Project cost management. Cost-based project cost management Estimation of project monetary costs

Annotation: Cost estimation of the project. Classification of cost estimates. Types of assessments: top-down, bottom-up, parametric, analogous. Estimating the cost of operations. Supporting data for estimating transaction costs. Development of expense budgets. Basic cost plan. Cost management. Methods for measuring project performance. Earned value method. Analysis of indicators. Forecasting project conditions

A project is considered successful if it is completed on time, within budget and in accordance with the customer's expectations. Cost management is to ensure compliance with the triple constraint on project management - cost, timing and content [10]. Cost management project includes the processes performed during planning, budgeting, and cost control to ensure that the project is completed within the approved budget. To processes cost management relate:

valuation- determination of the approximate cost of resources required to carry out project operations;

development of an expense budget- summation cost estimates individual operations or work packages in order to form basic plan at cost ;

cost management- influencing factors causing cost deviations and managing changes in the project budget.

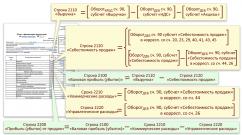

The interaction of processes is shown in Fig. 6.1.

Rice. 6.1.

With absence cost management the project usually gets out of control and its costs increase. Let's take a closer look at each of the processes.

Valuation

Valuation is the process of establishing value project resources, based on certain facts and assumptions. To determine the valuation, first of all it is necessary to define the operations (batch of operations), duration of operations and required resources. The assessment process and its outcome largely depend on the accuracy of the content description, the quality of the available information, and the stage of the project. The valuation process is influenced by: the time allocated to carry out the operation being valued, the experience of the manager, assessment tools, and the specified accuracy. Cost estimate of the project begins at the pre-project stage (before the contract is concluded) and is carried out throughout the entire duration of the project. The following are distinguished: cost estimates [ 12 ] :

- order of magnitude estimate;

- conceptual assessment;

- preliminary estimate;

- final assessment;

- control assessment.

At the pre-design stage, only the order of magnitude of the cost can initially be determined. The accuracy of estimating the order of magnitude of the project cost can range from (-50%) to (+100%). The accuracy of the conceptual assessment is in the range (-30%) - (+50%). The accuracy of the preliminary project assessment ranges from (-20%) to (+30%). At the final evaluation stage, the accuracy ranges from (-15%) to (+20%). The benchmark score has an accuracy of -10% to +15%. Thus, each subsequent stage project life cycle has a more accurate cost estimate (Fig. 6.2).

Rice. 6.2.

Valuation usually expressed in units of currency (dollars, rubles, etc.) to facilitate comparison of projects and transactions within a project.

The cost of scheduled activities is estimated for all resources involved in the project. Resources include, but are not limited to, personnel, equipment, telephone service, Internet, leased premises, and special items such as inflation or contingency expenses.

Input information for the cost estimation process

Enterprise environmental factors. External environmental factors include market conditions, commercial databases and price lists. Market conditions are the market for information systems, their competitive functionality, cost, implementation and maintenance services. Commercial databases and price lists contain information about the qualifications and cost of labor resources, the cost of implementing information systems.

Organizational Process Assets- formal and informal rules, procedures and guidelines for cost estimation, cost estimation templates, information on the cost of previously completed projects.

Project Scope Description contains important information about the requirements, constraints and assumptions of the project that must be taken into account when estimating costs.

Hierarchical structure of work defines the relationships between all project elements and project deliverables.

ISR Dictionary contains a detailed description of the work for each element of the WBS.

Project Management Plan- a general plan of activities for the execution, monitoring and control of the project, containing instructions and guidelines for drawing up the plan cost management and monitoring its implementation, as well as additional plans:

- schedule management plan ;

- project staffing management plan contains the characteristics of staffing and tariff rates for project personnel and are necessary elements when preparing a cost estimate of the schedule;

- risk register- when determining the valuation, information regarding risk responses is taken into account. Risks can lead to negative or favorable consequences, so they affect both planned activities and the cost of the project. If a negative risk occurs, the cost of the project may increase.

Tools and Methods Used for Cost Estimation

Depending on the stage of the project, the required degree of accuracy, possible costs and labor costs, different types are used cost estimates.

Top-down evaluation used in the early stages when there is insufficient information about the project. Only one is produced cost estimate of the entire project at the highest level. This assessment does not require much effort, but has low accuracy.

Valuation by analogues represents a top-down type of evaluation. In this case it is used actual cost previously completed projects to evaluate the current project. If you have a very similar project, the estimate can be quite accurate. This type of assessment is used at any stage project life cycle. Estimation by analogues does not require much effort with guaranteed accuracy, but it is not always possible to find and identify similar projects. The accuracy of assessment by analogy ranges from -30% to +50%. The cost of preparing such an estimate is 0.04%-0.15% of the total project cost.

Bottom-up evaluation is used at the stage of preparing the basic project plan and forming a control assessment. The process begins with assessing the details of the project and then summing up the details into resulting levels. The degree of accuracy of the estimate depends on the level of detail of the WBS. Bottom-up estimating provides accuracy of +0.15/-10% to +5%/-5%, but is expensive (0.45% to 2% of total project cost) and time-consuming.

Parametric estimation used in the early stages of a project. The process of parametric evaluation consists of determining the parameters of the project being evaluated, which change in proportion to the cost of the project. Based on one or more parameters, a mathematical model is created. For example, a software development parameter might be the cost of developing a line of code. For cost estimates survey, the number of business processes to be automated can be selected. The most common parameter cost estimates IT projects is the amount of required working time to complete operations (package of operations). If there is a close relationship between cost and design parameters and if parameters can be accurately measured, the accuracy of calculations can be increased. The advantage of this method: for

Project cost is determined by the totality of the costs of the project resources, the costs and time of completion of the project work.

Cost management project includes the processes necessary to ensure and ensure that the project will be completed within the approved budget.

Management system objectives cost (cost) is the development of policies, procedures and methods that allow planning and timely control of costs.

Project cost (cost) management includes the following processes:

· project cost assessment;

· project budgeting, i.e. setting cost targets for project implementation;

· cost control of the project, constant assessment of actual costs, comparison with those previously planned in the budget and development of corrective and preventive measures.

The main document with which the project cost is managed is is the budget .

It's called a budget a directive document, which is a register of planned expenses and income with distribution by item for the corresponding period of time. The budget is a document that defines the resource limitations of the project, therefore, when managing cost, its cost component comes to the fore, which is usually called the project estimate.

Project estimate - a document containing the justification and calculation of the cost of a project (contract), usually based on the scope of the project, the required resources and prices.

One of the ways to manage project costs , is use of cost account structure (charts of accounts ). To perform work, resources are required, which can be expressed both in the labor of workers, materials, equipment, and in the form of cash cost items, when there is no need or opportunity to know what specific resources constitute them. At the stage of budgeting for work, all resources involved in its implementation are written off to various cost items.

Since the structure of cost accounts is developed according to the principles of decomposition, by aggregating information from the accounts of the lower levels of the structure, it is possible to obtain cost data at the required level of detail, up to the upper level, characterizing the project budget.

20. Project budgeting.

Under budgeting is understood determination of the cost values of the work performed within the project and the project as a whole, the process of forming a project budget containing an established (approved) distribution of costs by type of work, cost items, by time of work, by cost centers or by another structure. The budget structure is determined by the chart of accounts for cost accounting of a specific project. The budget can be formed both within the framework of a traditional accounting chart of accounts, and using a specially developed chart of accounts for management accounting. Practice shows that in most cases, an accounting chart of accounts is not enough. Each specific project requires taking into account certain specifics in terms of cost management, so each project must have its own unique chart of accounts, but which is based on established management accounting indicators.

Budgeting is cost planning, i.e. determining the cost plan: when, how much and for what money will be paid.

