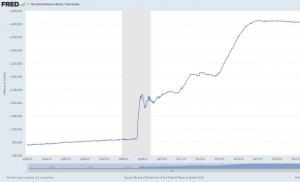

Nomura pic analyst Dmitry Petrov audio. The most accurate forecaster: “We are entering a phase of fear for the ruble

Petrov believes that in the next three months the dollar will fall in price from 74 to 67 rubles, provided that oil prices remain at the level of $35-40 per barrel. By the end of the year, the dollar will reach 65 rubles. The average dollar exchange rate in 2016 will be 69 rubles, the analyst believes.

According to Petrov’s forecast, the ruble will strengthen against the backdrop of an influx of funds into depreciated assets, as well as due to the fact that the population will show less interest in the dollar as a means of accumulating capital. In addition, according to the expert, the need for American currency will also decrease among business representatives due to the fact that the volume of payments on external debt will be halved.

The Russian currency, Petrov believes, will be an attractive, albeit risky, asset for investors this year. “The demand factor has really changed. The outlook for the trend is changing towards strengthening the ruble from current levels,” the expert emphasized.

Meanwhile, Barclays in early January lowered its forecast for the ruble exchange rate for the first quarter to 76 rubles per dollar. Previously, the bank predicted an exchange rate of 71 rubles per dollar in the first quarter. By the end of 2016, the exchange rate will drop to 78 rubles per dollar, the bank predicts.

Alfa-Bank economists expect the exchange rate to fall to 80 rubles per dollar in the first quarter of 2016.

It is also worth noting that the majority of experts surveyed by Bloomberg expect the Russian currency to weaken to 90 rubles per dollar.

Let us recall that in the last days of 2015, the ruble twice updated its historical minimums. On December 31, the Central Bank set the exchange rate of the American currency at 72.8827 rubles, which is the maximum since the 1998 denomination.

Earlier, on December 25, the head of Sberbank German Gref said that in 2016 the value of the ruble will fall following falling oil prices.

A few days earlier, the Chairman of the Central Bank of the Russian Federation, Elvira Nabiullina, noted that the volatility of the national currency was decreasing. According to her, a floating exchange rate regime is best suited for the Russian economy in the current conditions.

At the same time, the head of the Ministry of Economic Development, Alexey Ulyukaev, said: the main problem for the Russian economy is not a high or low exchange rate, but the fact that it fluctuates greatly. Ulyukaev recalled that 2015 began with a rate just above 60 rubles per dollar, in the middle of the year it fell to almost 40 rubles, and has now returned to 70 rubles. Business cannot adapt to such great volatility, Ulyukaev said.

Billionaire Alisher Usmanov, who founded USM Holdings, in turn, said at the end of December that next year will not be easier than this, and, perhaps, will be even more difficult - the price trend does not allow us to hope that there will be a sharp upward rebound. We need to learn to live in new economic realities, the businessman urges.

On Monday, January 11, the price of Brent oil is in negative dynamics. By 10:26 Moscow time it had decreased by 1.64% to $33 per barrel. WTI oil is falling in price more noticeably today, the cost of which by this time had decreased by 2.43% - to $32.36 per barrel.

The price of oil reached its lowest level since 2004 last week, when the Brent brand lost more than 4% of its value and fell below $33. The reason for this was the monetary policy of China (the largest consumer of oil after the United States, which creates demand for it) - the People's Bank of China weakened the yuan against the dollar over the past week by more than 1.5%, which was the largest change in the exchange rate of this currency since deflation in August, which shook global stock markets.

Despite the continuing decline in oil prices, the Bank of Russia increased the official US dollar exchange rate by 3.02 rubles from January 12, to 75.9507 rubles. The official euro exchange rate has added 3.17 rubles and will be 82.8090 rubles starting tomorrow.

Analyst at Nomura International Plc. Dmitry Petrov, recognized last year as the most accurate forecaster of the ruble exchange rate by Bloomberg, expects the Russian currency to strengthen its position in the first quarter of 2016. The dollar exchange rate, according to Petrov, will drop to 67-70 rubles due to rising oil prices, Bloomberg reports.

