

- the ability to increase assets with the growth of sales volumes;

- ability to repay debts.

Degrees of liquidity

Insufficient liquidity is expressed in the inability to pay debts and obligations assumed. We have to sell fixed assets, and in the worst case, liquidate the organization. The deterioration of the financial situation is expressed in a decrease in profitability, loss of capital investments of owners, delay in payment of interest and part of the principal on the loan.

The quick liquidity ratio (the formula for the balance sheet for calculation will be presented below) reflects the ability of an economic entity to repay the debt using the available funds in the accounts. Current solvency may affect the relationship with customers and suppliers. If the enterprise is not able to repay the debt on time, its continued existence is in doubt.

Any liquidity ratio (the formula for the balance sheet for calculation will be presented below) is determined by the ratio of the organization. These indicators are divided into four groups. In the same way, any liquidity ratio (the formula for calculating the balance sheet is needed for analyzing activities) can be determined separately for quickly and slowly sold assets and liabilities.

Assets

Liquidity is the ability of the company's property to generate a certain income. The speed of this process just reflects the liquidity ratio. The balance formula for calculations will be presented below. The larger it is, the better the company "stands on its feet."

Let's rank the assets according to the speed of their conversion into cash:

- money in accounts and at the box office;

- bills, treasury securities;

- non-overdue debt to suppliers, loans issued, the Central Bank of other enterprises;

- reserves;

- equipment;

- structures;

Now let's distribute the assets into groups:

- A1 (the most liquid): cash on hand and in a bank account, shares of other enterprises.

- A2 (quick selling): short-term debt of counterparties.

- A3 (slowly sold): reserves, WIP, long-term financial investments.

- A4 (hard to sell) - non-current assets.

A particular asset belongs to one or another group depending on the degree of use. For example, for a machine-building plant, a lathe will be treated, and a unit made specifically for the exhibition - to non-current assets with a useful life of several years.

Liabilities

The liquidity ratio, the formula for the balance sheet of which is presented below, is determined by the ratio of assets to liabilities. The latter are also divided into groups:

- P1 - the most demanded obligations.

- P2 - loans with a validity period of up to 12 months.

- P3 - other long-term loans.

- P4 - reserves of the enterprise

The lines of each of the listed groups must match the degree of liquidity of the assets. Therefore, before making calculations, it is desirable to modernize the financial statements.

Balance liquidity

For further calculations, it is necessary to compare the monetary values of the groups. In this case, the following ratios must be fulfilled:

- A1 > P1.

- A2 > P2.

- A3 > P3.

- A4< П4.

If the first three of the listed conditions are met, then the fourth will be fulfilled automatically. However, a shortage of funds in one of the groups of assets cannot be compensated by an overabundance in the other, since fast-moving funds cannot replace slow-moving

In order to conduct a comprehensive assessment, the overall liquidity ratio is calculated. Balance formula:

L1 \u003d (A1 + (1/2) * A 2 + (1/3) * A3) / (P1 + (1/2) * P2 + (1/3) * P3).

The optimal value is 1 or more.

The information presented in this way is not full of details. A more detailed calculation of solvency is carried out by a group of indicators.

Current liquidity

The ability of a business entity to repay at the expense of all assets shows the current liquidity ratio. Balance formula (line numbers):

Ktl = (1200 - 1230 - 1220) / (1500 - 1550 - 1530).

There is also another algorithm by which the current ratio can be calculated. Balance formula:

K = (OA - long-term DZ - debt of the founders) / (current liabilities) = (A1 + A2 + A3) / (Π1 + Π2).

The higher the value of the indicator, the better the solvency. Its normative values are calculated for each branch of production, but on average they fluctuate between 1.49-2.49. A value less than 0.99 indicates the company's inability to pay on time, and more than 3 indicates a high proportion of idle assets.

The coefficient reflects the solvency of the organization not only at the current moment, but also in emergency circumstances. However, it does not always provide the full picture. For commercial enterprises, the value of the indicator is less than the normative one, and for industrial enterprises - most often it is higher.

Quick liquidity

The ability of a business entity to repay liabilities at the expense of marketable assets less inventory reflects the quick liquidity ratio. Balance formula (line numbers):

Xl \u003d (1230 + 1240 + 1250) / (1500 - 1550 - 1530).

K= (multiple DZ + multiple financial investments + DC) / (multiple loans) = (A1 + A2) / (Π1 + Π2).

In the calculation of this coefficient, as well as the previous one, reserves are not taken into account. From an economic point of view, the sale of this group of assets will bring the company the most losses.

The optimal value is 1.5, the minimum is 0.8. This indicator reflects the share of liabilities that can be covered by cash receipts from current activities. To increase the value of this indicator, it is necessary to increase the volume of own funds and attract long-term loans.

As in the previous case, a value of more than 3 indicates an irrationally organized capital structure, which is caused by a slow inventory turnover and an increase in receivables.

Absolute liquidity

The ability of a business entity to repay debt at the expense of cash reflects the absolute liquidity ratio. Balance formula (line numbers):

Cal = (240 + 250) / (500 - 550 - 530).

The optimal value is more than 0.2, the minimum is 0.1. It shows that the organization can repay 20% of urgent liabilities immediately. Despite the purely theoretical possibility of a need for urgent repayment of all loans, it is necessary to be able to calculate and analyze the absolute liquidity ratio. Balance formula:

K= (short investments + DS) / (short loans) = A1 / (Π1 + Π2).

The calculations also use the critical liquidity ratio. Balance formula:

Kcl \u003d (A1 + A2) / (P1 + P2).

Other indicators

Capital maneuverability: A3 / (AO - A4) - (P1 + P2).

Its decrease in dynamics is considered as a positive factor, since part of the funds frozen in inventories and receivables is released.

The share of assets in the balance sheet: (balance sheet total - A4) / balance sheet total.

Endowment with own funds: (P4 - A4) / (JSC - A4).

