African countries have the largest development of palm oil. Palm oil in Russia, USA, Europe

RUSSIA IS IN THE TOP THREE WORLD LEADERS IN THE CONSUMPTION OF PALM OIL IN FOOD. It is included in more than half of the products.

And although doctors talk about the dangers of its use, and in the West they are discussing bans on the import of palm oil, more and more of it is being imported into the Russian Federation. From sweets to cottage cheese. How palm oil became the main component in Russian food The rapidly growing global production of palm oil can destroy the tropical flora and fauna of many countries in Asia, Africa and Latin America, environmentalists say. Doctors warn about the dangers of its use in food, and some Western countries and large grocery chains are discussing a possible ban on its import for food purposes. More and more palm oil is being imported into Russia - otherwise store shelves may become noticeably empty, experts say. India, Russia and China are the world's three leading consumers of palm oil for food, 90% of which is now produced by Indonesia and Malaysia. Three years ago, the volume of global production of palm oil came out on top among all other vegetable oils, surpassing, for example, sunflower oil by 2.5 times. The world's largest oil palm growing area is the island of Borneo, divided between Indonesia, Malaysia and tiny Brunei. Over the past 15 years, exactly half of all tropical forests have been cut down here for the sake of oil plantations. As the Regional Office of the Malaysian Palm Oil Council (MPOC) points out, these are former agricultural lands. In total, oil palm plantings occupy more than 250 thousand square kilometers on the planet - this is more than the area of Great Britain or Romania.

The International Union for Conservation of Nature (IUCN) released a special report on June 26, which states that massive clearing of jungles for oil palm plantations in Malaysia and Indonesia, as well as in Central Africa and South America, has brought some local animal species to the brink of extinction, including including orangutans, tigers, rhinoceroses and monkeys. Since the beginning of 2018, 335 thousand tons of palm oil of various grades and its fractions have been imported to Russia, which is more than 30% more than in 2017, judging by Rosstat reports. Volume is forecast to reach one million tonnes by the end of the year. Palm oil, as experts constantly emphasize, is part of more than half of all food products sold: from buns, chocolates, ice cream and pasta to surrogate or simply adulterated cheeses, butter and cottage cheese, where they replace milk fats. According to MPOC, palm oil does not contain cholesterol, claims of carcinogenic properties are fictitious, and it is “an internationally recognized healthy alternative to harmful trans fats.” Moreover, the Council said, palm oil is used in the manufacture of “far from cheap and low-quality goods,” citing as an example the Nestlé Corporation, which purchases 420 tons of oil annually. In Russia, unlike most other countries, there are no legislative acts regulating the import of palm oil. The growth of its imports into the country, as experts point out, is associated not only with economic, but also with political factors. In the spring of 2018, Moscow signed a contract for the supply of 11 Su-35 fighters worth $1 billion 140 million.

According to the terms of the deal, Indonesia will cover part of this amount by sending tens of thousands of tons of palm oil to Russia. The range of products in the production of which palm oil is used is very wide. Consumers only know about those that the media talk and write about a lot. For example, dairy products. Because people are accustomed to dairy products, they consume quite a lot of them, and the fact that they have changed their taste, appearance, and so on, quite clearly shows that they began to add them. But in fact, the same confectionery industry uses just as much palm oil. It’s just that confectioners somehow try not to notice these issues. However, all bakery and confectionery products with a long shelf life use palm oil. Just like palm oils are used in other industries, but in smaller volumes, of course. The main consumers of these imports are the dairy and confectionery industries.

What quality of palm oil does it come from? Technical grades of oil are imported, and, moreover, in improper, non-food containers, in wagons intended for products that are not used in the food industry. Even frankly technical oils with poor purification are used for the production of products. (Radio Liberty MPOC stated that the concept of “technical” palm oil does not exist). Today there is no active struggle in Russia against the use of palm and other tropical oils for one reason: the income of the people is not the same! The import of these oils makes it possible to produce cheaper products so that store shelves do not end up empty. In general, this problem has not yet been solved by any regulatory acts or laws. In addition, milk production volumes in Russia have now begun to grow - and at the same time, cases of detection of counterfeit products, including the replacement of milk fats with palm oil, have worsened. Most likely, in the next five years, the fight against its widespread use will intensify, especially illegally, when it is substituted for a real product, without indication on the label. There is a lot of counterfeit in the country. Against the background of speeches that “we will make a cheaper and more accessible product,” margarine, for example, is produced, which is called the word “butter” - and which costs much more than it would cost if it was openly written on it that it is "spread" made using palm oil.

Palm redistribution. Can Russia do without the tropics?

The introduction of quotas on the import of tropical oils into the countries of the Eurasian Economic Union, which has recently been actively discussed in the media, according to a number of players in the domestic dairy market, is intended to support Russian producers. Meanwhile, the demand for tropical oils as one of the essential ingredients for the production of confectionery, bakery and dairy products both around the world and in Russia is only growing. About what restrictive measures on the import of tropics mean for the Russian industry, what will happen if they are adopted with the Russian “food industry”, and also about how all this will affect Russian consumers - in the next reviewOilworld.ru

Myths and reality: they slander the tropics

There are many myths and legends around tropical oils, but the reality is much more prosaic. Tropical oils - palm, palm kernel, coconut oils - are ordinary natural vegetable oils that began to be eaten 5,000 years ago.

Due to high yields, low cost of raw materials, and most importantly - special quality characteristics that allow the use of tropical oils in various sectors of the food and non-food industry, they have become widespread throughout the world.