The budget can be drawn up as:

1) cost schedules,

2) cost distribution matrices,

3) cost bar charts,

4) bar charts of cumulative (cumulative) costs

5) linear diagrams of cumulative costs distributed over time

6) pie charts of cost structure

The form in which budgets are presented depends on:

· document consumer;

· the purpose of creating the document;

· established standards;

· information of interest.

Depending on the stage of the project life cycle, budgets can be:

· preliminary (evaluative);

· approved (official);

· current (correctable);

· factual.

After feasibility studies, preliminary budgets are drawn up, which are more evaluative than prescriptive in nature. Such budgets are negotiated with all stakeholders and ultimately approved by the project manager or other decision maker. Once the budget has acquired official status, it becomes the standard against which actual results are compared.

During the implementation of the project, deviations from previously planned indicators arise, which should be reflected in a timely manner in current budgets. And upon completion of all work, an actual budget is created as a final document, which reflects real numbers.

Estimates that represent expenditure budgets deserve special attention. Estimate documentation is an important component of budget documentation in large investment projects.

Ph.D. Meshcheryakova L. I., Starovoytova O. M.

Tyumen State Oil and Gas University,

Russian Federation

Evaluation as the main management process

cost of the project during the construction and modernization of oil and gas industry facilities

Oil and gas construction, like all other sectors of the economy, operates in market conditions, which have a number of features. Many construction projects, as well as modernization projects, are large-scale, which requires a large concentration of not only capital, but also production. The construction of main pipelines and large oil and gas complexes is often only within the capabilities of large construction associations. The specificity of this construction products market is that it, like the other source market, is associated with large volumes of lending, which is caused by the length of construction periods and the need for working capital. This requires careful organization of the entire spectrum of credit relations, from choosing a bank to signing an agreement and organizing its implementation.

During the implementation of such large projects as the construction of the Eastern Siberia - Pacific Ocean oil pipeline, BTS-2, Purpe-Samotlor, external borrowings were used. In particular, while the question of the financing scheme for the Purpe-Samotlor project was being considered by the line ministries, AK Transneft OJSC began its implementation using saved funds, which will still not be enough to construct the entire oil pipeline. However, Transneft does not plan to continue to resolve such issues through external borrowing, since this is a serious burden on loans. The issue of financing the route must be resolved either by increasing the authorized capital or by allocating targeted loans by the Central Bank of the Russian Federation.

A distinctive feature of project financing is that not only commercial but also investment banks, investment funds and companies, pension funds and other institutional investors, leasing companies and other financial, credit and investment companies can act as financial participants in the implementation of investment projects. institutions, i.e. the entire range of financial and investment institutions, which is especially important for the accumulation of large financial resources necessary for the implementation of international oil and gas projects and the distribution of risks between participants. Thus, the availability of investments and sources of financing is the key to the implementation of large oil and gas projects, including those on a national scale. However, the allocation of financial resources in a certain amount must be justified and confirmed by the project budget. Monitoring the implementation of the project within the approved budget is the main goal of project cost management.

Cost management is carried out throughout the entire project life cycle, with management processes implemented differently at different stages of the project cycle. This is reflected in the modern concept of project cost management - cost management throughout the project (Fig. 1).

Rice. 1. Cost management throughout the project life cycle

Project cost management includes the following core processes necessary to ensure and ensure that the project is completed within the approved budget:

Project cost estimation;

Project budgeting, i.e. setting cost targets for project implementation;

Project cost control, constant assessment of actual costs, comparison with previously planned costs in the budget and development of corrective and preventive measures.

The cost of the project is determined by the total cost of the project resources, costs and time of completion of the project work. For construction projects, the construction cost is determined, which is the portion of the project cost that includes the funds required for capital construction. Estimating all project costs is equivalent to estimating the total cost of the project. The cost of the project during its life cycle is distributed unevenly (Fig. 2).

Rice. 2. Distribution of project costs over its life cycle

As can be seen from Fig. 2, the bulk of the cost arises during the project implementation phase. The main decisions that determine the project cost indicators are made at the pre-investment phase of the project. Therefore, the ability to manage the cost of the project is also distributed unevenly throughout its entire life cycle.

Depending on the stage of the project life cycle and the purpose of the assessment, various types and methods of assessment and cost of the project are used. To estimate the cost of a project, you need to know the cost of the resources that make up the project, the time it takes to complete the work, and the cost of this work. Thus, cost estimation begins with determining the resource and work structure of the project. These tasks are solved as part of project planning, and the cost estimation module should receive the results of this process (Table 1).

Table 1. Types of project cost estimates

|

Characteristics of the project life cycle phase (PLP) |

Type of assessment |

Purpose of assessments |

Error,% |

|

Pre-investment (initial) phase of life cycle |

|||

|

Project concept |

Preliminary (assessment of project viability/feasibility) |

Assessment of project viability/financial feasibility |

|

|

Investment justification |

Factorial (enlarged cost calculation/estimate) |

Comparison of planned costs with budget restrictions, the basis for the formation of a preliminary budget |

|

|

Investment (construction) phase of the life cycle project |

|||

|

Tenders, negotiations and contracts |

Approximate (budget and financial calculation) |

Conducting negotiations and tenders, the basis for the formation of an updated budget |

|

|

Development of working documentation |

Final (estimate documentation) |

Basis for calculations and for project cost management |

|

|

Project implementation |

Actual (based on work already completed) |

Estimation of the cost of work already performed |

|

|

Commissioning |

Actual |

||

|

Forecast |

|||

|

Operational phase of life cycle |

|||

|

Exploitation |

Actual |

||

|

Forecast |

|||

|

Completion of the project |

Actual |

Full project cost estimate |

|

Cost estimation involves determining the approximate cost of the resources required to complete the project operation, namely the cost of equipment (purchase, rental, leasing); fixtures, devices and production facilities; worker labor; consumables (stationery, etc.); materials; training; subcontracts; transportation, etc. Valuation can be carried out as “evaluation by analogues” and as “determining resource cost rates.” Valuation by analogues means that when estimating the cost of a current project, the actual cost of previous similar projects is taken as the basis. This method is often used in cost estimation when detailed information about the project is lacking (for example, in the early phases of the project). To value planned operations, it is necessary to know the cost per unit. One of the methods for obtaining information on rates is to collect information from sellers when concluding a contract for the supply of products and services. Another source of information about current prices for goods and services are industry commercial databases and published price lists of sellers.

A project cost estimate is essentially an estimate of all the costs required for the successful and complete implementation of the project. Costs can be in the form of:

Obligations (arise, for example, when ordering any goods or services in advance of their use in the project);

Budget costs (characterize the costs planned during the execution of work);

Actual costs (reflect expenses arising during the implementation of the project work, or at the time of payment of funds).

The technique for estimating project costs can consist of a number of steps. These may vary depending on the project and generally include the following:

1. Determine the resource needs of the job

2. Development of a network model

3. Development of a work breakdown structure

4. Estimation of costs in terms of work breakdown structure (WBS)

5. Discussion of the project management system with each of the functional managers

6. Development of the main direction of action

7. Estimation of costs for each element of the WBS

8. Coordination of basic costs with the highest level of management

9. Discussion with functional managers about personnel needs

10. Development of a line responsibility scheme

11. Development of detailed schedules

12. Generating a summary report on costs

13. Inclusion of cost estimation results in project documents.

Project cost management is an important element of the management system for the construction of oil and gas projects, since this component of the management system includes the processes necessary to ensure and ensure that the project is completed within the approved budget. This involves not only compliance with certain financial investments, but also taking into account the work schedule and the schedule of resource requirements. The purpose of a project cost management system is to develop policies, procedures and methods that enable planning and timely cost control. Achieving the goal seems possible by assessing the cost of the project, setting target cost indicators for the implementation of the project, as well as by monitoring the cost of the project. In this case, it is necessary to start with an assessment of the cost of the project, since cost analysis of the project as a whole is one of the most important tools for project management, as it allows you to plan and apply tools for managing the financial flows of the project, control the profitability and investment attractiveness of the project.