The organization must have at least 10% of its own sources of funding in the capital structure.

Net working capital

This indicator reflects the difference between current assets and loans, accounts payable. This is the part of the capital, which is formed by long-term loans and equity. The formula for calculation looks like:

Net worth = OA - short-term loans = line 1200 - line 1500

The excess of working capital over liabilities indicates that the company is able to pay off debts, has reserves for expanding activities. The standard value is greater than zero. The lack of working capital indicates the inability of the organization to repay obligations, and a significant excess indicates the irrational use of funds.

Example

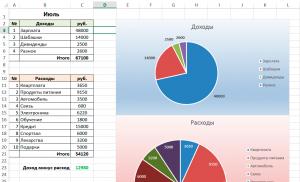

The company's balance sheet includes:

- Cash (DS) - 60,000 rubles.

- Short-term investments (KFV) - 27,000 rubles.

- (DZ) - 120,000 rubles.

- OS - 265 thousand rubles.

- NMA - 34 thousand rubles.

- Reserves (PZ) - 158,000 rubles.

- (KZ) - 105,000 rubles.

- Short-term loan (KK) - 94,000 rubles.

- Long-term loans - 180 thousand rubles.

Cal = (60 + 27) / (105 + 94) = 0.4372.

The optimal value is more than 0.2. The company is able to pay 43% of its obligations from the funds in the bank account.

Calculate the quick liquidity ratio. Balance formula:

Xl \u003d (50 + 27 + 120) / (105 + 94) \u003d 1.09.

The minimum value of the indicator is 0.80. If the enterprise uses all available funds, including debts of debtors, then this amount will be 1.09 times more than the existing liabilities.

Let's calculate the critical liquidity ratio. Balance formula:

Kcl \u003d (50 + 27 + 120 + 158) / (105 + 94) \u003d 1.628.

Interpretation of results

By themselves, the coefficients do not carry a semantic load, but in the context of time intervals, they characterize the activities of the enterprise in detail. Especially if they are supplemented by other calculated indicators and a more detailed consideration of the assets that are taken into account in a particular line of the balance sheet.

Illiquid stocks cannot be quickly sold or used in production. They should not be taken into account when calculating current liquidity.

In an organization that is part of a holding group, when calculating the liquidity ratio, indicators of internal receivables and payables are not taken into account. The level of solvency is best determined according to the absolute liquidity ratio.

Many problems will be caused by an overvaluation of assets. The inclusion of an unlikely debt in the collection calculations leads to an incorrect (reduced) assessment of solvency, obtaining unreliable data on the financial position of the organization.

On the other hand, when assets are excluded from the calculations, the probability of receiving income from which is low, it is difficult to achieve the normative values of liquidity indicators.

Calculate by division current assets for short-term liabilities(current liabilities). The initial data for the calculation contains the balance sheet of the company.

It is calculated in the FinEkAnalysis program in the solvency analysis block.

Total liquidity ratio - what does it show

Shows the company's ability to repay current (short-term) liabilities at the expense of current assets only. The higher the value of the coefficient, the better the solvency of the enterprise. This indicator takes into account that not all assets can be sold urgently.

Liquidity ratios are of interest both to the management of the enterprise and to external subjects of analysis:

- absolute liquidity ratio - for suppliers of raw materials and supplies;

- total liquidity ratio- for investors;

- quick liquidity ratio - for banks.

Total liquidity ratio - formula

The general formula for calculating the coefficient:

Total liquidity ratio - scheme

Was the page helpful?

Synonyms

More found about the total liquidity ratio

- Impact of IFRS on the results of the analysis of the financial position of PJSC Rostelecom

Debt coverage current liquidity ratio > 2 2.145 1.17 -0.975 1.901 1.233 -0.668 4 General liquidity ratio 2.0-2.5 0.549 0.434 -0.115 0.745 0.501 -0.244 5 - Debt management of the company

Interest coverage ratio on loans 0.08 -0.05 0.06 General liquidity ratio 1.16 0.74 0.89 Accounts payable coverage ratio in cash % 5.5 5.7 - Liquidity of companies' debts: a new toolkit for financial analysis

We propose to characterize the degree of liquidity of the total amount of debt by the debt liquidity ratio K, which is calculated according to formula 2 - Analysis of the financial condition in dynamics

Deviation 01/01/2015 from 01/01/2011 Total liquidity ratio R1 1.172 1.243 1.345 1.363 2.152 0.98 Absolute liquidity ratio R2 0.096 - Matrix in working capital management

In the future, the need for external sources of financing of working capital - the allowable amount of short-term liabilities - is determined based on the total amount of current assets determined according to the production program and the amount of current assets financed from own funds based on the logic of maintaining an acceptable level of liquidity The ratio of the total amount of current assets to the estimated allowable the value of short-term liabilities forms the coefficient of the current - Ranking of enterprises in the group

Current liquidity ratio L4 Operating capital maneuverability coefficient L5 OJSC Mitinsky cannery example 1.225 0.022 0.038 Total capital turnover ratio D1, turnover Duration of capital turnover D2, days Mobile asset turnover ratio D3, - Integral assessment of the working capital management policy of the housing and communal services enterprise

NP MZ 0.10 0.30 Indicators that characterize the policy of working capital liquidity management General liquidity ratio Кtot ObS TO 1.0 2.0 Quick liquidity ratio Kquick ObS - Z - Financial stability of the company: problems and solutions

Current ratio 1.622 1.289 1.063 General liquidity ratio 0.785 0.618 0.502 Source Authoring based on consolidated financial statements of UES - Improving the accounting and analytical support for managing the organization's working capital

Current liquidity ratio General liquidity ratio Solvency ratio Management impact on the achievement of evaluation indicators for the implementation of the target direction of management - We determine the liquidity of the balance