Thus, if in the 2016/2017 season global consumption of tropical oils was 72.2 million tons, then by the 2017/2018 season it increased by almost 3.4 million tons to 75.6 million and, according to experts, will continue to grow further. Among the main consumers of tropical oils are countries where palm oil is part of the traditional diet of residents of these regions: Indonesia (12.2 million tons), Malaysia (4.7 million tons), Pakistan (3.1 million tons), Thailand (2 .8 million tons), Egypt (1.3 million tons), as well as countries with developed economies and a high level of production development that import tropical oils for further advanced processing, primarily in the food industry. Among them are the EU (7.7 million tons) and the USA (2.4 million tons), as well as India (11.3 million tons) and China (5.5 million tons), which in general have been the engine of development in recent years economies for the whole world.

On average, Russia imports about 900 thousand tons per year and ranks only 15th in the world ranking of exporters. If we consider the per capita food consumption of tropical oils in the 2017/18 MY season, then Russia ranks 44th in the world, noticeably inferior to Japan and the EU countries. -

View from a palm tree: higher quality, more benefits, exports growing

Among tropical oils, palm oil is the most famous and widespread, and this is not surprising. From one hectare of land, palm trees produce four times more raw materials than sunflowers, soybeans or corn. In addition, unlike other oilseeds, palm oil production occurs year-round, which is more economical than seasonal processing and storage of other crops.

At the same time, the particular popularity of palm oil in the food industry is due to its unique properties.

“Palm oil is a rare case of vegetable fat with a semi-solid consistency, which allows it to be used in the production of food products that require solid fats,” says Vladimir Bessonov, head of the food chemistry laboratory of the Federal State Budgetary Institution of Nutrition, Biotechnology and Food Safety.

Experts in the scientific community also confirm that palm oil is a unique ingredient for the production of healthy food products. Palm oil has a balanced composition of saturated and unsaturated fatty acids (50%/50%) and is resistant to oxidation. In addition, according to Dr. med. Oleg Medvedev, director of the Healthy Nutrition Research Center, palm oil, unlike butter, does not contain cholesterol, does not require hydrogenation and is one of the best substitutes for dangerous trans fats. Victor Tutelyan, academician of the Russian Academy of Sciences and scientific director of the Federal Research Center for Nutrition and Biotechnology, adds that due to the presence of a large amount of palmitic acid (up to 45%), which is present in breast milk and is very useful for children, the oleic fraction of palm oil is a valuable ingredient for the production baby food.

Due to its technological advantages and quality characteristics, palm oil has been the most popular vegetable oil in the world for several decades and is especially in demand in the most intensive sectors of the food industry: confectionery, bakery, dairy, ice cream production, instant food products, snacks, HoReCa.

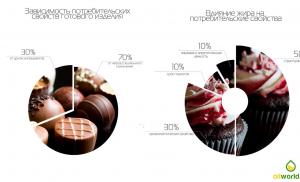

According to Soyuzmoloko, almost half of all fats and margarines produced go into the confectionery industry; part of the crude palm oil is used in non-food industrial processing: for the production of soap, perfumes and cosmetics, and use in the paint and varnish industry. The share of palm oil, which is used for the production of milk-containing products, of the total import volume does not exceed 15%.

To prepare confectionery products, you need solid oil, and there is practically no alternative to palm oil in terms of technology: margarine is more expensive and harmful, since various additives are added to give it hardness; butter is five times more expensive and has a specific taste that is not suitable for regular use.” , says Dmitry Baykov, general director of the Lyubimy Krai confectionery factory.

At the same time, the oils that are produced in Russia (sunflower, rapeseed, camelina) do not have the necessary quality characteristics that make it possible to replace palm oil ingredients in the recipe. “Replacing tropical oils with sunflower oil will affect the loss of quality and presentation, as well as reduce the shelf life of finished products,” says Elizaveta Nikitina, director of the Center for Confectionery Market Research.

Alena Surkova, director for the confectionery industry of the oil and fat division of EFKO Group of Companies, reminds that all over the world, including in Russia, palm oil as one of the raw ingredients is actively used for the production of high-quality confectionery products, and our country has something to offer in this matter be proud. “According to our assessment, the confectionery market in Russia is formed and saturated. Domestic enterprises were able to replace imports of confectionery products from Ukraine, and the quality of Russian confectionery products is evidenced by large export volumes. It is possible to produce such high-quality sweets only using high-quality, high-tech specialized fats and margarines. Until recently, Russia imported such fats; now only raw materials for their production are imported, and Russian technologists have been able to master high technologies and are independently solving issues of import substitution in this area,” notes Surkova.

Palm dilemma

However, despite the position of experts on this issue, “at the household level” in Russia the attitude of the end consumer towards palm oil cannot be called unambiguous. Zainudin Jalil, head of the Malaysian Trade Mission to Russia, believes that this is due to the extremely low awareness of the Russian population about the quality of palm oil products and the technologies used in production.

Even the Russian Ministry of Agriculture had to speak out on this topic. First Deputy Minister of Agriculture of Russia Dzhambulat Khatuov within the framework of the International Oil and Fat Conference “Markets of Oilseeds and Their Processed Products - 2017: Records and Prospects”, he called for stopping the discreditable information campaign against vegetable oils and fats, which has unfolded in the Russian media in recent years.

“As for the import of palm oil... and in general the production of products from vegetable oils, today everything is transparent and ideal with Russian producers. There is no need to inflame passions. It is necessary to close the issue of discrediting products based on vegetable oils once and for all,” he noted.

However, discussions and populist initiatives regarding one or another ban on the use of palm oil in Russia continue to appear on a regular basis.

Call for restrictions: how the introduction of quotas for the tropics will change the market

Not long ago, the question once again arose about the possibility of introducing palm oil quotas in the EAEU. According to Deputy Head of the Ministry of Agriculture Evgeniy Nepoklonov, an increase in its supplies seriously complicates the work of the dairy industry and makes “uncompetitive products from bona fide producers.”

However, experts interviewed by the site indicate that such an initiative could lead to the opposite situation.