After the ruble suffered a 20 percent fall in 2015 and hit a record low of 75.74 last week, the worst is over, Petrov says. For the next three months, according to analyst forecasts, the dollar will remain at around 67 rubles, and by the end of the year the rate will drop to 65 rubles. For most of the year, the dollar exchange rate will be 69 rubles. The ruble will strengthen due to rising oil prices, which could rise to $35-40 per barrel, the expert assures.

« We believe we are approaching the bottom in the dollar pair- ruble, and are inclined to consider the possibility of buying the ruble in the coming weeks“,” Petrov told Bloomberg. According to the expert, this is “ very attractive opportunity in 2016».

Other market watchers, including Barclays Plc, say the outlook for the ruble is dim as the country's economy struggles to recover from recession while the price of oil has hit a nearly 12-year low and economic growth in Russia's biggest trading partner, China. slowed down. According to Barclays forecasts, in the first quarter of 2016 the dollar will cost 76 rubles, and by the end of the year it will rise to 78.

source Bloomberg USA North America tags- 03:00

Apple presented AirPods Pro wireless headphones with a new design and active noise cancellation, which will go on sale in Russia next week.

- 03:00

Krasnodar striker Magomed-Shapi Suleymanov commented on the information that his age has been rewritten.

- 03:00

Music critic Alexander Volkov, in a conversation with Nation News, spoke about the reasons for the popularity of Metallica.

- 03:00

British Prime Minister Boris Johnson said the government will introduce a new, short bill to the British Parliament to hold snap elections on December 12.

- 03:00

Krasnodar striker Ivan Ignatiev commented on rumors that in the summer he could move to the St. Petersburg football club Zenit.

- 03:00

Pentagon chief Mark Esper said that American troops will continue to protect oil fields in Syria and will respond to any attempts by other parties to take control of them.

- 03:00

A storm warning has been announced in Crimea. A sharp change in weather is predicted in the republic this week. This was reported by RIA Novosti Crimea with reference to the regional Main Directorate of the Ministry of Emergency Situations of Russia.

- 03:00

Krasnodar forward Magomed-Shapi Suleymanov compared Spanish Barcelona striker Lionel Messi and the Ultimate Fighting Championship (UFC) lightweight champion, Russian Khabib Nurmagomedov.

- 03:00

The House of Commons of the British Parliament rejected Prime Minister Boris Johnson's proposal to hold early parliamentary elections on December 12.

- 03:00

Vice-President of the Russian Union of Tourism Industry (RST) Olga Sanaeva commented to RT on the possible appearance of an “accommodation tax” in hotels in Turkey in 2020.

- 03:00

American producer Robert Evans, who worked on the films “The Godfather” and “Chinatown,” has died at the age of 89. This was reported by the Associated Press with reference to his representative.

- 03:00

Krasnodar goalkeeper Matvey Safonov admitted that the Italian football club Fiorentina showed interest in him.

- 03:00

The Pentagon promised to soon present photo and video evidence of the liquidation of the leader of the terrorist group “Islamic State”* Abu Bakr al-Baghdadi during a US special operation in Syrian Idlib.

- 03:00

Kazan Ak Bars defeated Khabarovsk Amur in the regular season match of the Continental Hockey League (KHL).

- 03:00

St. Petersburg SKA in a shootout turned out to be stronger than Cherepovets Severstal in the regular season match of the Kontinental Hockey League (KHL).

- 03:00

Former Russian hockey player Andrei Nazarov, who played in the National Hockey League (NHL) from 1993 to 2005, commented on the information about the American citizenship of Russian national team and Pittsburgh Penguins striker Evgeni Malkin.

- 03:00

First Deputy Chairman of the Federation Council Committee on International Affairs Vladimir Dzhabarov commented on RT on the statement of Verkhovna Rada deputy Vadim Rabinovich about the risk of the return of fascism to Ukraine.