Essay

Research topic: “Project cost management.” The course work is presented on 49 pages, the work contains 6 figures, 18 tables, 2 appendices. List of sources used – 27.

Project, project management, project life cycle, cost, project cost management, performance indicators, project cost management system, optimization of project cost management.

Purpose of the work: to develop measures to improve cost management of a construction project. Achieving this goal made it necessary to solve the following tasks: Reveal the basic principles of project cost management. Review cost definitions and project budgeting. Reveal methods of project cost control. Analyze the main indicators of the project cost. Provide a financial and economic justification for the project. Develop a set of measures to improve project cost management. Calculate the economic results of implementing measures to improve project cost management.

Subject of research: cost management of construction projects. General scientific research methods were used in conducting the study. Special methods of investment analysis were also used.

Introduction

Organizational project management becomes especially relevant when conditions for the widespread use of project management methodology are being formed in Russia. This method is an effective management tool in real Russian conditions and at the same time a proven tool for implementing organizational projects of the required quality, on time, within the accepted budget.

A project is not only a matter of innovation and the need for large investments. The project involves numerous uncertainties, which makes calculations difficult. To this we must also add that work on the project is carried out in a team and requires special skills and abilities from all its participants.

Therefore, an enterprise should approach the planning, conduct and management of any complex project with great care. Skillful management will lead the company's endeavors to the road of success.

Project management is a methodology for organizing, planning, directing, coordinating human and material resources throughout the life cycle of a project (also called the project cycle), aimed at effectively achieving its goals by applying a system of modern methods, techniques and management technologies to achieve those defined in the project results on the composition and scope of work, cost, time, quality.

Project cost management includes the processes necessary to ensure and ensure that the project is completed within the approved budget. The main goal of project cost management is to complete the project within the approved budget.

Degree of scientific development: in modern works devoted to both investment activities and project management, issues of effective management of project costs are given significant attention.

The following authors were used in the preparation: Birman G. Gorbunov A. B. Joseph A. Endovitsky D. A. Ionova A. F., Selezneva N. N., Zhukov L. M. Zarembo Yu. G. Kirichenko T. V. , Kovalev V.V., Katasonov V.Yu. Clifford F. Gray, Eric W. Larson, Mazur I.I., Shapiro V.D. Melkumov Y. S. Michels V. A Vakhovich I. V. Sorokina E. M. etc.

Purpose of the work: to identify the theoretical basic management of project costs and develop optimization measures.

Achieving this goal made it necessary to solve the following tasks:

1. Reveal the basic principles of project cost management.

2. Review project costing and budgeting.

3. Reveal methods for controlling project costs.

4. Analyze the main indicators of the project cost.

5. Provide a financial and economic justification for the project.

6. Develop a set of measures to improve project cost management.

Object of study: investment projects in construction

Subject of research: cost management of construction projects

When conducting the study, general scientific research methods were used, as well as special methods of investment analysis.

1. Theoretical foundations of project cost management

1.1. Basic principles of project cost management

Project cost management includes the processes necessary to ensure and ensure that the project is completed within the approved budget.

In the context of this chapter, value management and cost management are practically identical concepts. The goals of a cost (cost) management system are to develop policies, procedures and methods that allow planning and timely control of costs.

I.I. Mazur, V.D. Shapiro point out that the cost of a project is determined by the totality of the costs of the project’s resources, the costs and time of completion of the project’s work.

For construction projects, the construction cost is determined, which is the portion of the project cost that includes the funds needed for capital construction. Estimating all project costs is equivalent to estimating the total cost of the project.

F. Clifford in his works indicates that managing the cost and financing of an investment project (Project Cost and Finance Management) is a section of project management that includes the processes necessary for the formation and control of the implementation of the approved project budget. Consists of resource planning, cost estimation, estimate and budget formation and cost control. It includes:

Pricing System

Influencing cost through organizing and conducting contract tenders and competitions that optimize cost indicators

Project cost calculation

Investment project assessment, investment analysis

Securing project financing

Cost management.

Within the framework of the project, there are four cost categories:

1) initial budget,

2) actual expenses,

3) forecasts for completion,

4) the actual budget of the implemented project.

Rice. 1.1. Financing an investment project throughout the Project Life Cycle

Rice. 1.2. Financing management structure throughout the Project Life Cycle

1) Planning cost and financing in the project:

Formation of the project budget;

Development of a financing plan that must correspond to the established project budget;

Development of a cost and financing management plan for the project.

2) Organization and control of project implementation at cost:

Distribution of functional duties and responsibilities in accordance with the cost and financing management plan for the project;

Implementation of a cost and financing management system for the project;

Accounting for actual costs in the project;

Budget control

Generating reports on the status of project costs and financing

3) Analysis of the status and regulation of the cost of creating a project:

Current audit of the project status in terms of cost and finances;

Determining the degree of project completion based on cost indicators (carried out on the basis of an analysis of actual costs and the estimated cost of work performed);

Analysis of deviations in the cost of work performed from the estimate and budget;

Analysis of various factors influencing positive and negative deviations;

Preparation and analysis of corrective actions;

Forecasting the status of project work execution by cost;

Making decisions on regulatory impacts to bring project performance to cost and within budget.

4) Completion of project management for cost and finance:

Economic analysis and evaluation of results;

Preparation of financial report;

Final settlements and closing of financing;

Archive formation

5. Cost management in an investment project:

Project cost forecast in the early stages

Formation of a basic budget (plan) for an investment project

Control over changes in the project budget. Comparing the total budget with actual costs

Detailed reporting of the cost of the project, including all its components.

Monitoring project obligations

Earned value analysis for all cost elements, not just those elements that are tracked to schedule.

Analyzing trends and forecasting deviations from the project budget.

Planning for spending money

Comparison and analysis of early trends Analyze trends at a summary or more detailed level.

1.2. Determining the cost and budgeting of the project

V.V. Kovalev points out that depending on the stage of the project life cycle and the purpose of the assessment, various types and methods of estimating the cost of the project are used. Based on the purposes of the assessments, the accuracy of such assessments also varies.

Types of project cost estimates:

· Preliminary (assessment of the viability, feasibility of the project);

· Factorial (enlarged cost calculation, preliminary estimate);

· Approximate (budget and financial calculation);

· Final (budget documentation).

To estimate the cost of a project, you need to know the cost of the resources that make up the project, the time it takes to complete the work, and the cost of this work. Thus, cost estimation begins with determining the resource and work structure of the project. These tasks are solved as part of project planning, and the cost estimation module should receive the results of this process.

The cost of the project is determined by the resources required to complete the work, including:

· equipment (purchase, rental, leasing);

· fixtures, devices and production facilities;

· labor (full-time employees hired under contract);

· consumables (stationery, etc.);

· materials;

· training, seminars, conferences;

· subcontracts;

· transportation, etc.

All costs can be classified as:

· direct and overhead costs;

· recurring and one-time. For example, monthly payments for the use of production facilities are recurring costs, the purchase of a set of equipment is a one-time cost;

· constants and variables depending on the volume of work;

· payment for overtime working hours.

The cost structure of a project by cost item is usually based on the structure of the project's chart of accounts, which is a decomposition of costs from the highest level of cost of the entire project to the lowest level of cost of one unit of resources. For a specific project, you select your own chart of accounts or a family of them. Russian accounting charts of accounts, international accounting charts of accounts, and management accounting charts of accounts can be used as basic options.

According to V.V. Kovalev, the technique for estimating project costs consists of 13 steps. These may vary depending on the project and generally include the following:

1. Determination of work resource requirements.

2.Development of a network model.

3.Development of a work breakdown structure.

4. Cost assessment in terms of the work breakdown structure.

5. Discussion of the work breakdown structure (work breakdown structure) with each of the functional managers.

6.Development of the main direction of action.