Ekaterina Nesterova, executive director of the Association of Producers and Consumers of Oil and Fat Products, believes that quotas in the tropics will only aggravate the problem of the production and sale of counterfeit products. “The problem of combating counterfeiting cannot be solved by introducing unreasonable requirements for bona fide manufacturers. The social consequences of all this are not difficult to imagine - low-income consumers will generally be deprived of the opportunity to buy both dairy products and products that perform their function,” warns Nesterova.

Obviously something else too. The establishment of a quota for tropical oils will entail an increase in the cost of Russian specialized fats and margarines and finished products based on them. As a result, this will lead to a decrease in consumer demand, on the one hand, and will make domestic products less competitive in relation to imported analogues, on the other.

“Why do we currently have low imports of finished oil and fat products? We practically do not buy margarines or fats now. Palm oil allows us to create competitive and safe food products. Selective introduction of quotas on tropical raw materials, but not on finished fats and margarines from the same palm oil, will flood the market with imported products,” notes Nesterova.

In a letter that the Oil and Fat Union of Russia sent to the director of the department of food and processing industry of the ministry, Evgeny Akhpashev, it is noted that limiting the supply of palm oil to Russia is inappropriate and harmful not only for the fat and oil products market, but also for the dairy market. “Dairy products are half made up of milk and its derivatives - this is about 3 million tons in current consumption. If the production of milk-containing products decreases, then the demand for raw milk, and, consequently, prices for it will fall,” the authors of the letter indicate.

Tropic quotas could affect not only the dairy industry, but also the rapidly developing Russian confectionery industry, which, according to Elizaveta Nikitina, executive director of the Confectionery Market Research Center, consumes almost a third of the volume of imported palm oil suitable for use in food products. “The Russian confectionery industry is one of the most dynamically developing food markets in the country. Exports of Russian sweets are growing at a double-digit rate—in the first quarter of 2018, sales growth was almost +16% (compared to the same period in 2017). And last year, $980 million worth of confectionery products were sold for export. This is perhaps the only type of prepared food that Russia exports in such volumes,” notes Nikitina.

The general director of the Lyubimy Krai confectionery factory, Dmitry Baykov, believes that if using palm oil is unprofitable due to the excise tax, manufacturers will switch to margarine from sunflower oil, which is more harmful and can affect the rise in prices for finished products.

The idea of quotas for the supply of tropical oils is not supported by Alexey Udovenko, regional representative of the Malaysian Palm Council of Palm Oil Producers in Moscow, who called this initiative “a shot in the foot.” “At the beginning of the year, at the state level, they decided to limit trans fats, and in the middle of the year they began to discuss quotas for the supply of the only raw materials that can replace these trans fats,” Udovenko noted.

The expert believes that since quotas are proposed to be set at 600 thousand tons, their introduction will lead to a shortage of tropical raw materials at the level of 300 thousand tons. A deficit of 30% will affect the ability to produce domestic products that would compete in quality and price with imported ones.

According to Udovenko, it is necessary to fight not against raw materials for the production of products, but to significantly increase the level of responsibility for counterfeiting for those who, using tropical oils as raw materials, produce counterfeit products that do not comply with the standards of the Technical Regulations.

Today, there are many different organizations in Russia (Rosselkhoznadzor, Rospotrebnadzor, the non-profit organization Roskachestvo), the main task of which is to monitor the quality of finished products, so the quota measure, according to the expert community, is inappropriate.

Who is for quotas: Belarus will “help us”

In general, the story with the quota initiative is reminiscent of the situation in 2016 with the proposal to introduce an excise tax on palm oil, if not for one “but”. Then the president had to put an end to this issue. During a direct line with Vladimir Putin, one of the richest deputies of the Voronezh region (income for 2017 was 263 million rubles), introducing himself as an ordinary farmer, complained to the president that natural milk cannot compete with palm oil, since the latter is several times cheaper, and proposed a ban on palm oil. The President had to remind that palm oil is not so harmful, and the introduction of an excise tax on it is fraught with an increase in food prices. At this point the topic of excise tax was closed.

The story of quotas is only gaining momentum, and it is being initiated not by Russia, but by the fraternal republic of Belarus. After all, it was Alexey Bogdanov, head of the main department of foreign economic activity of the Ministry of Agriculture and Food of the Republic of Belarus, who proposed that Russia initiate the introduction of quotas on the territory of the EAEU countries. “For my part, I appeal to my Russian colleagues with a proposal to move from words to deeds and initiate before the Eurasian Economic Commission the issue of limiting the import and circulation of palm oil,” Bogdanov said during the Dairy Olympics. According to the Minsk official, the import of significant volumes of palm oil puts strong pressure on the dairy market of the Union countries.

At the same time, one of the sources in the Government notes that in this issue, obviously, we are talking about lobbying for an increase in imports of Belarusian products in Russia. As Alexey Bogdanov noted, now Belarusian producers, in the event of the closure of the Russian market, calmly and systematically work in the markets of third countries. However, Belarus is still the largest exporter of dairy and milk-containing products to the Russian Federation, which allows them to earn more than $3 billion annually on this market. Last year, the Republic’s share in the Russian market was 86%.

At the same time, prices for Belarusian products are significantly lower than Russian ones, and Belarusian imports have a strong impact on prices within the country. Therefore, according to experts, the introduction of quotas on palm oil will force out not only domestic milk-containing products from the market, but will also hit the Russian dairy industry as a whole.

In addition, one should not exclude the possibility of creating a transit zone through Belarus for imported specialized fats and margarines, as was the case with sanctioned products, when the tables of Russians were filled with “Belarusian” parmesan and pineapples.

In this regard, the most logical and effective measures to improve the situation on the Russian dairy market could be import substitution of dairy products through limiting imports and loading domestic dairy processing enterprises with domestic raw materials.