- 03:00

British Prime Minister Boris Johnson sent a letter to President of the European Council Donald Tusk, in which he confirmed his agreement with the European Union’s decision to postpone Brexit until January 31, 2020.

- 03:00

Red Bull sports consultant Helmut Marko, who said earlier that Russian Toro Rosso driver Daniil Kvyat is not a candidate for the main team next season, denied his own words.

- 03:00

Representatives of the international coalition to combat the terrorist organization "Islamic State"* will hold a meeting in Washington on November 14.

- 03:00

Russian cross-country skiing team coach Markus Kramer said that Yulia Belorukova and Elena Soboleva, who will miss the season due to pregnancy, will be replaced by other talented athletes.

- 03:00

Verkhovna Rada deputy Vadim Rabinovich, during the celebrations marking the anniversary of the liberation of Ukraine from the Nazi invaders, noted that there is a risk that fascism has returned to the country.

- 03:00

American President Donald Trump misspoke and called his Ukrainian colleague Vladimir Zelensky “the new president of Russia.” Users of social networks drew attention to the US leader’s reservation.

- 03:00

The striker of Juventus Turin and the Portuguese national football team, Cristiano Ronaldo, admitted that if he had the opportunity, he would only take part in important matches.

- 03:00

The head of the Sober Russia organization, Sultan Khamzaev, in a conversation with the 360 TV channel, appreciated the proposal to develop amendments to tighten responsibility for promoting drugs on the Internet.

- 03:00

The head of the Center for British Studies at the Institute of Europe of the Russian Academy of Sciences, Elena Ananyeva, in a conversation with NSN, commented on the situation around Brexit.

- 03:00

Chilean President Sebastian Piñera has replaced eight ministerial heads amid two weeks of protests in the country.

- 03:00

In the Moscow region, 18.9 billion rubles have been allocated for the implementation of the national project “Demography”, reports TV channel “360”.

- 03:00

The international congress “History of Sambo” will be held on November 6-8 at the National Research University “MPEI”, reports the online publication argumenti.ru.

- 03:00

The head of Yakutia, Aisen Nikolaev, and the general director of the Fund for the Protection of the Rights of Shareholders, Oleg Govorun, entered into an agreement on co-financing the completion of a number of problem houses in the region. This was reported by Gazeta.Ru with reference to the press service of the republican government.

- 03:00

Nutritionist Elena Solomatina, in a conversation with Vechernaya Moskva, spoke about the most harmful food combinations.

- 03:00

Users of the Strelka virtual transport card will be able to pay for travel on public transport in the Moscow region using mobile devices, the 360 TV channel reports, citing the press service of the regional Ministry of Transport and Road Infrastructure.

- 03:00

Forward of the Russian national hockey team and the Pittsburgh Penguins, Evgeni Malkin confirmed his American citizenship.

- 03:00

Fishing is temporarily limited on the southern coast of Crimea, reports RIA Novosti Crimea with reference to the press service of the Border Department of the FSB of Russia for the republic.

- 03:00

The Association of Tour Operators of Russia said that in 2020 a new tax may appear in the Turkish tourism industry, which will affect all accommodation facilities, including hotels.

- 03:00

Small missile ships "Uglich" and "Veliky Ustyug" arrived at the base of surface ships of the Caspian flotilla in the Astrakhan region, the Zvezda TV channel reports.

- 03:00

The exhibition “The Vorontsovs and Italy” will open on October 31 at the Alupka Museum-Reserve, Kryminform reports. Ronaldo spoke about his immediate career goal

Striker of Turin Juventus and Portugal national football team Cristiano Ronaldo named his goal for the coming years in his career.

- 03:00

Russian artist Nikolai Kasatkin, whose paintings are kept in the American Zimmerli Museum, Tretyakov Gallery, Pushkin Museum and other cultural institutions, died at the age of 88.