7. Estimation of costs for each element of the WBS.

8. Coordination of basic costs with the highest level of management

9. Discussion with functional managers of personnel needs.

10. Development of a line responsibility scheme.

11. Development of detailed schedules.

12. Formation of a summary report on costs.

13. Inclusion of cost estimation results in project documents.

A project cost estimate is essentially an estimate of all the costs required for the successful and complete implementation of the project. These costs can have different ideas, colored by different economic meanings. Moreover, the differences between such ideas are sometimes very subtle.

There are three types of costs:

· obligations;

· budget costs (estimated cost of work distributed over time);

· actual costs (cash outflow).

Obligations arise, for example, when ordering any goods or services in advance of their use in the project. As a result, invoices are issued, payment for which can be made either at the time the goods are ready for delivery, or at the time of receipt, or in accordance with the payment policy adopted by the organization. In any case, when ordering, the budget is reduced by the amount of this order. In some cases, it is not taken into account until the invoice is received, which does not correctly reflect the current state of the budget. In this regard, there is a need for a system for planning and accounting for project obligations. In addition to performing its main functions, this system will allow you to predict future payments.

Budget costs characterize the costs planned for the production of work.

Actual costs reflect expenses incurred during the implementation of the project work or at the time of payment of funds.

V.D. Shapiro points out that the actual ratio of these types of costs depends on several factors, including:

· the relationship between the volumes of labor resources, materials and subcontracts in the project;

· bill payment policy in the organization;

· delivery period of main equipment;

· schedule of work under subcontracts;

· the influence of the work schedule on when and how workers' costs will be written off when delivering equipment.

Understanding the differences between the cost “expressions” described will allow you to effectively manage your overall project costs.

I.I. Mazur, V.D. Shapiro indicate that based on the structure of the project life cycle, its cost includes the following components:

♦ cost of research and development: conducting pre-investment studies, cost-benefit analysis, system analysis, detailed design and development of prototype products, preliminary assessment of project products, development of design and other documentation for products;

♦ production costs: production, assembly and testing of project products, maintaining production capacity, logistics, personnel training, etc.;

♦ construction costs: production and administrative premises (construction of new ones or reconstruction of old ones);

♦ current costs: wages, materials and semi-finished products, transportation, information management, quality control, etc.;

♦ removal of products from production: costs for re-equipment of production facilities, disposal of residues.

Under budgeting I.I. Mazur, V.D. Shapiro understand the determination of the cost values of the work performed within the project and the project as a whole, the process of forming a project budget containing an established (approved) distribution of costs by type of work, cost items, by time of work, by cost centers or by another structure. The budget structure is determined by the chart of accounts for cost accounting of a specific project. The budget can be formed both within the framework of a traditional accounting chart of accounts, and using a specially developed chart of accounts for management accounting. Practice shows that in most cases, an accounting chart of accounts is not enough. Each specific project requires taking into account certain specifics in terms of cost management, so each project must have its own unique chart of accounts, but which is based on established management accounting indicators.

Budgeting is cost planning, i.e. determining the cost plan: when, how much and for what money will be paid.

I.I. Mazur, V.D. Shapiro indicate that the budget can be drawn up in the form:

1) cost schedules,

2) cost distribution matrices,

3) cost bar charts,

4) bar charts of cumulative (cumulative total) costs (Fig. 1.3.),

Rice. 1.3. Cumulative Cost Bar Chart

5) linear diagrams of cumulative costs distributed over time (Fig. 1.4),

Fig.1.4. Line diagram of cumulative costs distributed over time

6) pie charts of cost structure, etc.

The form in which budgets are presented depends on:

· document consumer;

· the purpose of creating the document;

· established standards;

· information of interest.

Depending on the stage of the project life cycle, budgets can be:

· preliminary (evaluative);

· approved (official);

· current (correctable);

· factual.

After feasibility studies, preliminary budgets are drawn up, which are more evaluative than prescriptive in nature. Such budgets are negotiated with all stakeholders and ultimately approved by the project manager or other decision maker. Once the budget has acquired official status, it becomes the standard against which actual results are compared.

During the implementation of the project, deviations from previously planned indicators arise, which should be reflected in a timely manner in current budgets. And upon completion of all work, an actual budget is created as a final document, which reflects real numbers.

Estimates that represent expenditure budgets deserve special attention. Estimate documentation is an important component of budget documentation in large investment projects.

1.3. Project cost control methods

EAT. Sorokina emphasizes that project cost management includes:

Project cost management is part of overall change management and involves identifying the causes of both positive and negative variances. For example, an inadequate response to a cost variance may result in schedule or quality problems, or an unacceptable increase in risk later in the project.

Rice. 1.5. Cost Management: Inputs, Tools & Techniques, Outputs

Project cost control arises from the influence of factors that cause deviations from the previously planned budget, and is aimed at managing changes in the cost of the project in order to reduce the negative aspects and increase the positive consequences of changes in the cost of the project. Project cost control includes:

· monitoring of project implementation cost indicators in order to detect deviations from the budget;

· managing budget changes to ensure budget execution;

· prevention of previously planned erroneous decisions;

· informing all stakeholders about the progress of the project in terms of budget compliance.

According to E.M. Sorokina, project cost control has two components: accounting, i.e., an assessment of the actual cost of work performed and resources expended, and forecasting, i.e., an assessment of the future cost of the project. The basic indicators used to control the cost of the project are the following:

· required to complete (NDZ): an estimate of the costs that will be required to complete the work or project is established. The LPD estimate is the best current estimate of how much additional investment needs to be made at this time to complete the job;

· estimated cost (PC): the best estimate of the total cost that a job or project will have when completed. The estimated cost is calculated as the sum of actual costs as of the current date and VAT;

There are two main methods of cost control: traditional method; earned value method.

The performance measurement analysis method helps to establish the magnitude of any deviations. The earned value method (EVM) is that the total planned cost of work performed (received) of the initial estimated budget is compared with both the planned cost of planned work (plan) and the actual cost of work performed (actual). This method is most suitable for cost, resource and production management.

V.V. Kovalev points out that an important part of cost management is identifying the reasons causing deviations, the size of deviations and understanding whether corrective actions need to be taken in relation to deviations. The earned value method uses a cost baseline, which is part of the project management plan, to evaluate the progress of the project and determine the amount of variance generated.

When using the earned value method, the following key values must be calculated for each schedule activity, work package, and control account:

1) Planned volume Planned volume is the budget cost of work that, according to the schedule, must be completed as a result of an operation or WBS element by a certain date.

2) Earned Value Earned Value is the budgeted amount of work actually completed as a result of a planned activity or WBS element during a specified period of time.

3) Actual cost Actual cost is the total cost of performing work as a result of a planned activity or WBS element over a specified period of time. Actual cost, by definition and scale, must match what is budgeted for planned volume and earned value (for example: direct labor time only, direct costs only, or all costs including indirect costs).

4) Forecast before completion and forecast after completion. The development of the pre-completion forecast and the post-completion forecast is described in the following forecasting method.

In Fig. 1.6. S-curves are depicted, displaying the cumulative data of the project's earned value, which is above those provided for in the budget and below those provided for in the work plan.

Rice. 1.6. Example of a graphical performance report

Analysis of project performance indicators involves comparison of cost effectiveness over time, for planned operations or work packages, the implementation of which differs from the budgeted values, both upward and downward (planned volume), planned milestones and actual milestones.

Analysis of the effectiveness of project execution occurs during joint meetings of relevant specialists and is intended to assess the implementation and status of planned activities, work packages or cost accounts. The analysis typically uses one or more of the following performance reporting methods:

1. Deviation analysis. Variance analysis involves comparing actual project performance data with planned or expected performance. Variations in cost and schedule are the most frequently analyzed, but deviations from plan in content, resources, quality and risk are often of equal or greater importance.

2. Trend analysis. Trend analysis involves examining project performance data over time to determine whether project performance is improving or deteriorating.