Kcl > 0.5 0.8. The projected payment capabilities of the company, subject to the repayment of short-term receivables and the sale of existing inventories, taking into account cost compensation, reflects the current liquidity ratio other names general liquidity ratio total coverage ratio total coverage ratio of short-term debts circulation ratio Table 2 - Enterprise liquidity

There are the following liquidity indicators of the enterprise quick liquidity ratio quick liquidity ratio critical liquidity ratio intermediate liquidity ratio current liquidity ratio total liquidity ratio absolute liquidity ratio coverage ratio solvency recovery ratio loss of solvency ratio ratio - Analysis of the integral dynamics of financial and economic activity using a rating score

At the same time, such indicators as the total liquidity ratio of the balance sheet, the financial independence ratio, the return on sales and the return on assets are considered. However, even the calculated - Financial ratios

Current liquidity ratio Total liquidity ratio Absolute liquidity ratio Coverage ratio Solvency recovery ratio Loss of solvency ratio Coefficient - Relative liquidity ratios

Relative liquidity ratios are the total liquidity ratio of the current liquidity coverage the quick liquidity ratio of the intermediate liquidity ratio of the acid test ratio - Formation of a credit rating of buyers in order to differentiate the terms of a commercial loan

To do this, the following indicators should be used: general liquidity ratios autonomy ratios immobilization ratios net working capital indicator Proposed method for determining the credit rating - The concept, principles and method of managing investment projects on the factors of resource intensity of products

The choice is based on the complexity of the action of a general indicator that takes into account particular indicators, the general liquidity ratio Kl, the autonomy coefficient - The relationship of financial risks and indicators of the financial position of the insurance company

Total turnover ratio 0.77 0.77 0.89 5 Absolute liquidity ratio 0.85 0.97 18.59 6 Autonomy ratio - Statistical analysis of the relationship between indicators of capital management and market value of public companies in Russia

Capital - NWC current ratio Current ratio - CR ratio of own working capital - The impact of the turnover of assets and liabilities on the solvency of the organization

Current liquidity ratio ≥ 2 Total solvency ratio ≥ 1 Investment ratio ≥ 1 V V Kovalev - Optimization of the structure of the balance sheet as a factor in increasing the financial stability of the organization

Forecast values Total current liquidity ratio 1.426 2.329 Absolute liquidity ratio 0.020 0.923 Capital ratio

In this article, we will consider the current liquidity ratio, which shows the company's ability to repay current (short-term) liabilities at the expense of current assets only.

Due to a simple calculation formula and information content, the current liquidity ratio has an important place in assessing the financial activities of various industries, and is used in a number of effective methods for predicting bankruptcy.

Current liquidity ratio. general information

The current (or total) liquidity ratio (k) is a financial value showing the ratio of current assets to current liabilities, or short-term liabilities, which is compiled on the basis of information from the balance sheet. It is also an indicator of the ability to repay short-term loans with working capital. The higher k is, the more solvent the company is. Its decrease suggests that the assets are no longer sold urgently. General formula:

- k = (current assets) : (current liabilities).

Current assets:

- cash (including electronic money) at the cash desk, on settlement accounts of banks;

- receivables + reserve for bad debts;

- investments in securities;

- material values and products for sale.

Current responsibility:

- loans for up to one year;

- unpaid obligations to suppliers, the treasury.

- other loans.

The formula for deducting assets and liabilities:

- k = (Al + Ab + Am) : (Ps + Pk), where

- Al - Liquid assets;

- Ab - fast-acting;

- Am - slowly realizing;

- Ps - Liabilities of urgent obligations;

- PC - short-term.

Balance formula:

- k = (p. 1200 + p. 1170) : (p. 1500 - p. 1530) - p. 1540).

Purpose of the overall liquidity ratio

This value performs the following tasks:

- an indicator of the availability of the ability to pay off its obligations during the current production cycle;

- "litmus test" of the company's solvency, its ability to cover all loans with available amounts;

- performance indicator of both a separate operating period and the selected direction of product turnover;

- important information for investors;

- the components necessary for the formula of a given k are also used in the calculation of working capital.

The norm of the current liquidity ratio and deviations from it

The value of the current liquidity ratio:

| Short | Norm | Tall |

| < 1,5 | 1,5 -2,5 | > 2,5 |

| Difficulties in fulfilling obligations - the result should be the closure of accounts payable and a decrease in current assets, since the company will not be able to pay its obligations at this moment. However, such budgetary instability does not always lead to the bankruptcy of the company. | It illustrates how many rubles of current assets fall on the ruble of current liabilities. Theoretically, such an enterprise will be able to meet its obligations in a timely manner at any time. | Current assets and commodities are misused – availability of short-term loans should be expanded |

Important! When calculating, we must not forget that liquid assets are uneven - it is necessary to take into account in detail the speed of their turnover (use the second formula).

Ways to increase the liquidity of the enterprise

To optimize the indicators k, the following methods are used:

| Way | Actions | pros | Minuses |

| Increasing the profitability of the main activity, keeping most of the income at your disposal | Dividend cuts Reducing funding for non-productive purposes | Quick reduction of k to the norm | Negative impact on the company's image, trust of founders, shareholders |

| Reducing the number of projects financed by short-term capital | Reducing the amount of investments in investment in construction, reconstruction, purchase of expensive equipment | The company stops investing amounts that exceed its financial capabilities | Reflection at the level of compliance with international standards for equipment and conditions of production and other activities |

| Limitation of financing through short loans | Using short-term debt only to replenish working capital, a multi-year loan is used to cover other items of expenditure | Long-term programs are invested using a long-term loan and current income | Emergence of new credit obligations |

| Changes in money management principles | Programs to improve the efficiency of working capital management | General modernization of business methods | Suitable only for companies whose increase in working capital is due to financing through short loans |

| Restructuring of debts to creditors | Set-off and subsequent write-off as unclaimed amount | Get rid of unbearable debt | Complicated, credible process |

Important! Shortk real liquidity is not an indicator of a company's cash deficit. Since current assets include receivables, investments, products, etc.