- 03:00

Chairman of the State Duma Committee on Energy Pavel Zavalny, commenting on RT on the completion of trilateral consultations between Russia, the European Union and Ukraine on gas transit in Brussels, noted that the most important conclusion is that the parties are committed to resolving the issue.

- 03:00

The girl's mother, instead of the Ingush Ombudsman Zarema Chakhkieva, became the legal representative of seven-year-old Aisha Azhigova from Ingushetia, who was allegedly beaten by her aunt. Anna Kuznetsova, Commissioner for Children's Rights in Russia, reported this.

- 03:00

President of the Biathlon Union of Serbia Velimir Vukadin said that the executive committee of the International Biathlon Union (IBU) refused to allow former Russian biathlete Ekaterina Avvakumova to compete for the Serbian national team.

Stoltenberg urged Belarus not to worry about NATO exercises

NATO Secretary General Jens Stoltenberg said that he sees no reason for Belarus to be concerned in connection with NATO exercises near its borders.

- Why are your forecasts more accurate than other forecasters?

There are two aspects to any forecast - fundamental factors and psychological factors, that is, the mood of market participants, their sense of how calm or panicked the market is, what stage of the cycle it is in, etc. The fundamental models of most analysts who make forecasts for the ruble are approximately the same.

- So the differences in forecasts are mainly explained by the interpretation of investor sentiment?

Yes, everyone draws their own conclusions after communicating with market participants. I spend half of my working time talking with investors from all over the world, and the impressions from this communication, their thoughts about what will happen to the ruble, their negative or positive attitude towards this currency significantly influences my forecasts. Simple technical positioning is not enough and does not take into account, for example, panic cycles. Therefore, we can say that my job is to adjust fundamental calculations to the sentiments of market players.

During the first trading days of this year, the ruble depreciated against the dollar by 4%. Can we say that we are at the stage of selling off the ruble due to expectations of lower oil prices?

This is a rather interesting moment; we are entering a phase of fear, not entirely justified panic about the ruble. The situation, of course, is not comparable to what it was at the end of 2014, but this trend is indicated by the positioning of investors in the market, whose fears do not always lead to correct assessments of the situation. This mood, by the way, is connected not only with the ruble; there is a lot of panic in relation to China, although we believe that the problems that exist in the Chinese stock market do not reflect the problems of the economy. Oil prices, which are now at very low levels, are also more likely to be explained by speculative pressure than by fundamental factors. The excess oil that is on the market is not so critical and does not make the price of $30 per barrel logical. All these external factors put pressure on the ruble, but the market has not fully appreciated the influence of internal factors that actually support the ruble.

- What do you mean by internal factors? Is this the policy of the Central Bank?

Including. The rather tough and cautious policy of the Bank of Russia provides some support to the ruble; without it, the situation would have been more negative. Another important factor is the budget changes that are currently being considered. This is of great interest to investors. Everyone understands that the easiest way to balance the budget would be to devalue the ruble, but in the last 2-3 months we have seen that the discussion is more about cutting costs. This is a strong signal that there is a structurally correct approach to solving budgetary problems, and if the Ministry of Finance insists on this option, there will be a fairly serious revaluation of the ruble in a positive direction. Finally, we see a change in the behavior of the population, which has often been an unsettled participant in the foreign exchange market during sharp fluctuations in exchange rates. Now it has ceased to react sharply to them.

What explains this? And is there a possibility that, following the panic among professional investors, Russians will rush to buy dollars?

There is always such a risk. But we saw that during the last sharp fluctuations there was no panic among the population. Firstly, there is a certain getting used to both such volatility and new levels. Secondly, people who had savings and wanted to convert them into foreign currency have most likely already done so. In addition, we see a strong drop in real incomes of the population, that is, Russians now have much less free money to buy dollars. Thus, the balance of factors suggests that, most likely, there will be no panic among the population. Moreover, we see that the demand for currency from corporations is also decreasing. Considering the positive current account balance, which remains despite the fall in oil prices due to the compression of imports, and the decrease in capital outflow, we can expect stabilization of the currency. In general, we are now approaching new, not yet fully realized, structural changes in the formation of the dynamics of the ruble.