Imports of palm oil into the Russian Federation increased by 19 percent due to EU bans and low world prices, despite the critical attitude towards it from the WHO and the Ministry of Agriculture of the Russian Federation.

Palm oil imports to Russia grew by 19% last year. And this is despite the harsh policy of the Russian authorities, who are ready to soon ban its use in the food industry (from confectionery to butter), imposing increasingly stringent requirements for packaging and merchandising since 2018. At the beginning of 2019, the WHO dealt a blow to palm oil, comparing its producers with the alcohol and tobacco lobby and announcing an increase in mortality from heart disease due to increased consumption of this product. In Europe, oil began to be “banned” last year, and as a result, European importers of “palm” transferred the product, now prohibited for them, to Russian warehouses. Manufacturers in our country are unlikely to voluntarily abandon its use, primarily in the confectionery industry, since it reduces production costs by almost a third.

Imports of palm oil to Russia increased by almost 19 percent

After Rosstat reported at the end of January that in November 2018 Russia significantly increased imports of palm oil and its fractions - the increase compared to November 2017 was 84.5% - a number of media outlets sounded the alarm. But over the 11 months of last year, the volume of imports into the country changed “only” by 24.1% compared to the same period in 2017, amounting to 946 thousand tons. And according to the analytical service of Realnoe Vremya, the volume of palm oil imports for the entire 2018 exceeded 1 million tons.

These data were confirmed on February 6, 2019 by the Federal Customs Service (FCS), which presented a sample of imports of the most important goods for January - December 2018: during the year, 1,059.7 thousand tons of palm trees were supplied to Russia for the amount of $748.4 million. In terms of volume of imported goods, palm oil ranks 16th, second only to apples (1.1 million tons), bananas (1.5 million tons), citrus fruits (1.6 million tons) and soybeans (2.2 million tons) among food products. million tons). Thus, in 2018, palm oil imports actually increased significantly, but not “almost twice”, but by 18.8%. Moreover, since 2015 it has grown by approximately 6-7% per year.

Main countries exporting palm oil to the Russian Federation in 2018

| A country | Cost, $ | Weight, kg |

| INDONESIA | 601.287.747,5 | 891.644.264,6 |

| MALAYSIA | 67.289.042,7 | 86.738.477,1 |

| NETHERLANDS | 42.923.791,0 | 48.479.308,0 |

| SWEDEN | 14.720.877,7 | 9.774.370,0 |

| GERMANY | 11.552.395,1 | 15.324.772,8 |

| ITALY | 7.345.238,1 | 4.474.155,6 |

| UKRAINE | 1.295.399,8 | 1.518.003,5 |

| BELGIUM | 781.994,6 | 534.290,0 |

| SWITZERLAND | 768.673,9 | 958.420,0 |

| SINGAPORE | 349.469,3 | 221.145,0 |

| AUSTRIA | 42.996,5 | 33.840,0 |

| INDIA | 34.822,5 | 34.000,0 |

| NIGERIA | 8.890,9 | 3.557,6 |

| FRANCE | 5.424,0 | 300,0 |

| Türkiye | 4.140,0 | 2.162,2 |

| JAPAN | 1.734,7 | 2.560,0 |

| BELARUS | 1.531,2 | 5.902,0 |

| SYRIAN ARAB REPUBLIC | 771,2 | 386,5 |

| Total | 748.414.940,6 | 1.059.749.914,9 |

The Ministry of Agriculture is ready to ban the use of palm oil

A noticeable increase occurred already in the first half of 2018, when 20% more palm oil was imported - 550 thousand tons (second place in terms of import volume). These data then caused alarm among the authorities: several months before their publication, the Ministry of Agriculture of the Russian Federation proposed banning the use of vegetable fats in the production of all dairy products, while one of the most used fats in its production is palm oil.

From mid-2018, dairy products must be labeled as containing palm oil. However, some manufacturers can bypass the requirements, since mentioning palm oil is voluntary. According to amendments to the technical regulations on the safety of dairy products, manufacturers are required to indicate on the packaging only information about replacing milk fat with vegetable fat.

From mid-2019, however, the requirements will become more stringent: natural dairy products and products using vegetable fats will have to be placed on different shelves in the store.

WHO compared palm oil producers with the alcohol and tobacco lobby

Some experts believe that the increase in imports of palm oil is caused by restrictions on the content of trans fats in food products - a standard recommended by WHO in 2018 came into force in January 2019, including in the European Union and the United States: trans fats are recognized as harmful to health, but earlier used in the production of butter, significantly reducing the cost of it for industrial baking.

Palm oil is three times cheaper than milk fat. According to the Fat and Oil Union of the Russian Federation, 30% of this raw material in Russia is used in the production of flour and sugar products, 15% of palm oil is used for the production of bakery products, only 13% for milk-containing products and 3% for consumer margarines. In other words, a consumer is more likely to buy a confectionery product in the production of which palm oil was used at some stage, rather than pseudo-butter itself, which costs 30-70% less (by this criterion, buyers, in fact, have long learned to distinguish the original from the fake) .

It has been officially stated that consumption of palm oil leads to obesity and the development of chronic diseases on a global scale, and its production causes irreparable damage to the environment. Photo by African Hope (wikimedia.org)

This is why a report from the World Health Organization published in early 2019 is worth keeping in mind when shopping: for the first time, it was officially stated that eating palm oil leads to obesity and the development of chronic diseases on a global scale, and its production causes irreparable damage to the environment. The WHO directly compared the industry for the production and sale of palm oil with tobacco and alcohol products (including the attempts of the “palm lobbyists” to prove the harmlessness of the product). WHO doctors point to a connection between increased consumption of palm oil in 23 countries and an increase in the mortality rate from coronary heart disease.