Calculation of the indicator on the example of AVTOVAZ

| Indicator | year 2014 | 2015 | 2016 |

| working capital | 49 783 | 40 073 | 55 807 |

| Short term loans | 86 888 | 112 867 | 117 723 |

Using the general formula:

- k (2014) = 49,783/ 86,888 = 0.00001151;

- k (2015) = 40,073/112,867 = 0.00000886;

- k (2016) = 55,807/117,723 = 0.4740535.

Average current liquidity ratio by industries of the Russian Federation

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Agriculture | 1,7644 | 1,7437 | 1,7678 | 1,7651 | 1,862 |

| Construction | 1,327 | 1,2474 | 1,2069 | 1,251 | 1,243 |

| Oil and gas industry | 1,8771 | 1,7718 | 1,8343 | 1,7849 | 2,3887 |

| Trade enterprises | 1,6426 | 1,6931 | 1,658 | 1,7146 | 1,6006 |

| Industry (metallurgy) | 1,5689 | 1,5572 | 1,5297 | 1,592 | 1,5261 |

| Small business (hotel, restaurant service) | 1,4887 | 1,1795 | 1,2726 | 1,5998 | 1,2305 |

| General indicators for the country | 1,7143 | 1,6764 | 1,5012 | 1,5389 | 1,4903 |

Comparison with other liquidity ratios

Comparative table of existing liquidity deduction ratios:

| kabsolute liquidity | kgeneral liquidity (current) | kquick liquidity | |

| Essence | Analyzes liquidity by calculating k between the company's total budget, its equivalent and current loans | Possibility to repay short-term debt at the expense of working capital | The ability to repay a loan with your fastest cashing assets, for example, in the event of sudden difficulties in selling the company's goods. An indicator of the soundness of financial status |

| Peculiarities | Credit profile of the company. It does not take into account the debts of debtors, inventories of goods and unsold products - only monetary assets that are available at the moment. Assesses the current ability to respond to their loans | General information about solvency, including its assessment for one production period. Data on the ability to cash out their products. The indicators for its calculation can be used in the formula that subtracts working capital | Somewhat similar to subtracting k total liquidity, but shifts the focus to a narrower area, excluding inventories - the slowest part of assets in terms of liquidity. In assessing solvency, the method is more conservative and cautious |

| Calculation formula | K= ((monetary assets) + (short-term investments)) : (short-term loans) | K = (current assets) : (current loans) | K = ((monetary assets) + (short-term investments) + (debt debts)) : (current current liabilities) |

| Norm values | <0,2 – неимение возможности ответить по обязательствам при помощи только оборотных средств; 0.2 - 0.5 - normal solvency; >0.5 - unclaimed monetary assets in banks, irrational investments | <1,5 – трудности в покрытии долгов; 1.5-2.5 - solvency is normal; >2.5 - irrational distribution of assets, infringement in the financing of any industries | 0.7-1 is the norm, loans taken and granted by the company are approximately equivalent. Below 0.7 - there is a possibility of a shortage of liquid values. More than 1: the company's desire to provide loans to debtors in greater quantities than the acquisition of such obligations for itself |

| Application | Calculation is required for future suppliers who require payment using term loans | The indicators of this k are of greater interest to investors | Wide Range: for managers - assessment of the financial performance of the company; for creditors - checking the financial stability of the enterprise, the risks associated with it; for investors - return on investment forecast |

Important! The ratios may vary depending on the industry of the enterprise.

Using the Current Liquidity Ratio in Bankruptcy Forecasting

The current liquidity ratio is one of the quantities that allow you to calculate the state of affairs of the company in the future - bankruptcy or prosperous activity. In calculations, the formula of Edward Malton is often used:

- B \u003d - 0.3877 - 1.0736 x k l + 0.0579 x k n. (k l - current liquidity ratio, k n - concentration of borrowed funds):

- B > 0 - the probability of bankruptcy is low;

- B \u003d 0 - 50/50;

- IN< 0 – чем выше величина, тем вероятнее разорение.

The advantage of the formula is its simplicity. However, it is not adapted to Russian business, as it was created using the example of foreign countries' reporting, so there is a possibility of a forecast error. A more accurate formula is the so-called four-phase, but with different components:

- B \u003d (8.38 x A 1) + A 2 + (0.054 x A 3) + (0.63 x A 4), where

- A 1 - working capital / asset;

- A 2 - net income / own budget;

- A 3 - profit from the sale of products / asset;

- A 4 - net revenue / integral costs.

Important! It is believed that this formula is able to predict the future of the company with a result of up to 80%.

What does a negative indicator of current liquidity show?

In the literal sense, the value of the indicator cannot be a negative number - it can be small up to one ten thousandth. The progressive negative dynamics of the value indicates the following:

- incorrect financial policy of the company and the distribution of funds;

- oversaturation with obligations to creditors;

- a large volume of unsold products;

- about excessive investment;

- the presence of a large number of debts outstanding to the company.

- the likelihood of bankruptcy.

Methods for assessing the financial condition using the current liquidity indicator

The main assessment methods with the participation of the coefficient:

- Selezneva-Ionova model. The methodology is aimed at comparing actual indicators with the standard, detecting the profitability of assets in terms of their net income, as well as an overall assessment of the company's management.

- Saifullin-Kadykov model. Similar to the previous one, it can be true for analyzing the financial status of companies of various industries and sizes. It also calculates the success of sales and turnover of its own budget.

- Postyushkov's model. Suitable for predicting the ruin of an enterprise with a state prediction range of up to six months.

Current liquidity ratio: topical issues

Answer: All information is taken from the company's annual financial report, accounting documents.

Question number 2: Is it worth focusing on the all-Russian norms of the current liquidity ratio?

Answer: Only for possession of information. For each industry, depending on the subject of the Russian Federation where it operates, the indicators k vary greatly.