3. Earned value method. The earned value method involves comparing planned performance indicators with actual ones.

The main advantage of the earned value methodology is the possibility of “early detection” (detection in the early stages of project implementation) of discrepancies between the actual project indicators and the planned ones, forecasting on their basis the results of the project (deadlines, costs, etc.) and taking timely corrective actions, up to termination of the project.

In addition to estimating the total costs of the project, based on the observed earned value indicators, it is also possible to predict other project characteristics.

Cost forecasting, according to V.V. Kovalev, implies an assessment of the final cost of the project based on information about the costs of the project at the current time.

There are the following options for estimating the final cost of a project (EFC), which use both the traditional valuation method and the earned value method:

· Cost at completion = Actual costs to date + Remaining project cost adjusted by cost absorption index;

· Cost at completion = Actual costs to date + Estimated remaining project cost (ETC);

· Cost at completion = Actual costs to date + New estimate for the remainder of the project.

The cost absorption index (CPI) is calculated as the ratio of the absorbed volume to the actual costs:

(1.1)

(1.1)

In parallel, the schedule performance index (SPI) is calculated:

(1.2)

(1.2)

Using these metrics, the cost estimate at completion (cost forecast) is calculated as follows:

1.Traditional method:

EAC = ACWP + ETC. (1.3)

2.Earned value method:

· Pessimistic assessment:

(1.4)

(1.4)

· Optimistic assessment:

(1.5)

(1.5)

An indicator of projected project cost deviation (varianceatcompletion - VAC) can also be used:

VAC=BAC - EAC. (1.6)

These formulas use summary indices rather than periodic or discrete indices. Periodic cost data at different points in time may differ significantly from each other, which ultimately will incorrectly affect the final estimate. Aggregate data smooths out these variations while remaining a more reliable tool for long-term forecasting. In any case, we must not forget that no matter how accurately the assessment is made upon completion, it will not 100% correctly reflect the final result of the project. The closer the assessment is to the completion of the project, the smaller the difference between these two values.

2. project cost management at Venta LLC

2.1. Project characteristics

Let's consider the main indicators of the cost of the investment and construction project of a large-panel 1-section residential and commercial complex, the implementation of which began in April 2010.

The main technical and economic indicators characterizing the project under consideration are given in table. 2.1.

Table 2.1

Main technical and economic indicators of the project

The need for material resources is determined based on the volume of work and material consumption standards , adopted according to SNiP part IV. The deadlines and delivery of materials are linked to the work schedule. Materials and structures are delivered to the construction site by road. The supply of materials and structures is accepted for 5-12 days of work. The concrete mixture is supplied at the time of laying. Calculation of the need for materials, structures and semi-finished products for the project is given in table. 2.2.

Table 2.2.

Calculation of the need for materials, structures and semi-finished products

The basis for drawing up a schedule for the movement of workers around the facility is the work schedule

In accordance with the work schedule, a schedule for the movement of the main construction vehicles around the site has been drawn up. The need for construction machinery and mechanisms is determined based on the volume of work.

Table 2.3.

Schedule of labor movement around the facility.

| № | Name professions |

Average daily number of workers | |||||||

| May | Jun | July | Aug | Sep | Oct | ||||

| 1 | General workers | person-days | 402 | 70 | 45 | 60 | 100 | 75 | 52 |

| 2 | Machinists | person-days | 14 | 4 | 10 | 0 | 0 | 0 | 0 |

| 3 | Diggers | person-days | 44 | 20 | 24 | 0 | 0 | 0 | 0 |

| 4 | Installers | person-days | 850 | 50 | 720 | 80 | 0 | 0 | 0 |

| 5 | Waterproofers | person-days | 6 | 0 | 6 | 0 | 0 | 0 | 0 |

| 6 | Plumbers | person-days | 150 | 50 | 50 | 20 | 20 | 10 | 0 |

| 7 | Concrete workers | person-days | 45 | 10 | 0 | 30 | 5 | 0 | 0 |

| 8 | Roofers | person-days | 12 | 0 | 0 | 12 | 0 | 0 | 0 |

| 9 | Carpenters | person-days | 85 | 0 | 0 | 40 | 45 | 0 | 0 |

| 10 | Glaziers | person-days | 18 | 0 | 0 | 12 | 6 | 0 | 0 |

| 11 | Joiners | person-days | 6 | 0 | 0 | 6 | 0 | 0 | 0 |

| 12 | Specialist. installers | person-days | 45 | 0 | 0 | 40 | 5 | 0 | 0 |

| 13 | Electricians | person-days | 29 | 0 | 0 | 19 | 10 | 0 | 0 |

| 14 | Plasterers | person-days | 60 | 0 | 0 | 0 | 60 | 0 | 0 |

| 15 | Clayers | person-days | 120 | 0 | 0 | 0 | 20 | 100 | 0 |

| 16 | Painters | person-days | 150 | 0 | 0 | 0 | 150 | 0 | 0 |

| 17 | Finishers | person-days | 35 | 0 | 0 | 30 | 5 | 0 | 0 |

| Total: | 2071 | 204 | 855 | 349 | 426 | 185 | 52 | ||

Quantity machine shifts distributed by month taking into account the duration of the mechanized process. The calculation results are given in table. 2.4.

Table 2.4.

Movement schedule of main construction vehicles around the site

| № | Names |

Average daily number of cars | ||||||||

| May | Jun | July | Aug | Sep | Oct | but I | ||||

| 1 | Bulldozer DZ-43 |

machine-shift |

||||||||

| 2 | Excavator EO-4321 |

machine-shift |

||||||||

| 3 | Crawler crane SKG-30 |

machine-shift |

||||||||

| 4 | Auto-hydranator |

machine-shift |

||||||||

| 5 | Tower crane KB-160 |

machine-shift |

||||||||

Calculation of the volume and labor intensity of construction work on the housing and commercial complex is made in table 2.5

Table 2.5

Calculation of the volume and labor intensity of construction work on the residential and commercial complex “Perekrestok”.

| Name of works | Scope of work | Labor intensity, person-days | |||

| Unit change | Qty | Per unit change | For the whole complex | ||

| 1. Preparatory work (throughout the entire facility) | an object | 1 | 5% of Qbas | 111,63 | |

| Underground part | |||||

| 2. Mechanic. soil development with an excavator | m3 | 625,45 | 0,0043 | 2,69 | |

| 3. Reworking the soil manually | m3 | 58,8 | 0,33 | 19,4 | |

| 4. Installation of prefabricated structures of the underground part, concreting of individual places, brickwork | m3 | 425 | 0,164 | 69,7 | |

| 5. Vertical coating waterproofing | m2 | 100,8 | 0,041 | 4,1 | |

| 6. Input and outlet device | PC. | 3 | 10 | 30 | |

| 7. Preparation device for floors in the basement | m2 | 205,2 | 0,035 | 7,182 | |

| 8. Installation of pipelines in technical underground | m2 | 180,20 | 0,15 | 27,03 | |

| 9. Backfilling of sinuses with manual compaction | m3 | 152,35 | 0,103 | 15,69 | |

| Total: | 175,8 | ||||

| Aboveground part | |||||

| 10. Construction of a tower track and installation of a tower crane | 2 | 5 person-days at 12.5m + (8-20) | 24,6 | ||

| 11. Dismantling the tower crane and dismantling the crane runway | Number of sections ways | 2 | 50% of Q faucet installation | 12,3 | |

| 12. Installation of floor structures | PC. | 857 | 0,723 | 619,6 | |

| 13. Installation of prefabricated roof structures | PC. | 85 | 0,448 | 38,08 | |