The four-fold increase in the production and consumption of palm oil over the 12 years since 2003 is explained by the connection of the palm industry with manufacturers of finished products and semi-finished products, whose lobbyists defend the indication of the alternative name “vegetable fats” in the ingredients. Now the palm oil market is estimated at $60 billion a year, 85% of it comes from two countries - Malaysia and Indonesia.

How European palm importers transferred prohibited goods to Russia

Indeed, according to detailed data from the Federal Customs Service, over the 11 months of 2018, Indonesia imported 791.7 thousand tons of palm oil to Russia, Malaysia added another 83.4 thousand tons to this treasury. Taking into account the 946 thousand tons of oil imported from January to November 2018, it turns out that the bulk of imports - 92% - come from these two countries. In much smaller volumes, this raw material is supplied from the Netherlands (43.4 thousand tons), Germany (11.5 thousand tons) and even Ukraine (1.5 thousand tons).

Note that while in Malaysia palm oil is one of the cheapest ($0.003 per kg) and can probably be used only for technical purposes, then in Indonesia its cost last year was $0.4 per kg or $404.8 per a ton Let us also add that European countries in the table of the Federal Customs Service are most likely presented as re-exporting countries: in fact, for example, in the import line “Netherlands” there is the same palm oil of Malaysian origin, since it is delivered from Asia, including to Dutch ports, and in particular to Rotterdam, spreading from there throughout Europe.

Taking into account the European ban on the use of palm oil in food production (see below), it turns out that all the “harmful raw materials” previously supplied to European countries in 2018 ended up in the warehouses of Russian producers.

European countries have decided to ban the use of palm oil for the production of biofuels. Photo mirsmazok.ru

Indonesia has increased duties on “palm gold” significantly and is increasing its production

It is precisely in the low cost, as well as in the low market prices for palm oil, that lies the explanation for the fact that with an increase in imports by 18.5%, the cost of this raw material imported to the Russian Federation increased only by 6.6% - to $748.4 million. In 2017, the growth of imports in price terms was 8.5% (up to $702 million), in 2016 - only 0.8% (up to $647 million). Obviously, this will once again push manufacturers to use inexpensive raw materials.

The reasons for the high cost of palm oil in Indonesia relative to Malaysia are that the Jakarta authorities back in 2017, taking advantage of the 25% increase in prices for palm oil in the world (this raw material in 2016 showed better dynamics on world exchanges than popular goods, including including gold and silver), increased the duties that local producers must pay when selling palm oil abroad sixfold: from $3 to $18 per ton. And duties on unprocessed palm kernel oil were increased 21 times - from 1 to 21 dollars. Malaysia then raised duties by only 0.5%. At the same time, Indonesia decided to increase palm oil production to 40 million tons by 2020.

Why did palm oil prices begin to fall in 2018?

However, the market changed dramatically in 2018. Already at the beginning of the year, palm oil quotations fell by 1.5%, to $636.82 per ton. Analysts then noted that pressure on prices was exerted by the plans of the European Parliament to reduce imports of the product into the European Union in order to prevent deforestation of tropical forests.

As a result, in the same January 2018, European countries decided to ban the use of palm oil for the production of biofuels, and already in March 2018, food quality requirements came into force in the European Union, which prohibit the use of harmful vegetable oils. Palm trees were also included among them.

However, in reality, the decline in prices was rather influenced by the increase in palm oil production to record levels in Indonesia and Malaysia: by the end of 2018, it was expected that Indonesia would produce 37.8 million tons of oil, and Malaysia - 20.5 million tons. As a result, prices could fall by 7%.

In March 2018, food quality requirements came into force in the European Union, which prohibit the use of harmful vegetable oils. Palm trees were also included among them. Photo yaplakal.com

…reaching a 12-year low before starting to rise again

It turned out, however, that Indonesia exceeded its target, producing 43 million tons. Accordingly, exports also increased by 8%, to 34.7 million tons; in 2019, exports of this raw material are planned to increase by another 4-5%. What is significant is that exports to the European Union decreased by 5% - which Indonesian producers compensated for by an 18% increase in exports to China: and the decrease in exports to the EU itself may formally mean nothing: as we have already noted, it will go to Russia through Dutch ports already like Dutch palm oil.

At the same time, due to falling palm oil prices in value terms, Indonesian palm oil exports fell from $22.97 billion to $20.5 billion. Vegetable oil prices in 2018 reached a 12-year low precisely because abundant supplies of palm oil. The price index for vegetable oils was 15% lower than the 2017 data. However, at the end of 2018, prices began to rise again under the influence of both growing domestic demand in the main producing countries (including Indonesia) and increasing demand in world markets. In 2019, this price increase continued, although it has not yet recovered all the losses of last year - see the palm oil futures table, according to which one ton of raw materials today costs $560.8.