- That is, the ruble exchange rate will gradually decouple from oil prices?

The correlation between the ruble and oil, which was very high last year, was probably primarily justified by investor expectations. When the price of oil fell, players who needed to purchase dollars to pay off foreign debts or for other purposes tried to do so in advance. Nowadays this behavior is less common. And if the right steps are taken in fiscal policy, the correlation will decrease significantly.

- What is your forecast for the ruble for 2016?

I'm waiting for the ruble to strengthen. By the end of the first quarter, we expect oil prices to stabilize in the range of $35–40 per barrel. This should change investor sentiment, and the ruble could strengthen to 66–68 rubles/dollar. At the same time, it is unlikely that the ruble will be significantly stronger than these levels during 2016: we believe that if the ruble strengthens to 60 rubles/dollar. with oil around $40 per barrel, we can expect intervention from the Central Bank, which will again begin to accumulate reserves.

Interviewed by Siranush SHAROYAN

The most accurate “ruble analyst” according to Bloomberg is Dmitry Petrov from Nomura International Plc. announced a “phase of fear for the ruble.”

During the first trading days of this year, the ruble depreciated against the dollar by 4%. Can we say that we are at the stage of selling off the ruble due to expectations of lower oil prices?

This is a rather interesting moment; we are entering a phase of fear, not entirely justified panic about the ruble. The situation, of course, is not comparable to what it was at the end of 2014, but this trend is indicated by the positioning of investors in the market, whose fears do not always lead to correct assessments of the situation. This mood, by the way, is connected not only with the ruble; there is a lot of panic in relation to China, although we believe that the problems that exist in the Chinese stock market do not reflect the problems of the economy. Oil prices, which are now at very low levels, are also more likely to be explained by speculative pressure than by fundamental factors. The excess oil that is on the market is not so critical and does not make the price of $30 per barrel logical. All these external factors put pressure on the ruble, but the market has not fully appreciated the influence of internal factors that actually support the ruble.

What do you mean by internal factors? Is this the policy of the Central Bank?

Including. The rather tough and cautious policy of the Bank of Russia provides some support to the ruble; without it, the situation would have been more negative. Another important factor is the budget changes that are currently being considered. This is of great interest to investors. Everyone understands that the easiest way to balance the budget would be to devalue the ruble, but in the last 2-3 months we have seen that the discussion is more about cutting costs. This is a strong signal that there is a structurally correct approach to solving budgetary problems, and if the Ministry of Finance insists on this option, there will be a fairly serious revaluation of the ruble in a positive direction. Finally, we see a change in the behavior of the population, which has often been an unsettled participant in the foreign exchange market during sharp fluctuations in exchange rates. Now it has ceased to react sharply to them. The Russian authorities do not plan to strengthen the ruble too much, according to the words of President Vladimir Putin. At a meeting with Russian industrialists at the St. Petersburg Economic Forum, in response to a request from the director of one of the companies not to let the dollar exchange rate fall, Putin said that the government supports this thesis. “The Central Bank has many regulatory instruments. This regulation will be used to ensure the interests of our producers in the real sector,” the president promised. What is the best way to manage your savings in this case? RBC addressed this question to the forum participants - officials, bankers and investors.

What explains this? And is there a possibility that, following the panic among professional investors, Russians will rush to buy dollars?

There is always such a risk. But we saw that during the last sharp fluctuations there was no panic among the population. Firstly, there is a certain getting used to both such volatility and new levels. Secondly, people who had savings and wanted to convert them into foreign currency have most likely already done so. In addition, we see a strong drop in real incomes of the population, that is, Russians now have much less free money to buy dollars. Thus, the balance of factors suggests that, most likely, there will be no panic among the population. Moreover, we see that the demand for currency from corporations is also decreasing. Considering the positive current account balance, which remains despite the fall in oil prices due to the compression of imports, and the decrease in capital outflow, we can expect stabilization of the currency. In general, we are now approaching new, not yet fully realized, structural changes in the formation of the dynamics of the ruble. - The correlation of the ruble to oil, which was very high last year, was probably primarily justified by investor expectations. When the price of oil fell, players who needed to purchase dollars to pay off foreign debts or for other purposes tried to do so in advance. Nowadays this behavior is less common. And if the right steps are taken in fiscal policy, the correlation will decrease significantly.