| 14. Roof installation | m2 | 197,41 | 0,07 | 13,82 | |

| 15. Filling window openings | m2 | 204,33 | 0,2 | 40,87 | |

| 16. Filling doorways | m2 | 347,26 | 0,138 | 47,92 | |

| 17. Glazing (double) | m2 | 487,5 | 0,059 | 28,76 | |

| 18. Installation of built-in wardrobes and mezzanines | m2 | 41,0 | 0,2 | 8,2 | |

| 19. Preparation device for floors | m2 | 1247,14 | 0,036 | 44,90 | |

| 20. Installation and adjustment of elevators | PC | 2 | 110 | 220 | |

| 21. Installation of internal engineering equipment (installation of heating, water supply, sewerage, gas supply) | m3 | 6997,23 | 0,0156 | 109,16 | |

| 22. Installation of engineering equipment devices | m3 | 6997,23 | 0,0079 | 55,28 | |

| Total: | 1263,5 | ||||

| Electric installation work | |||||

| 23. Stage 1 (pre-plaster complex) | 6997,23 | 0,0043 | 30,09 | ||

| 24. Stage 2 (post-plaster complex) | m3 | 6997,23 | 0,0017 | 11,89 | |

| 25. Installation of electrical fittings (post-painting complex) | m3 | 6997,23 | 0,0009 | 6,30 | |

| 26. Grouting surfaces | m2 | 6882,36 | 0,016 | 110,11 | |

| Total: | 158,4 | ||||

| Floor installation | |||||

| 27. Ceramic floors | m2 | 92,2 | 0,135 | 12,44 | |

| 28. Parquet floors | m2 | 850,45 | 0,124 | 105,46 | |

| 29. Linoleum floors | m2 | 564,7 | 0,094 | 53,08 | |

| 30. Cement floors | m2 | 104,45 | 0,035 | 3,66 | |

| Total: 174.6 | |||||

| Carpentry work | |||||

| 31. Adjustment of window frames and doors | m2 | 657,56 | 0,03 | 19,72 | |

| 32. Installation of window and door devices, license plates | m2 | 598,87 | 0,06 | 35,93 | |

| 33. Painting work | m2 | 7458,87 | 0,046 | 343,11 | |

| 33. Exterior facade decoration | m2 | 1230,78 | 0,050 | 61,54 | |

| Total: 460.3 | |||||

| Labor intensity of main construction work (sum of labor costs) | Qbas= | 2232,6 | |||

| 34. Improvement | An object | 1 | 5% of Qbas | 111,63 | |

| 35. Unaccounted for work | An object | 1 | 17% of Qbas | 379,54 | |

| 36. Preparing the property for delivery | An object | 1 | 3% of Qbas | 66,98 | |

2.2. Financial and economic feasibility study of the project

The project is planned to be financed with the initial investment of the customer (investor), corresponding to the estimated cost of the project - 18,090.55 thousand rubles.

The expected payback of the project is 1 year (commercial enterprises will begin to function immediately after the commissioning of the facility - the customer plans to sell commercial space and apartments and receive a one-time income, it is also assumed that the housing stock will be 100% occupied - the purchase of new apartments by residents - within 6 months after delivery object).

The housing department is designed for 20 apartments - 10 two-room and 10 three-room apartments with a total living area of 1540.98 m2. The total living area of 3-room apartments is 924.90 m2, 2-room apartments are 616.08 m2. The total area of commercial premises is 290.56 m2.

Estimated cost:

2-room apartment – 31.9 thousand rubles

3-room apartment – 38.1 thousand rubles.

Commercial space – 36.7 thousand rubles.

In total, the forecast revenue from the customer’s sale of a residential and commercial complex at planned prices will be:

Ext. = 31.9 * 616.08 + 38.1 * 924.9 + 36.7 * 290.56 = 65,661.9 thousand rubles.

Let's calculate the financial indicators of the project (Table 2.6)

Table 2.6.

Calculation of project financial indicators.

In terms of profitability, the project took a high position. We will calculate the gross margin of the project and also find the break-even point.

1) Gross margin (GM) is a measure of the efficiency of a company's production activities.

Obviously, the higher the VM, the better.

In our case, the calculation gave the following results:

For this investment and construction project:

TB = 10458.2 / (65661.9 – 7632.35) * 65661.9 = 11,819.14 thousand rubles.

That is, even with a noticeable decrease in revenue, the project has a certain margin of safety.

When assessing investment performance, these indicators are usually calculated: NPV (net present value), IRR (internal rate of return) and PI (investment return index).

The method for calculating NPV is to sum up the modern (currently recalculated) values of net effective cash flows for all planning intervals throughout the study period.

For a one-time investment, the calculation of net present value can be represented by the following expression:

|

where Rk is annual cash receipts for n years, k = 1, 2, …, n;

IC – initial investment;

i – discount rate (0% - payback of the project is no more than a year, discount is not applied).

For this project option:

NPV = (65661.9/1) – 18090.55 = + 47 571.35 (The value of the indicator coincided with the balance sheet profit indicator due to the lack of discounting in the short term)

The investment return index (PI) is closely related to the indicator of the net modern value of investments, but, unlike the latter, it allows us to determine not an absolute, but a relative characteristic of investment efficiency. The return on investment index (PI) for a one-time investment is calculated using the following formula:

where IC is the total investment costs of the project.

The return on investment index answers the question: what is the level of project-generated income received per unit of capital investment.

For one-time investments, this indicator is equal to:

PI times = 65,661.9 / 18,090.55 = 3.63

Internal Investment Rate of Return (IRR)

The interpretative meaning of the internal rate of return is to determine the maximum cost of capital used to finance investment costs, at which the owner (holder) of the project does not incur losses.

The internal rate of return (IRR) is calculated by iteratively selecting a discount rate such that the net present value of the investment project becomes zero. Two values of the discount factor are selected at which the NPV function changes its sign, and the formula is used:

IRR = i1 + NPV(i1) / (i2 - i1)

i1 – discount rate at which the net present value has a negative value

i2 is the last discount rate at which NPV has a positive value

In this case, calculating IRR is not practical, since the discount rate is not expected to change during the year of project implementation.

When implementing the project, economic and political risks are possible. The adjustment for project risk is determined according to the following table:

Table 2.7

Adjustments for project risk.

Due to the fact that the residential-commercial complex is a new construction industry, the risk value should be taken in the amount of 13-15% (high risk value).

Let's take P = 15%

The discount rate, which takes into account risks during project implementation, is determined by the formula:

where is the risk adjustment

d = 0 + 15/100 = 0.15 (that is, the project still has a large margin of safety when risks arise).

3. improving project cost management at Venta LLC

3.1. Directions for improving cost management at Venta LLC

The proposed project for optimizing the project cost management system at Venta LLC is based on the principle of forming business units and involves the implementation of capital expenses (investment expenses) at various periods of time. The structure and distribution schedule of capital investments are presented in Table 3.1. The volume of capital investments is determined by the total cost of managing business units.

Table 3.1

Structure and schedule for distribution of capital investments

Expenses under the cost item for “Software” include developer costs associated with the acquisition of the Oracle Advanced Procurement Release 12 program, which will serve the system of business units of the enterprise.

Expenses under the capital investment item “Technical support” involve the following stages of work: installation and implementation of software, as well as user training.

The total volume of capital investments is 221,300 rubles. Each of the capital investment items is tied to the corresponding stage of work, that is, payments for the project occur according to a schedule corresponding to the system implementation calendar plan.

Operating costs include the following elements:

1. wages of service personnel with contributions for social needs;

2. cost of consumed energy resources;

3. expenses for depreciation and current repairs of equipment.

Let's calculate the listed elements of operating costs.

To calculate staff salaries, we use the formula:

ZP = (1 + 0.356) * (12 * O * )*N,

where ZP is the monthly salary of service personnel, rubles;

О – official salary of service personnel, rub.;

B1 – number of hours per month required to complete the task, hours;

K – estimated number of working hours per month, hours;

N – number of employees working with documents.

K = 8*24 = 192 hours/month.