Question 3: For whom should k of total liquidity be calculated in the first place?

Answer: It is useful for the head of the enterprise to have this information, and it may also be required by your creditors and investors.

Question #4: If my calculated ratio is high - more than two, then my business is moving in the right direction?

Answer: Unfortunately, it is not. High figures indicate that working capital is not actually working.

Question #5: Can the current liquidity ratio be negative?

Answer: No, even his formula does not imply this. Maybe a negative trend or a negative result - less than 1.5.

The problem of solvency management occupies a special place in the financial management system of any enterprise. A distinctive feature of a reliable and stable enterprise is its ability to meet its obligations on time and in full, which indicates the high financial stability of the enterprise and the low probability of bankruptcy.

Solvency- the main indicator of the financial stability of the enterprise, reflecting its ability to promptly meet its obligations, pay off debts.

In a narrower sense, solvency is the ability of an enterprise to pay off accounts payable in the short term.

The main sources of information for solvency analysis:

- balance sheet (f. 1);

- report on financial results (f. 2);

- cash flow statement (f. 3);

- other reporting forms that detail individual balance sheet items.

The concept of solvency is often replaced by the concept of liquidity, since its solvency depends on the level of liquidity of an enterprise.

Regardless of the stage of the life cycle at which the enterprise is located, its optimal level of liquidity should be determined, since insufficient liquidity of assets can lead to insolvency or bankruptcy, and excess liquidity can lead to a decrease in profitability.

In general, solvency analysis is necessary not only for the manager - for effective management and forecasting of the financial condition, but also for creditors and investors - in order to determine the solvency and assess the financial stability of the enterprise.

We analyze the liquidity of the balance

The liquidity analysis of the balance sheet involves checking the ratio of assets to liabilities for liabilities, each of which is grouped in a certain way: assets - by the degree of liquidity, liabilities - by maturity.

The main task in assessing the liquidity of the balance sheet is to determine the extent to which the company's liabilities are covered by its assets, the period for converting them into cash (liquidity) corresponds to the maturity of the liabilities (urgency of return). The liquidity of the balance sheet is achieved by establishing the identity between the obligations of the enterprise and its assets.

In other words, balance sheet liquidity is the ability of an enterprise to turn its assets into cash to pay off its payment obligations.

The most liquid, fast-selling and slow-moving assets are considered to be current assets, since during the reporting period their values are constantly changing, but hard-to-sell, as a rule, do not decrease.

Let's evaluate the liquidity of the balance sheet using the example of the manufacturing enterprise Alpha LLC, which is engaged in the repair and maintenance of automotive units (Table 1).

Table 1 Balance sheet of Alfa LLC for 2013–2016

|

ASSETS |

indicator |

2013. |

2014. |

2015. |

2016. |

|

I. Non-current assets |

|||||

|

Intangible assets |

|||||

|

fixed assets |

|||||

|

Profitable investments in material values |

|||||

|

Financial investments |

|||||

|

Other noncurrent assets |

|||||

|

Total for Section I |

|||||

|

II. current assets |

|||||

|

Value added tax on acquired valuables |

|||||

|

Receivables |

|||||

|

Cash and cash equivalents |

|||||

|

Total for Section II |

|||||

|

BALANCE |

|||||

|

LIABILITY |

|||||

|

III. Capital and reserves |

|||||

|

Authorized capital |

|||||

|

Reserve capital |

|||||

|

Retained earnings (uncovered loss) |

|||||

|

Total for Section III |

|||||

|

IV. long term duties |

|||||

|

Total for Section IV |

|||||

|

V. Current liabilities |

|||||

|

Borrowed funds |

|||||

|

Accounts payable |

|||||

|

Section V total |

|||||

|

BALANCE |

Traditionally, balance sheet liquidity is considered absolute if all of the following identities hold:

But in real activity, absolute liquidity is a fabulous rarity.

The results of grouping assets and liabilities by years are presented in Table. 2.

table 2 Liquidity analysis of the balance sheet of Alfa LLC

|

Indicator |

2013. |

2014. |

2015. |

2016. |

The liquidity condition of the balance sheet is not fulfilled in any of the analyzed years, and the same inequality is not always fulfilled - A1 ? P1.

Output

The company lacks the most liquid assets, therefore, it is impossible to talk about the absolute liquidity of the balance sheet.

In a narrower sense, an enterprise is considered liquid if its current assets (TA) exceed short-term liabilities (TO). In this case, the inequalities are fulfilled during all analyzed periods:

2013: TA (24,537 thousand rubles) > KO (10,011 thousand rubles);

2014: TA (23,159 thousand rubles) > KO (2,012 thousand rubles);

2015: TA (46,863 thousand rubles) > KO (650 thousand rubles);

2016: TA (63,179 thousand rubles) > KO (4,350 thousand rubles).

In addition, based on the results of the analysis, we can conclude that there is a positive trend in the development of the enterprise due to the growth in the level of current assets in the analyzed period and the reduction in the amount of liabilities (the exception is 2016, when the amount of borrowed funds grew, but at the same time the level of current assets increased compared to 2015 by 2621 thousand rubles).

Solvency and financial stability are interrelated concepts: solvency is an external manifestation of financial stability, a general indicator of which is a surplus or shortage of funds for the formation of reserves and costs (the difference in the size of sources of funds and reserves and costs).

The ratio of the cost of reserves and the values of own and borrowed sources of their formation is one of the most important factors in the stability of the financial condition of an enterprise.

The degree of provision of reserves with sources of formation reflects the state of the current solvency (or insolvency) of the organization.

To characterize the sources of formation of reserves and costs, indicators are used that reflect various types of sources:

1. Availability of own working capital(SOS). Calculated as the difference between capital and reserves (section III of the balance sheet liability) and non-current assets (section I of the balance sheet asset):

SOS \u003d SK - VA,

where SC - equity (line 1300 f. 1);

VA - non-current assets (line 1100 f. 1).