Palm oil customer regions, import volume, kg

| Region | 2018 | 2017 | 2016 | 2015 |

| KRASNODAR REGION | 570.283.550,0 | 510.777.400,0 | 530.104.925,0 | 572.798.032,0 |

| SARATOV REGION | 159.803.733,0 | 101.896.614,0 | 64.775.900,0 | 67.802.190,0 |

| TULA REGION | 96.091.087,0 | 80.419.829,0 | 100.970.665,0 | 66.452.596,0 |

| NIZHNY NOVGOROD REGION | 68.712.525,0 | 57.499.016,0 | 46.216.525,0 | 49.954.361,0 |

| KALININGRAD REGION | 56.677.518,0 | 50.487.507,0 | 65.893.831,0 | 61.432.811,1 |

| SAINT PETERSBURG | 45.221.500,5 | 36.726.074,4 | 37.831.662,4 | 33.387.996,5 |

| BELGOROD REGION | 20.272.321,0 | 13.017.614,0 | 14.850.913,0 | 5.297.326,0 |

| MOSCOW | 20.266.859,7 | 22.026.178,0 | 14.979.991,0 | 14.164.619,8 |

| PSKOV REGION | 7.540.344,0 | 4.378.234,0 | 54.750,0 | |

| MOSCOW REGION | 6.650.563,7 | 63.310,0 | 281.280,0 | 4.511.534,0 |

| VLADIMIR REGION | 4.250.150,0 | 3.731.580,0 | 3.724.370,0 | 3.743.380,0 |

| CHELYABINSK REGION | 1.311.000,0 | 540.000,0 | 40.000,0 | |

| RYAZAN OBLAST | 664.420,0 | 662.780,0 | 641.220,0 | 112.000,0 |

| SVERDLOVSK REGION | 523.310,0 | 4.067.050,0 | 3.107.500,0 | 7.109.400,0 |

| THE REPUBLIC OF DAGESTAN | 515.200,0 | 196.240,0 | ||

| NOVOSIBIRSK REGION | 396.000,0 | 108.557,6 | ||

| SAMARA REGION | 277.040,0 | 315.660,0 | 315.880,0 | 469.960,0 |

| VOLGOGRAD REGION | 132.180,0 | 22.420,0 | 264.020,0 | 110.640,0 |

| 81.000,0 | 474.550,0 | |||

| PRIMORSKY KRAI | 70.560,0 | |||

| KURSK REGION | 4.800,0 | 5.350,0 | ||

| SAKHALIN REGION | 2.560,0 | 2.736,0 | 1.881,0 | |

| SMOLENSK REGION | 902,0 | 735,0 | ||

| VORONEZH REGION | 491,0 | 334,6 | 250,4 | |

| KALUGA REGION | 300,0 | 21.000,0 | 2.160,0 | 4.300,0 |

| BRYANSK REGION | 3.729.880,0 | 726.200,0 | 720.000,0 | |

| LENINGRAD REGION | 53.280,0 | |||

| NOVGOROD REGION | 139.050,0 | 79.000,0 | ||

| OMSK REGION | 528.000,0 | |||

| ROSTOV REGION | 412.035,0 | 194.460,0 | 191.250,0 | |

| Total | 1.059.749.914,9 | 891.636.134,6 | 885.117.433,8 | 888.869.226,4 |

Tatarstan producers purchased palm oil for the first time in 3 years

Of course, the largest volume of palm oil in the Russian Federation comes to regions with developed agricultural and food industries: half of the imports go to the Krasnodar Territory (570 thousand tons), 159.8 thousand tons in 2018 were purchased by Saratov producers, 96.1 thousand - Tula. Of the regions of the Volga Federal District, only the Samara region (277 thousand tons) and, interestingly, Tatarstan purchase palm oil. At the same time, Tatarstan producers purchased palm oil for the first time since 2015 (then they supplied 474.5 tons to the region), however, last year’s figure was small: only 81 tons of palm oil worth $84.4 thousand were supplied.

In value terms, the largest volumes similarly went to the Krasnodar Territory ($362.8 million), the Saratov Region ($121.1 million) and the Tula Region ($67.6 million).

Palm oil customer regions, import volume, $

| Region | 2018 | 2017 | 2016 | 2015 |

| KRASNODAR REGION | 362.839.428,1 | 370.066.211,6 | 357.591.565,8 | 383.015.565,6 |

| SARATOV REGION | 121.132.246,3 | 82.763.035,5 | 50.613.139,6 | 52.912.999,5 |

| TULA REGION | 67.635.064,5 | 63.197.990,5 | 71.621.661,4 | 45.685.868,9 |

| NIZHNY NOVGOROD REGION | 52.638.865,0 | 49.160.344,1 | 38.656.728,0 | 38.387.549,5 |

| KALININGRAD REGION | 45.281.351,1 | 44.344.316,5 | 53.038.537,8 | 48.915.782,0 |

| SAINT PETERSBURG | 35.079.818,5 | 33.621.587,3 | 33.078.944,9 | 32.691.438,3 |

| MOSCOW | 26.863.611,3 | 28.390.481,8 | 18.913.529,6 | 17.724.908,7 |

| BELGOROD REGION | 15.082.701,3 | 10.427.023,2 | 11.516.943,0 | 3.900.707,4 |

| VLADIMIR REGION | 7.012.083,0 | 6.927.357,3 | 6.544.818,5 | 6.507.765,5 |

| PSKOV REGION | 5.685.181,8 | 3.359.439,9 | 55.959,4 | |

| MOSCOW REGION | 5.146.892,6 | 54.443,6 | 207.477,4 | 3.923.486,2 |

| CHELYABINSK REGION | 1.272.681,7 | 477.437,3 | 30.813,4 | |

| RYAZAN OBLAST | 918.062,8 | 1.030.822,9 | 1.274.877,1 | 259.880,0 |

| SAMARA REGION | 418.227,0 | 428.193,2 | 418.630,4 | 746.946,7 |

| THE REPUBLIC OF DAGESTAN | 405.440,0 | 163.182,6 | ||

| NOVOSIBIRSK REGION | 356.574,8 | 103.654,9 | ||

| SVERDLOVSK REGION | 348.538,5 | 3.349.480,8 | 2.415.760,3 | 5.834.907,5 |

| VOLGOGRAD REGION | 135.727,9 | 26.072,0 | 271.783,6 | 110.602,5 |

| REPUBLIC OF TATARSTAN (TATARSTAN) | 84.434,4 | 415.051,1 | ||

| PRIMORSKY KRAI | 63.712,3 |

We bring to your attention another vegetable oil market research from AB-Center: “ World palm oil market in 2001-2013, January-September 2014.” The study examines indicators, including palm oil production by country, and the dynamics of world prices for palm oil.