Let's determine the annual salary of the staff when solving the problem requires 80 hours of work - the base case:

Salary=(1+0.356)*(12*12000*80/192)*3=244080 rub./year

The salary for 1 worker will be 325440/2 = 81360 rubles/year.

Let us determine the wages of service personnel who will work with the proposed software product - the designed option:

Salary=(1+0.356)*(12*12000*40/192)=40680 rub./year.

The annual total savings in wages will be 203,400 rubles/year.

Cost of consumed energy resources:

Let us determine the cost of consumed energy resources for the base case, when solving the problem requires 96 hours of work:

E = 12*(0.1*0.902*8*80+0.3*0.902*3*30) *3 = 2954.95 rub.

Let us determine the cost of consumed energy resources for the designed option, when solving the problem requires 40 hours of work:

E = 12(0.1*0.902*8*40+0.3*0.902*3*15) × 1 = 492.5 rub.

Thanks to the new software application, 2,642.5 rubles will be saved in energy consumption per year.

The amount of expenses for depreciation and wear and tear (current repairs) of equipment:

The annual useful working time fund is defined as:

PFVR = (365 – 114) * 8 = 251 * 8 = 2008 hours.

Depreciation in the basic version will be:

Self=(22000*3*(20+3)/100)/2008*80*12=7257.37 rub.

Depreciation in the designed version will be:

Sam = (22000*4*(20+3)/100)/2008*40*12=1209.5 rub.

Consequently, the annual savings on depreciation charges is equal to 6047.87 rubles.

The cost price in the basic version is equal to:

C1 =244080+2954.95+7257.37= 254,292.32 rubles/year.

Operating costs in the designed version will be:

C2 = 40680 +492.5 +1209.5 = 42382 rub./year

Savings from the restructuring of OJSC Stankostroy will be equal to:

C1 – C2 = 254292.32 - 42382 = 211,910.32 rubles/year.

In this project, the volume of capital investments is 67,570 rubles.

Thus, optimization due to the restructuring of business processes and the introduction of new software in various areas amounts to:

3.2. Economic results of improving project cost management

The payback period of the project will be calculated as the ratio of capital investments in the project equal to 221,300 rubles. and returns due to the successful implementation of the project (planned reduction of business costs in various areas), which amounts to 211,910.32 rubles.

RR = 221300/ 211910.32 * 12 = 13 months

Thus, the payback period of the project is approximately 13 months.

To calculate the net present effect, it is necessary to bring the planned savings to the prices of the base period, i.e. discount them using a real discount rate calculated taking into account inflationary changes. Let's take the market rate for commercial loans as the basis for calculating the discount multiplier. The refinancing rate will be taken at a rate equal to 10.5% per annum (ro = 10.5%) Projected inflation rate for 2007-2008. is 8%, then the required discount rate for the payment stream.

rr= 0.105 + 0.08 + 0.105*0.08 = 0.1934 or 19.34% - real discount rate taking into account inflation.

NPV =(211,910.32 -42382)/ 1.1934- 221300=16676.5 rub.

The resulting net present value value is greater than zero, which indicates that the project should be accepted.

Project profitability index (PI) is the ratio of total discounted income to total discounted costs, it is defined as

PI = (211,910.32 - 42382)/ 1.1934-/221300=2.35 rub.

Since the profitability index is greater than 1, the project should be accepted.

We calculate IRR (internal rate of return) in Table 3.2.

Table 3.2

IRR calculation

| Period of time | Outgoing flows | Incoming streams | Flow Balance |

r1=21% | NPV1 | r2=22% | NPV2 |

| 1 sq. | 272 159,00 | 42 383,00 | -229 776,00 | 0,60 | -137 865,60 | 0,61 | -140 163,36 |

| 2 sq. | 50 859,00 | 42 383,00 | -8 476,00 | 0,40 | -3 390,40 | 0,19 | -1 610,44 |

| 3 sq. | 50 859,00 | 42 383,00 | -8 476,00 | 0,40 | -1 695,20 | 0,24 | -1 186,64 |

| 4 sq. | 50 859,00 | 42 383,00 | -8 476,00 | 0,20 | -1 695,20 | 0,05 | -423,80 |

| 5 sq. | 50 856,32 | 42 378,40 | -8 477,92 | 0,20 | -1 695,58 | 0,05 | -423,90 |

| 6 sq. | 42 383,00 | 42 383,00 | 0,20 | 8 476,60 | 0,05 | 2 119,15 | |

| 7 sq. | 42 383,00 | 42 383,00 | 0,10 | 4 238,30 | 0,05 | 2 119,15 | |

| 8 sq. | 42 380,25 | 42 380,25 | 0,10 | 4 238,03 | 0,05 | 2 119,01 | |

| Total | 475 592,32 | 339 056,65 | -136 535,67 | 2,00 | -129 389,06 | 1,19 | -137 450,82 |

Outgoing flows are the volume of capital investments in the project; they are carried out in the first quarter of the project. Incoming flows are the sum of savings due to the implementation of the project, these flows are distributed over time, their value was predicted taking into account the purchased equipment reaching its design capacity.

IRR = 20 + 129389.06/(-129389.06-(-137450.82))*(22-21) =18.1% (in the range from 21 to 22)

Therefore, the internal profitability of the project is 18.1%. Such a high level of internal rate of return shows the feasibility of investing financial resources in the project.

Conclusion

The following results were obtained during the study:

A project is a set of interrelated activities designed to achieve a specific goal within a given period of time and within the allocated budget. Project management has recently gained recognition as the best method for planning and managing the implementation of investment projects.

The cost of the project is determined by the total cost of the project resources, costs and time of completion of the project work.

For construction projects, the construction cost is determined, which is the portion of the project cost that includes the funds needed for capital construction. Estimating all project costs is equivalent to estimating the total cost of the project.

Managing the cost and financing of an investment project (Project Cost and Finance Management) is a section of project management that includes the processes necessary to form and monitor the implementation of the approved project budget. Consists of resource planning, cost estimation, estimate and budget formation and cost control. Venta LLC is located in Vologda, legal address: Vologda, st. Chekhova, 1.

The main activity of the enterprise is repair and construction services.

Services are sold to clients at prices based on costs and current market conditions. Prices vary depending on the volume of services ordered. Depending on the prevailing economic conditions, prices for services sold by Venta LLC may be revised either downward or upward. The company provides additional price discounts to regular customers.

Project cost management at Venta LLC includes:

· Influence the factors causing changes in the cost baseline

· Verifying that requested changes have been approved

· Manage actual changes as they occur

Ensure that potential cost overruns will not result in increased costs beyond authorized funding limits, either periodically or for the project as a whole.

· Monitoring cost implementation in order to detect and analyze deviations from the basic cost plan

Accurately capture and maintain records of all relevant changes in costs that differ from the cost baseline

· Protecting the rules for the use of approved resources or funds from making incorrect, inappropriate or unapproved changes to them

· Informing relevant project participants about approved changes

· Carrying out actions necessary to ensure that cost overruns remain within acceptable limits.

The proposed project for optimizing the project cost management system at Venta LLC is based on the principle of forming business units and involves the implementation of capital expenses (investment expenses) at various periods of time. Thus, optimization due to the restructuring of business processes and the introduction of new software in various areas amounts to:

For staff salaries 203,400 rubles.

For electricity RUB 2,462,452.

Depreciation charges RUB 6,047.87.

In total, the total cost reduction due to the restructuring of business processes and the introduction of new software is 211,910.32 rubles annually.

Based on the indicators calculated above, the following conclusions can be drawn about obtaining an economic effect from the implementation of the developed IS:

The labor intensity of technological processes is reduced;

The efficiency of using computer technology increases;

Using the system will improve the quality of operations performed by employees and increase the efficiency of processing incoming documents.

The annual reduction in business costs when implementing these proposals for restructuring business processes at Venta LLC is estimated at 211,910.32 rubles.