The increase in this indicator compared to the previous period indicates the development of the enterprise.

2. Availability of own and long-term borrowed sources of reserves and costs, or functioning capital(own long-term working capital, SDS). Determined by increasing the previous indicator by the amount of long-term liabilities:

SDOS \u003d SOS + TO,

where TO - long-term liabilities (line 1400 f. 1).

3. The total value of the main sources of formation of reserves and costs(general working capital, OOS). Calculated by increasing own long-term working capital (SDOS) by the amount of short-term liabilities (KO, line 1500 f. 1):

OOS \u003d SDOS + KO.

The three indicators of the availability of sources of formation of reserves and costs correspond to three indicators of the availability of reserves and costs by sources of formation:

1. Excess or lack of own working capital (? SOS):

SOS \u003d SOS - ZZ,

where ZZ - stocks and costs (line 1210 f. 1 + line 1220 f. 1).

2. Surplus or shortage of own long-term working capital (? SDS):

SDOS = SDOS - ZZ.

3. Surplus or shortage of general working capital (? OOS):

OOS \u003d OOS - ZZ.

There are 4 types of financial stability:

1. Absolute. Stocks and expenses are provided at the expense of own circulating assets. This type of financial situation is extremely rare and meets the following conditions:

SDOS ≥ 0;

2. Normal- guarantees solvency, i.e. reserves and costs are provided at the expense of own working capital and long-term loans:

SDOS ≥ 0;

3. Unstable financial condition. It is associated with a violation of solvency, but at the same time it remains possible to restore balance by replenishing sources of own funds, reducing receivables, and accelerating inventory turnover. In this case, reserves and costs are provided at the expense of own working capital, long-term and short-term loans:

SDOS< 0;

4. Crisis financial condition. The enterprise is on the verge of bankruptcy, because in this situation, cash, short-term securities and receivables do not even cover its accounts payable:

SDOS< 0;

The calculation of indicators of security with own working capital of Alpha LLC is presented in Table. 3.

Table 3 Calculation of indicators of provision with own working capital

|

Indicator |

2013. |

2014. |

2015. |

2016. |

|

Absolute stability |

||||

|

Normal stability |

||||

|

Unstable financial condition |

–14 922 < 0; –14 922 < 0; |

–10 345 < 0; –10 345 < 0; |

||

|

Crisis financial condition |

Output

Alfa LLC in 2013–2015 functioned unsustainably, experiencing a lack of own funds and an excess of the total value of the main sources of reserves formation.

It should be noted that every year the enterprise sought to increase the amount of own funds, but it was not enough due to the increase in the size of reserves, and even attracting borrowed funds did not help the enterprise achieve financial stability.

We analyze the liquidity of the enterprise using relative indicators

Along with absolute indicators, relative indicators are also calculated to assess the liquidity of an enterprise:

1. Absolute liquidity ratio(cash reserve ratio; K abs) is defined as the ratio of cash and short-term financial investments to the amount of short-term debts of the enterprise:

K abs \u003d (DS + PV) / KO,

where DS - cash (line 1250 f. 1);

FV - financial investments (line 1170 f. 1);

KO - short-term liabilities (line 1500 f. 1).

Shows what part of short-term liabilities can be repaid at the expense of available cash.

The normative value of this coefficient is > 0.1–0.2 (i.e., 10–20% of short-term liabilities are subject to repayment daily).

2. Quick (urgent) liquidity ratio(To BL) - the ratio of cash, financial investments and receivables, payments on which are expected within 12 months after the reporting date, to short-term liabilities:

K BL \u003d (DS + FV + DZ) / KO,

where DZ - receivables (line 1230 f. 1).

It characterizes the company's ability to repay current (short-term) liabilities at the expense of current assets. Standard values - from 0.7–0.8 to 1.

3. Current liquidity ratio(total debt coverage ratio; To TL) - the ratio of the total amount of current assets to the total amount of short-term liabilities:

K TL \u003d OA / KO,

where OA - current assets (line 1200 f. 1).

The coefficient gives an overall assessment of the liquidity of assets, showing how many rubles of the company's current assets account for one ruble of current liabilities. Standard value - > 1.

Calculation results of liquidity ratios of Alfa LLC for 2013–2016 are presented in table. 4.

Table 4

Calculation of liquidity ratios of Alfa LLC

|

Indicator |

2013. |

2014. |

2015. |

2016. |

Standard value of the indicator |

|

Absolute liquidity ratio |

|||||

|

Quick (urgent) liquidity ratio |

|||||

|

Current liquidity ratio |

Output

Absolute liquidity ratio in 2013–2016 is constantly growing, which indicates a good trend in the development of the enterprise.

It should be noted that the values of indicators in 2013 and 2014 did not meet the standard value, i.e. the enterprise could not balance and synchronize the inflow and outflow of funds in terms of volume and timing. And in 2015 and 2016 values of indicators of absolute liquidity reached the normative value.

In 2015, 10% of short-term liabilities were due daily, and in 2016 - 70%, which is a very good indicator.

The value of the quick liquidity ratio in 2013 was 0.81 (corresponds to the standard value), and in 2014 - 0.29 (decreased due to the reduction in the amount of receivables). But in 2015, the enterprise again managed to reach the standard value, and in 2016 - to increase it to 1.34. This indicates that the company is able to repay short-term liabilities at the expense of marketable assets.

Throughout the study period, the value of the current liquidity ratio is growing (shows the excess of current assets over short-term financial liabilities, which provides a reserve stock to compensate for losses - at this enterprise this stock is enough to cover losses).

We monitor the company's solvency on a daily basis

Daily monitoring of the solvency of the enterprise involves tracking the size of debts to other enterprises. For this they lead payment plan for each day and monitor their deviations, as well as monitor the balances on accounts 51 "Settlement accounts" and / or 52 "Currency accounts".