Particular attention in the study is paid to foreign trade in palm oil. Volume data displayed export and import of palm oil by country TOP-20 largest exporters and importers in dynamics 2001-2013.

Important! Vegetable oil market research is published at the following link: Database. Vegetable oils (oilseeds and their products)

World palm oil production

Palm oil production in the world in 2012, according to the Food and Agriculture Organization of the United Nations (FAO), amounted to 53.2 million tons, which is 2 times more than in 2002. Over the past 20 years, palm oil production in the world has increased 4.1 times, over 30 years - 8.6 times, over 50 years - 36.1 times.

Main share palm oil production worldwide accounts for Indonesia, Malaysia and Thailand. In 2012, these three countries provided 89.1% of the world production of this type of vegetable oil. In addition to these countries, the TOP 10 leading palm oil producers include Nigeria, Colombia, Papua New Guinea, Cote d'Ivoire, Honduras, Ecuador and Brazil.

The TOP 10 key producing countries provide 96% of global palm oil consumption. Total palm oil is produced in 43 countries peace.

Global palm oil trade

Over the past 5 years, the global palm oil trade on average varies from 35 to 40 million tons. For comparison, in the early 2000s the figures were at the level of 15-20 million tons.

World palm oil exports

Indonesia is currently a leading country in both production and palm oil exports. Volume palm oil production in Indonesia in 2012 amounted to 26.9 million tons, which is 2.8 times higher than in 2002.

Export of palm oil from Indonesia in 2012 amounted to 18,845.0 thousand tons, and in 2013 it reached 20,578.0 thousand tons. In 2013, Indonesia accounted for 49.9% of the world's palm oil supply.

Basic consumers of Indonesian palm oil- India, China, the Netherlands (which actively re-export it), Pakistan, Italy, Singapore, Egypt, Bangladesh, Spain and Ukraine.

In 2013, Russia was twelfth in terms of volume palm oil market from Indonesia(about 3.7% of oil exported from Indonesia was sent to the Russian Federation).

Over 10 years, total palm oil exports from Indonesia increased 3.2 times. In the first quarter of 2014, there was no increase in palm oil exports from Indonesia compared to the same period in 2012. Volumes of supplies abroad decreased by 1.9% to 5,391.0 thousand tons.

Until 2005 inclusive, Malaysia occupied the leading position in the production and export of palm oil in the world. The country currently ranks second in these indicators after Indonesia. In 2012, Malaysia produced 18,785 thousand tons of palm oil, exported 15,609 thousand tons, in 2013 exports amounted to 15,251 thousand tons. Malaysia provided 37.0% of global palm oil exports in 2013.

In the first half of 2014, Malaysia supplied 6,921.7 thousand tons of palm oil to world markets, which is 5.4% less than the same period last year. Also in the TOP 10 largest exporters of palm oil at the end of 2013 are the Netherlands (re-exports - volume 1,552.6 thousand tons), Papua New Guinea (562.1 thousand tons), Thailand (549.2 thousand tons) , Guatemala (361.9 thousand tons), Germany (347.2 thousand tons), Honduras (289.9 thousand tons), Ecuador (213.3 thousand tons) and Colombia (185.0 thousand tons) .

World palm oil imports

In the TOP 10 largest palm oil importing countries in 2013 includes India (8,389.7 thousand tons), China (5,979.6 thousand tons), the Netherlands (2,925.6 thousand tons - this country exports a significant part of the imported volume), Pakistan (2 248.6 thousand tons), Germany (1,467.4 thousand tons), Italy (1,392.2 thousand tons), USA (1,373.2 thousand tons), Spain (902.8 thousand tons) , Bangladesh (883.7 thousand tons) and Russia (770.6 thousand tons).

The TOP 10 key importing countries account for 64.5% of world imports. Russia's share in total world imports in 2013 was 1.9%.

World prices for palm oil

Average palm oil prices(CIF, Northwestern Europe) in August 2014 amounted to 762 USD/t. Compared to July 2014, they decreased by 9.4%, over the year by 8.1%, over two years - by 23.6%, over three years - by 29.6%. Palm oil prices dropped to the levels observed in 2009.

The weakening of world prices in recent years has been observed not only for palm oil, but also for other types of vegetable oils.

For example, prices for sunflower oil (FOB, ports of North-Western Europe) in August 2014 amounted to 828 USD/t. Over the month they decreased by 6.7%, over the year - by 13.7%, over two years - by 36.3%, over three years prices dropped by 37.6%.

Soybean oil prices (EXW - ex-factory price, EU) in August 2014 amounted to 857 USD/t. Over the month, the price decline was 3.5%, over the year - 14.2%, over two years prices decreased by 31.5%, over three years they dropped by 35.6%.

Palm oil accounts for 38% of the world's vegetable oil consumption. It is one of the most widespread and traded products in the herbal ingredients segment, according to WWF. In Russia, palm oil often becomes the subject of negative headlines, with government inspection bodies and various organizations posing as them trying to find palm oil in milk and cottage cheese. Journalists conduct investigations and publish shocking facts that dairy products with vegetable fats provoke terrible diseases, although there is no scientific evidence of these frightening facts. In the minds of consumers, milk and palm oil are already conflated, although plant-based ingredients can be found in almost every item around us, from lip balm to cookies. Milknews looked into the issue of using palm oil in more detail.

Where does palm oil come from?

Every year, the main palm oil producing countries - Indonesia and Malaysia - produce 63 million tons of palm and palm kernel oil, most of which, about 42 million tons, is exported to 70 countries around the world. Production of the ingredient has doubled over the past 10 years and will increase by the same amount until 2020, WWF predicts. 42% of the oil produced is distributed between three countries: India, Indonesia and China. About 10% of the received volume goes to Europe.