What is your forecast for the ruble for 2016?

I'm waiting for the ruble to strengthen. By the end of the first quarter, we expect oil prices to stabilize in the range of $35–40 per barrel. This should change investor sentiment, and the ruble could strengthen to 66–68 rubles/dollar. At the same time, it is unlikely that the ruble will be significantly stronger than these levels during 2016: we believe that if the ruble strengthens to 60 rubles/dollar. with oil around $40 per barrel, we can expect intervention from the Central Bank, which will again begin to accumulate reserves.

The Russian currency completed pre-Christmas trading with a significant weakening against its key counterparts. The fall against the dollar was 1.44 rubles, against the euro - 1.92 rubles. At today's session, the domestic currency starts at ₽74.7590/dollar. and ₽80.6480/euro.

The ruble will begin trading on Monday against the backdrop of significantly sagging oil, the cost of which during the holidays approached the 30-dollar mark ($33.19 at 08:52 Moscow time). A new wave of falling prices was provoked by Saud. Arabia, which provided European customers with a discount on supplied raw materials. The situation is aggravated by the weakening of the Chinese economy, an oversupply of inventories in the United States and an imbalance between the production and consumption of raw materials.

Experts, meanwhile, continue to make forecasts for the ruble exchange rate for the current year. The most accurate forecasters from Bloomberg and Moskovsky Komsomolets shared their thoughts on this matter the day before.

“Number 1” in the rating of the American agency is Dmitry Petrov from Nomura International Plc., who predicted an exchange rate of ₽75.15/dollar for January 2016, expects the national currency to strengthen to ₽67.00 and ₽65.00 during the starting trimester and by the end of the year, respectively.

According to the economist, the dollar/ruble pair is not far off from reaching the exchange rate bottom.

“Therefore, we will consider the possibility of buying Russian currency in the coming weeks,” Petrov admitted.

The strengthening of the domestic currency, according to Petrov, will be facilitated by factors within the Russian Federation, coupled with the influx of funds into cheap Russian assets.

Economists at Barclays Plc. Petrov and the company do not share the “ruble optimism”, declaring the vague prospects for the Russian currency in the light of extremely cheap oil, the current state of the Russian economy and the vague prospects of the PRC.

Updated on January 6, Barclays experts’ forecast for January-March is the dollar at ₽76.00 (instead of the previously stated level of ₽71.00). At the end of 2016, experts from the British Financial Institute predict “green” to be around ₽78.00.

The most successful forecaster of "MK" Ruslan Grinberg from the Institute of Economics of the Russian Academy of Sciences exactly a year ago he predicted the dollar exchange rate of ₽74.65 on 01/10/2016. The expert, who was wrong by only 10.9 kopecks, cited the incompetence of the government and the Central Bank as the reason for the fall of the national currency (the officials’ forecast for RUR/USD, we recall, assumed an exchange rate of ₽63.00).

The fall in production in China, plans to resume the export of Iranian oil and the excess of supply over demand, according to Greenberg, were obvious last year.

“They didn’t take it seriously,” the academician comments on the authorities’ mistakes. — They also didn’t take into account that there is a lot of pure psychology in prices. Our leaders' nerves turned out to be stronger than those of the market.

Greenberg called the Central Bank’s decision to liberalize the currency regime in a state dependent on oil prices “an adventure for which we are all now paying.”

The academician’s forecast for RUR/USD for 2016 is balancing within the range of ₽65-100.

“I’ll be more precise only if I find out that radical changes in monetary policy are being prepared,” the economist summed up.