It is recommended to draw up not only a payment plan, but also a payment calendar, which will display not only the expenditure of funds, but also their receipts. The payment calendar should be kept daily and at the end of the reporting day or the beginning of the next one, study deviations and identify their causes.

An example of a payment calendar is presented in Table. five.

Table 5 Payment calendar for 01/17/2017

|

No. p / p |

Name of articles |

Counterparty name |

Purpose of payment |

Amount, rub. |

Existence of delay |

Note |

|

PAYMENTS |

||||||

|

Raw materials |

OOO "Beta" |

payment for the supply of bearings according to invoice No. 1 dated 01/16/2017 |

||||

|

Raw materials |

OOO "Gamma" |

payment for the supply of C-14 nuts according to invoice No. 2 dated 12/23/2016 |

||||

|

Electricity |

Electricity supply |

February electricity bill |

||||

|

Thermal energy |

Heat supply |

heating bills for february |

||||

|

Water supply |

Water supply |

January water bill |

||||

|

office |

OOO "Omega" |

monthly purchase of office supplies |

||||

|

TOTAL expense |

||||||

|

INCOME |

||||||

|

Sales of products |

OOO "Prima" |

payment for work under contract No. 212 dated February 14, 2016 |

||||

|

Sales of products |

JSC "Context" |

payment for work under contract No. 74/11 dated 11/16/2016 |

||||

|

TOTAL income |

||||||

|

Excess of payments over receipts |

||||||

|

Excess of receipts over payments |

Thus, at the beginning of the working day (01/17/2017), the company’s account must have at least 101,400 rubles. Otherwise, you will have to wait for payments from counterparties, which may come at the end of the working day, and since many banks do not make payments after 16:00, they will generally be transferred to the next business day. Therefore, it is necessary to constantly monitor account balances (opening balance) on a specific date.

If there is neither the required balance nor receipts (which will subsequently be displayed in the debit of account 51 “Settlement accounts”), there will be debts to counterparties.

For your information

The indicator of balances at the beginning of the working day on account 51 "Settlement accounts" can also be included in the payment plan in order to control their spending.

If there are not enough funds to make payments, it is worth looking at the turnover on this account for the previous day: the debit, as mentioned earlier, will reflect the income, and the credit will reflect the expense.

If there are not enough funds, classify all payments by maturity, level of penalties, size of payments - this way you will determine the priority of payments on a given day (for example, you need to urgently pay for the supply of raw materials or materials to ensure the continuity of the production process).

In addition, it is necessary to maintain not only daily payment plans, but also monthly or weekly (planning frequency is set individually for each enterprise) in order to see the full picture for a certain period and be able to make adjustments in accordance with changes (delays, new customers and suppliers, increase or decrease in output, etc.).

Various forms are used for monthly monitoring, for example, the income and expenditure budget (Table 6).

Click on the image to enlarge it

As in the payment plan, the budget of income and expenses can include lines about the excess of expenses over income, or vice versa. Analyzing the data of the income and expense report, the head of the enterprise may find that in a certain period there will not be enough funds on the account to carry out, for example, advance payments to suppliers, and then he will have the opportunity to respond quickly (for example, agree on postponing the advance payment to the supplier or about the postponement of advance payments from customers).

Naturally, such reports are constantly adjusted depending on changes in planned payments.

Often managers request a more detailed report showing all types of payments in order to see the big picture.

When assessing the solvency of an enterprise, it is necessary to analyze receivables and payables.

The appearance of receivables or payables is inevitable in any financial and economic activity due to the time gap between payments and the transfer of finished products (work performed, services rendered). Accounts receivable - the amount of money owed to the enterprise by debtors; accounts payable - the amount of money that the company itself owes.

It is worth remembering that debt reports are compiled for a specific date (an example is presented in Table 7). The very fact of debt - both accounts payable and receivable - arises after the acquisition of goods, the provision of services or the performance of work and until repayment to the supplier, buyer or customer.

The main tasks of accounting for accounts payable and receivable:

- control of the status of settlements;

- control over the performance of duties.

Accounts receivable in the balance sheet is displayed as the company's own funds, accounts payable - as borrowed funds. Therefore, the analysis of the company's debts is primarily necessary to determine its solvency.

Table 7 Report on receivables and payables as of 01/17/2017

|

No. p / p |

Debtors/ Lenders |

Amount, rub. |

Shipment |

Payment (advance) |

Amount owed as of 01/17/2017 |

||

|

date of |

Amount, rub. |

date of |

Amount, rub. |

||||

|

Debtors |

|||||||

|

OOO "Beta" |

|||||||

|

OOO "Gamma" |

|||||||

|

OOO "Omega" |

|||||||

|

Lenders |

|||||||

|

OOO "Norman" |

|||||||

|

Dixit LLC |

|||||||

Include in the report on receivables and payables of suppliers not only raw materials and materials necessary for the direct performance of the main activities of the enterprise, but also electricity, water, communications, transport organizations, organizations providing utilities, etc.

Particular attention should be paid to the oldest debts and the largest amounts of debt.

Note!

The level of solvency and financial stability of the enterprise directly depends on the speed of turnover of receivables and payables.

Accounts payable turnover ratio(To OKZ) is defined as the ratio of sales proceeds to the average value of accounts payable. Shows how many times the company repaid its accounts payable for the analyzed period.

Accounts receivable turnover ratio(To ODZ) is calculated as the ratio of sales proceeds to the average value of receivables. Shows the speed of transformation of goods (services, works) of the enterprise into cash.

Calculate the turnover ratios of Alfa LLC for the reporting year 2016:

To OKZ \u003d p. 2110 f. 2 / ((line 1520 f. 1 at the beginning of the period + line 1520 f. 1 at the end of the period) / 2) = 188,537 / ((39,770 + 42,391) / 2) = 4.6;

K ODZ \u003d p. 2110 f. 2 / ((line 1230 f. 1 at the beginning of the period + line 1230 f. 1 at the end of the period) / 2) = 188,537 / ((26,158 + 29,286) / 2) = 6.8.