1. Birman G. Economic analysis of investment projects / Birman G., Schmidt S. Per. from English edited by L.P. Belykh. - M.: Banks and exchanges, UNITY, 2007. - 631 p.

2. Gorbunov A. B. Financial flow management. - M.: Ankil, 2009. - 265

3. Joseph A. Business plans: a complete reference guide. / Joseph A. Covello D. - M.: ALANS, 2003. – 458 p.

4. Endovitsky D. A. Complex analysis and control of investment activities. – M.: Finance and Statistics, 2006. – 394 p.

5. Ionova A.F., Selezneva N.N., Financial analysis: textbook. / ed. A.F. Ionova – M.: TK Welby, Prospekt Publishing House, 2008. – 624 p.

6. Zhukov L. M. Financial and economic analysis for assessing the effectiveness of investments. // Construction Economics, 2008, No. 4. - pp. 14-32.

7. Zarembo Yu. G. On a unified methodology for assessing the effectiveness of investments. // Construction Economics, 2007, No. 9. - pp. 10-20.

8. Kirichenko T.V., Financial management: Textbook / ed. A.A. Komzolova. - M.: Publishing and trading corporation "Dashkov and Co", 2007. - 626 p.

9. Kovalev V.V., Management of cash flows, profit and profitability: educational and practical work. allowance. – M.: TK Welby, Prospekt Publishing House, 2008. – 336 p.

10. Katasonov V.Yu. Project financing: global experience and prospects for Russia. - M., Ankil, 2008 – 410 p.

11. Clifford F. Project Management. Practical Guide / Clifford F. Gray, Eric W. Larson. – M.: Business and Service, 2006. – 432 p.

12. Clifford F. Project Management. -M.: DIS, 2008. – 341 p.

13. Marenkov N. L. Investment management of Russian entrepreneurship / N. L. Marenkov, N. N. Marenkov. - M.: Editorial URSS, 2008. - 501 p.

14. Mazur I.I., Shapiro V.D. and others. Restructuring of enterprises and companies: a reference guide for specialists and entrepreneurs, a guide / edited in general. ed. I.I. Mazura. -M.: Alans, 2007 – 369 p.

15. Mazur I.I., Shapiro V.D., Olderogge N.G. Project management: Textbook / edited by. ed. I.I. Mazura. – M.: Omega-L, 2007. – 510 s.

16. Mazur I.I., Shapiro V.D. and others. Project management: a handbook for professionals / edited by. ed. I.I. Mazura. - M. Alans, 2006. -264 p.

17. Melkumov Ya. S. Economic assessment of the effectiveness of investments and financing of investment projects - M.: ICC "DIS", 2007. - 460 p.

18. Michels V. A. Vakhovich I. V. The intensity of capital investments in an entrepreneurial project is a criterion for their effectiveness // Construction production, 2008, No. 42. - P. 68-72.

19. Sorokina E.M., Analysis of enterprise cash flows: theory and practice in the context of reforming the Russian economy. – 2nd ed., revised. and additional – M.: Finance and Statistics, 2004. – 176 p.

20. Investment management. In 2 volumes / V.V. Sheremet, V.D. Shapiro et al.-M.: Higher School, 2005. – 1022 p.

21. Project management. Explanatory English-Russian dictionary-reference book / Ed. prof. V.D. Shapiro - M.: “Higher School”, 2003. – 401 p.

22. Fergus O'Connell. How to successfully manage projects: the silver bullet. - M.: Ankil, 2005. – 223 p.

23. Financial and economic condition of the enterprise. /Bakadorov V.L., Alekseev P.D. Practical guide. – M.: Prior, 2000.-129 p.

24. Financial analysis: methodological instructions./Compiled by O.A. Tupikova. - Vladivostok: Publishing House of Far Eastern State Technical University, 2004.-138 p.

25. Sheremet A.D. Theory of economic analysis. – M.: Finance and Statistics, 2006.-376 pp.;

26. Sheremet A.D., Sayfulin R.S. Methodology of financial analysis. - M.: Infra-M, 2007.-465 pp.;

27. Enterprise Economics / ed. S.F. Pokropivny. - K.: Knowledge - Press, 2006. - 373 p.

APPLICATIONS

Annex 1

Movement of fixed assets in 2008

| Groups | Balance at the beginning of the year | Received | Dropped out | Remaining on the end of the year |

Change |

||||

| Building | 126534 | 85,0 | 3638 | 68 | 3638 | 99,4 | 126534 | 84,0 | -1,0 |

| Facilities | 543 | 0,4 | - | - | - | - | 543 | 0,4 | - |

Gear devices |

2793 | 2,0 | - | - | - | - | 2793 | 2,0 | - |

|

equipment |

17978 | 12,0 | 1724 | 32 | 17 | 0,5 | 19685 | 13,0 | +1,0 |

Transport facilities |

50 | 0,03 | - | - | 4 | 0,1 | 46 | 0,03 | - |

| Tool | 5 | 0,003 | - | - | - | - | 5 | 0,003 | - |

Industrial and household inventory |

434 | 0,3 | - | - | - | - | 434 | 0,3 | - |

| Total | 148337 | 100 | 5362 | 100 | 3659 | 100 | 150040 | 100 | - |

Appendix 2

Balance sheets of the enterprise for 2006-2008.

| Index | Year | |||

| As of 12/31/2006 | As of 12/31/2007 | As of 12/31/2008 | ||

| thousand roubles. | thousand roubles. | thousand roubles. | ||

| 1. Non-current assets, incl. | 1724 | 1646 | 1830 | |

| fixed assets | 1648 | 1512 | 1739 | |

| 2. Current assets | 10131 | 11319 | 13190 | |

| 2.1 Reserves | 7649 | 8742 | 10115 | |

| 2.2 Accounts receivable | 2420 | 2512 | 3003 | |

| 2.3 Cash | 62 | 65 | 72 | |

| BALANCE | 11855 | 12965 | 15020 | |

| 4. Capital and reserves | 6550 | 6550 | 6550 | |

| 6. Short-term liabilities | 5305 | 6415 | 8470 | |

| 6.1 Credits and loans | - | - | 1500 | |

| 6.2 Accounts payable | 5305 | 6415 | 6970 | |

| BALANCE | 11 855 | 12 965 | 15 020 | |

The cost of the project is determined by the total cost of the project resources, costs and time of completion of the project work.

For construction projects, the construction cost is determined, which is the portion of the project cost that includes the funds needed for capital construction. Estimating all project costs is equivalent to estimating the total cost of the project.

Project cost management includes the processes necessary to ensure and ensure that the project is completed within the approved budget.

In the context of this chapter, value management and cost management are practically identical concepts. The goals of a cost (cost) management system are to develop policies, procedures and methods that allow planning and timely control of costs.

Project cost (cost) management includes the following processes:

project cost assessment;

project budgeting, i.e. setting cost targets for project implementation;

control of the cost (expenses) of the project, constant assessment of actual costs, comparison with those previously planned in the budget and development of corrective and preventive measures.

The main document by which project cost is managed is the budget. A budget is a directive document that is a register of planned expenses and income distributed by item for the corresponding period of time. The budget is a document that defines the resource limitations of the project, therefore, when managing cost, its cost component comes to the fore, which is usually called the project estimate.

Project estimate is a document containing the justification and calculation of the cost of a project (contract), usually based on the scope of the project, the required resources and prices.

One way to manage project costs is to use a structure of cost accounts (charts of accounts). To perform work, resources are required, which can be expressed both in the labor of workers, materials, equipment, and in the form of cash cost items, when there is no need or opportunity to know what specific resources constitute them. At the stage of budgeting for work, all resources involved in its implementation are written off to various cost items.

Since the structure of cost accounts is developed according to the principles of decomposition, by aggregating information from the accounts of lower levels of the structure, it is possible to obtain cost data at the required level of detail, up to the upper level, characterizing the project budget.