Palm plantations, Indonesia, WWF

About 20 million hectares of land are occupied by plantations; each acre produces 3.3 tons of oil per year, which is more than the yield of any other vegetable oil. The manufacturing industry employs more than 5 million people, according to WWF. It is an industry of national importance to the economies of Indonesia and Malaysia. Palm oil accounts for 11% of Malaysia's exports.

Major palm oil producers

Palm oil is widely used in various industries, this is due to its quality characteristics: at room temperature it remains relatively hard, but it is easy to heat treat and melt. It is cheaper than any of the available animal fats and is widely available in the market, unlike other plant-based alternatives.

Where is it going?

According to WWF, 68% of palm oil is used for the needs of the food industry, 27% for the production of household goods and cosmetics, and 5% for biofuel. According to the Palm Oil Investigation Foundation, 50% of the products in the consumer basket contain palm oil. The oil is suitable not only for food production, it is fatty, therefore it is used for the production of cosmetics with the appropriate texture, for example, lip balms and shampoos. It moisturizes and softens, so it is ideal for creams. At the same time, it does not need to be further processed in order to achieve the desired structure, like, for example, rapeseed or sunflower oil. Palm oil is found in household cleaning products, soaps, candles, biofuels for cars, ships and airplanes, and food for pets and farm animals.

If you look at the labels of many of the products listed, there is no direct mention of palm oil. This is due to an active campaign against the ingredient in the media. On the foundation's website you can find up to 200 alternative names for palm oil.

All well-known international companies buy palm oil. The top ten leaders in palm tree purchases look like this:

McDonald's - 0.10 million MT

Rechitt Benchiser - 0.10 million MT

CSM - 0.11 million MT

Ferrero - 0.15 million MT

Mondelez - 0.29 million MT

Nestle - 0.41 million MT

Pepsico - 0.46 million MT

P&G - 0.53 million MT

Ruchi - 1.43 million MT

Unilever - 1.52 million MT

Palm oil has a fairly powerful anti-lobby, these are public foundations and environmental movements that argue that the production of the product is associated with the use of illegal labor and the destruction of local ecosystems. Community foundations WWF and Greenpeace are working with major palm oil importers to make production transparent. Some companies, such as Unilever and Nestle, have made public statements that they buy traceable palm oil. France, Germany, Great Britain and Italy promised that by 2020 the volume of “transparent” oil purchased by local processors would reach 100%.

What about in Russia?

In Russia, the average annual import of palm oil is 800-900 thousand tons. About 80% are Indonesian imports, the rest is imported from Malaysia and the Netherlands. According to the Oil and Fat Union of Russia, in 2016, imports of palm oil and its fractions amounted to 862 thousand tons, in 2017 - 879 thousand tons, exactly the same as in 2015. “The difference is small, but it rather indicates a restoration of production, primarily of confectionery products in Russia. In general, the palm oil market is stable, we do not see any prerequisites for a sharp increase or decrease in its volumes,” the press service comments on the statistical data Oil and fat union.

Executive Director of Soyuzmoloko Artem Belov also agrees with the stable dynamics of palm oil imports. According to him, one should not expect an explosive increase in palm oil supplies to Russia, since this market is quite stable and it has its own main consumer.

According to data for January-February 2018, the Russian Federation purchased 170 thousand tons of product, which is 36.7% more than last year. Artem Belov earlier said that the indicators for several months do not indicate an increase in the volume of total annual purchases. “The dynamics of the increase in imports must be assessed not by month, but in annual terms, and I think that the average figure of previous years will remain,” he said.

The Oil and Fat Union of Russia also agrees with Belov’s opinion. “As for the latest data from Rosstat on the increase in the volume of imports of palm oil and its fractions to Russia in January-February 2018 (compared to the same period in 2017), if you don’t just compare the two figures, but fully analyze the statistics, you won’t get a sensation “, the experts pointed out. Last year, according to the union, the average monthly import was 74.4 thousand tons. In January 2018, imports were below this figure, in February - slightly higher. “If we translate the numbers into production processes, in February two more ships could have called at the ports, which could have been delayed in January, in other words, these are natural monthly fluctuations, and on a production scale the volumes are definitely not the right ones to declare serious changes in the market.” , - noted the press service of the Fat and Oil Union.

Imports of palm oil will not increase in 2018 as long as there are no such prerequisites. Domestic demand has been formed, and without any additional factors it will remain at the same level, noted the Oil and Fat Union.

Where is it used in Russia?

According to representatives of the association, almost all palm oil imported to Russia is used by the fat and oil industry; in the future, fats and margarines based on vegetable oils are in demand in the most intensive sectors of the food industry: confectionery, bakery, dairy, ice cream production, instant food products, snacks, HoReCa. “Almost half of all fats and margarines produced go into the confectionery industry; part of the crude palm oil is used in non-food industrial processing: for the production of soap, perfumes and cosmetics, and use in the paint and varnish industry,” the union noted. The share of palm oil, which is used for the production of milk-containing products, of the total volume of imports does not exceed 15%, Soyuzmoloko clarified.

Palm oil is not the most popular vegetable oil on the Russian market. Sunflower oil is the leader in the segment; last year it was produced in the amount of 4.7 million tons, of which 1.8 million tons were exported, and 2.9 million tons remained in the country for domestic needs.

According to the press service of the Fat and Oil Union of Russia, tropical oils are used mainly in the B2B market, in those sectors where a semi-solid fraction of fats is technologically required. “In the production of margarines and specialty fats, tropical oils make it possible to comply with the requirements for limiting the content of trans fats - up to 2%; sunflower oil does not always give such results,” the union said.

The union noted that palm oil is an important component in the production of fat and oil products in all countries of the world, including in our country. At the same time, according to representatives of the union, Russia will never be a leader in the consumption of palm oil, but we will not be able to replace it with other oils. There are simply no analogues to this type of vegetable oil.