There are no standard values for turnover ratios, a positive trend is considered to be an increase in values:

- the higher the value of the turnover ratio of accounts payable, the higher the solvency of the enterprise;

- the higher the value of the receivables turnover ratio, the higher the rate of cash turnover between the analyzed enterprise and its counterparties.

The fact that the value of the accounts payable ratio exceeds the value of the accounts receivable ratio is also positive, the observance of such an inequality leads to an increase in the profitability of the enterprise.

conclusions

Solvency analysis allows you to answer the main question: does the company have enough free cash?

Solvency is assessed in several stages.

First, the liquidity of the balance sheet is analyzed, the ratio between the assets and liabilities of the enterprise is calculated in order to find out whether the enterprise can pay for its obligations with the help of assets.

An analysis of the liquidity of the balance sheet of Alfa LLC showed that the company lacks the most liquid assets, but there is an increase in current assets along with a reduction in short-term liabilities, i.e., in general, the solvency of the enterprise is growing.

Secondly, the sources of formation of stocks and costs are analyzed.

Thus, between 2013 and 2015 the financial condition of Alpha LLC was unstable, the company experienced a lack of own funds and an excess of the total value of the main sources of reserves formation, the size of own working capital and reserves increased annually.

But in 2016, having reduced inventories by more than 20 times and increased the amount of own funds by 2.5 times due to retained earnings, the company was able to achieve a state of financial stability.

Thirdly, the solvency of the enterprise is analyzed using relative indicators.

Based on the results of such an analysis, it was established that in 2013 the financial condition of Alfa LLC was in crisis, the enterprise was on the verge of bankruptcy. But between 2014 and 2016 financial condition improved.

An analysis of solvency using financial ratios for 2016 showed that the company has sufficient solvency, i.e., it is partially able to pay off its payment obligations with cash resources in a timely manner.

And finally, it is important to constantly monitor solvency indicators. The reports presented earlier will help to assess the ability of the enterprise to pay off its obligations depending on the receipt of payments and cash balances in the accounts.

Such a comprehensive analysis allows you to monitor the solvency of the enterprise in the context of different reporting periods - a day, several days, a month and a year, quickly and promptly respond to any changes.

Liquidity is the ability of an enterprise to repay its obligations in both the short and long term. Also, liquidity refers to the ability and speed of working capital resources to turn into cash. This indicator is important for enterprises that use various types of loans, loans, payment deferrals, etc.

Liquidity is the ability of an enterprise to repay its obligations in both the short and long term. Also, liquidity refers to the ability and speed of working capital resources to turn into cash. This indicator is important for enterprises that use various types of loans, loans, payment deferrals, etc.

What is the current ratio

Current liquidity ratio (CR - current ratio) - a relative indicator that assesses the organization's ability to repay short-term (current) liabilities solely at the expense of current assets (working capital).

This indicator is also called coverage ratio And working capital ratio.

This ratio is necessary for a correct assessment of the company's ability to repay borrowed funds. As a financial instrument, it helps to correctly form the amount of liabilities based on the volume of working capital, which is called “current assets” in the balance sheet.

From the point of view of analyzing the organization's activities, the liquidity ratio reflects the solvency of the enterprise in the short term(up to 12 months) - the higher the value of the indicator, the better the solvency of the organization.

Too high values of the coefficient may indicate an imbalance in the company's funds (too much amount in working capital).

Current liquidity ratio: formula for calculating the balance sheet

Formula

To quantify the liquidity ratio, the following formula is required:

K lt \u003d OK / THEN,

where Кlt – liquidity ratio,

OK - the amount of working capital,

TO - the amount of current liabilities (with a repayment period within a year).

By balance

All the data necessary to calculate the liquidity ratio are presented in the organization's balance sheet. The quantitative measurement of the indicator is carried out on the following lines of the balance sheet:

- line 1200 "Section II total"

- lines 1510, 1520, 1550.

The balance sheet liquidity ratio is calculated once per period (year).

The calculation formula is as follows:

K lt \u003d s. 1200 / (s. 1510 + s. 1520 + s. 1550),

where K t is the coefficient;

from. 1200 = s. 1210 + p. 1220 + p. 1230 + p. 1240 + p.1250 + p.1260;

from. 1510 - "Borrowed Funds";

from. 1520 - "Accounts payable";

from. 1550 - "Other obligations".

Line 1200 indicates the total amount of working capital, which includes raw materials, materials in stocks, cash in receivables, cash and non-cash cash, short-term financial liabilities and others.

Lines 1510, 1520 and 1550 refer to section V "Current liabilities", that is, their maturity is not more than 12 months. This section also contains the line “Deferred income”, but it does not affect liquidity and is not taken into account.

The formula can be written according to the degree of liquidity of current assets and the maturity of liabilities:

K lt \u003d Ak1 + Ak2 + Ak3 / (Pa1 + Pa2),

A1 - lines 1240 and 1250 - highly liquid assets;

A2 - line 1260 - medium liquid assets;

A3 - lines 1210, 1220 and 1230 - low-liquid assets.

The higher the liquidity of current assets, the faster they can turn into cash.

P1 - 1520 - extremely urgent obligations;

P2 - 1510 and 1550 - current liabilities (short-term accounts payable).

Normative value of the current liquidity ratio

Data on normative values are determined according to the guidelines that underlie the financial analysis of the activities of enterprises.

The normal value of the liquidity ratio is considered to be in the range one and a half to two and a half.

For most industries, a value less than one indicates existing problems with covering short-term debts.

In the spheres retail or catering coefficient equal to one will be the norm, since these industries are characterized by a high percentage of short-term loans.

For industrial enterprises with a long duration of the production cycle, the value of the indicator at the level 3 and above, since such enterprises have a large amount of inventory and work in progress.

Video - what value of the current liquidity ratio can be considered the norm: